Monthly Futures Seasonality, June 2024: Slow Start to Summer

Monthly Futures Seasonality, June 2024: Slow Start to Summer

After five green months, a sixth red month and a green seventh month, note that June tends to be softer

‘Sell in May and go away’ proved nonsensical as expected, with U.S. equity markets climbing back to and through the former yearly and all-time highs last month. While the seasonality remains robust for a market that saw five green months, a sixth red month and a green seventh month, it is worth noting that June tends to be a softer month.

In fact, even while the May-July window has produced positive returns over the past 10 years and the past 20 years for both the S&P 500 and Nasdaq 100, June is the weak link in that chain. Weakness in both stocks and bonds may sought to be faded, particularly if there is the typical June jump in volatility.

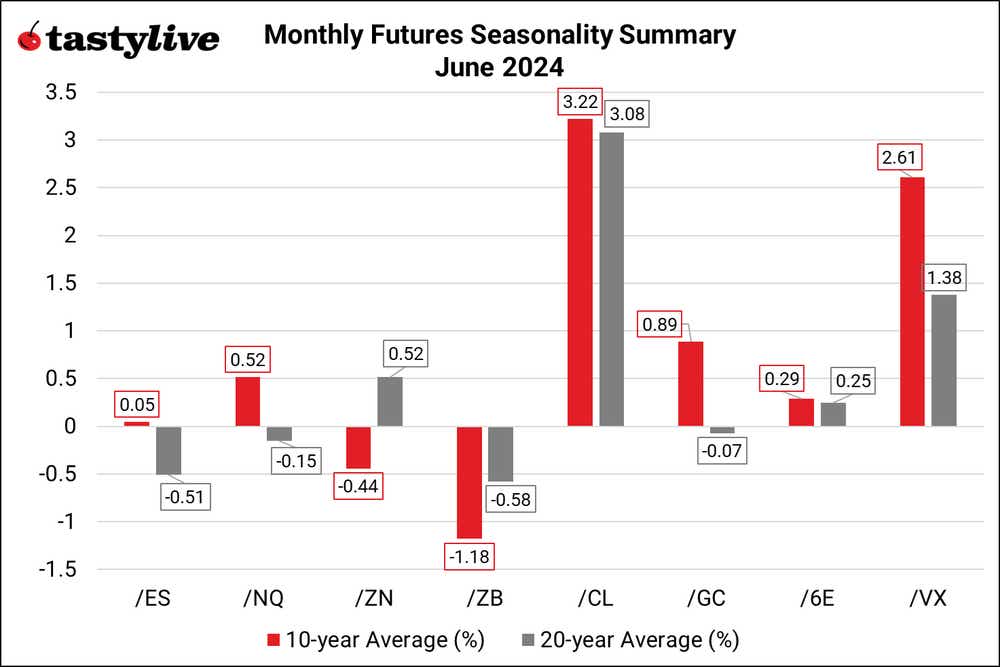

Monthly Futures Seasonality Summary – June 2024

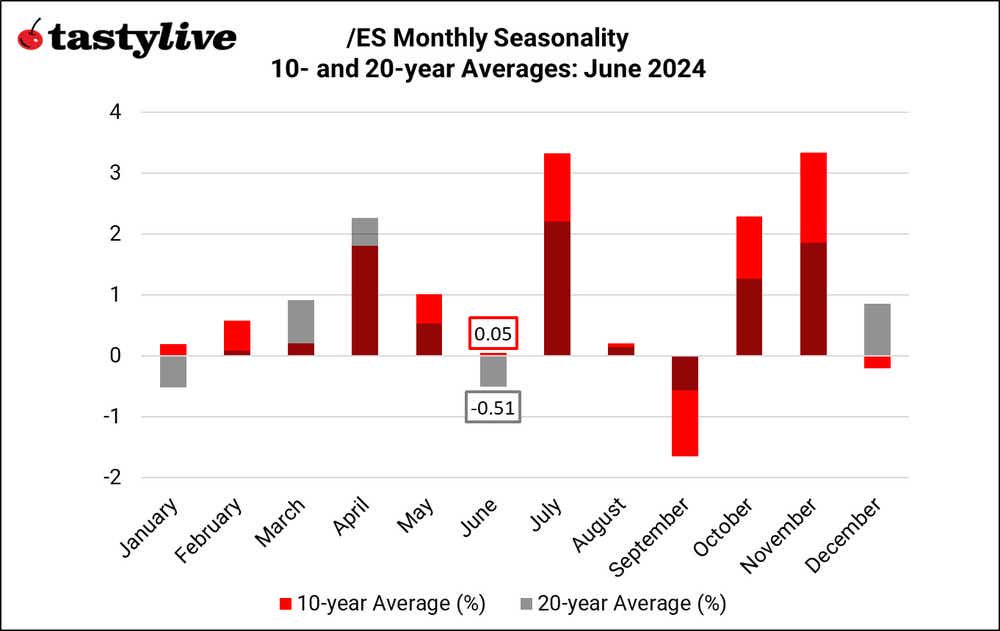

Monthly Seasonality in S&P 500 (/ES)

June is a mixed month for /ES, on a seasonal basis. Over the past 10 years, it has been the third-worst month of the year for the index, averaging a gain of 0.05%. Over the past 20 years, it has been the third-worst month of the year, averaging a loss of 0.51%.

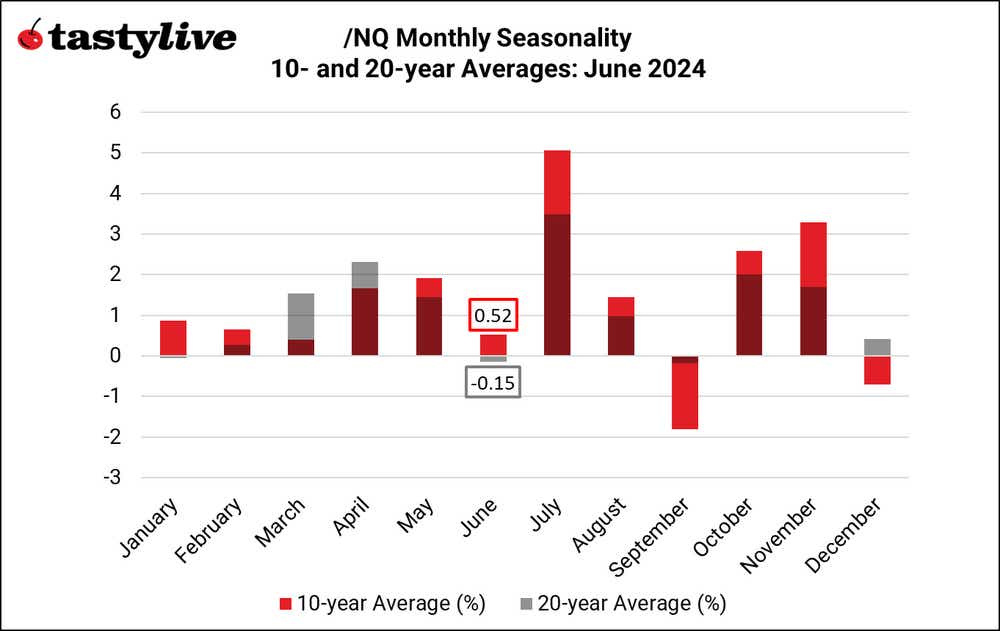

Monthly Seasonality in Nasdaq 100 (/NQ)

June is a mixed month for /NQ, on a seasonal basis. Over the past 10 years, it has been the fourth-worst month of the year for the index, averaging a gain of 0.52%. Over the past 20 years, it has been the second worst month of the year, averaging a loss of 0.15%.

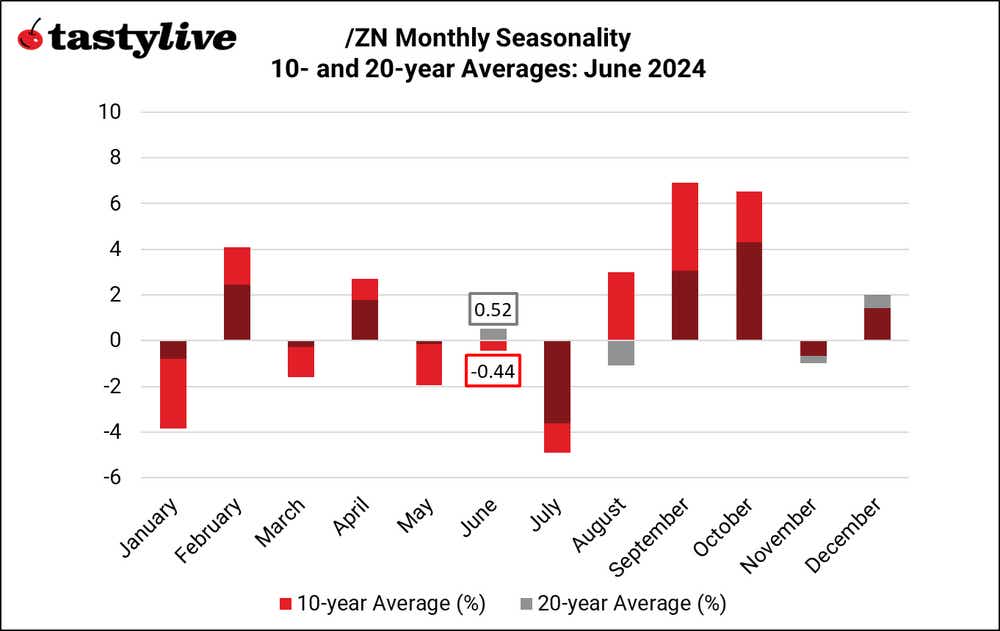

Monthly Seasonality in Treasury Notes (/ZN)

June is a mixed month for /ZN, on a seasonal basis. Over the past 10 years, it has been the sixth-worst month of the year for the notes, averaging a loss of 0.44%. Over the past 20 years, it has been the sixth-best month of the year, averaging a gain of 0.52%.

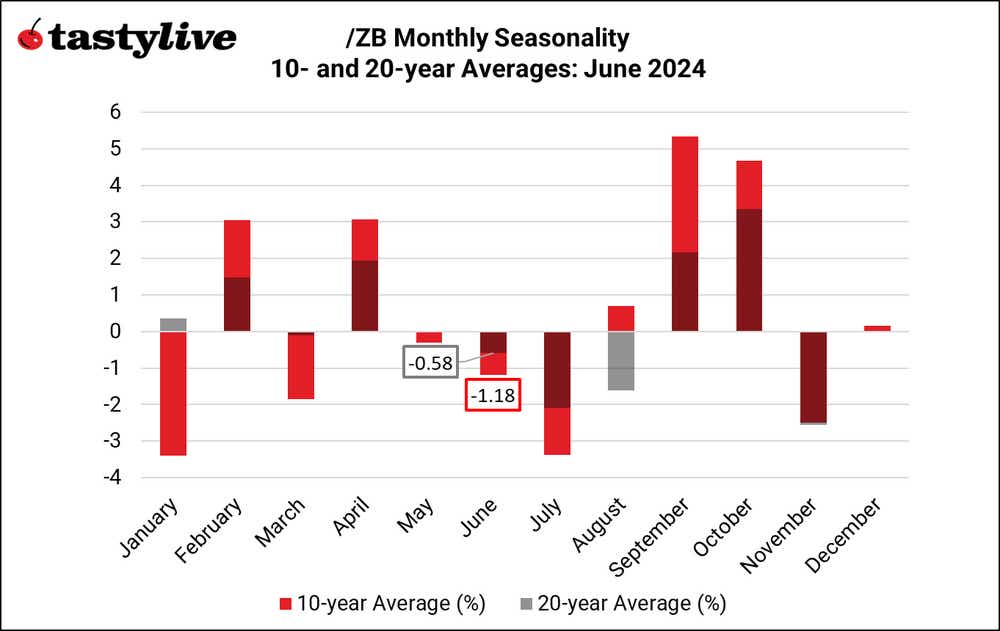

Monthly Seasonality in Treasury Bonds (/ZB)

June is a bearish month for /ZB, on a seasonal basis. Over the past 10 years, it has been the fifth-worst month of the year for the bonds, averaging a loss of 1.18%. Over the past 20 years, it has been the fourth-worst month of the year, averaging a loss of 0.58%.

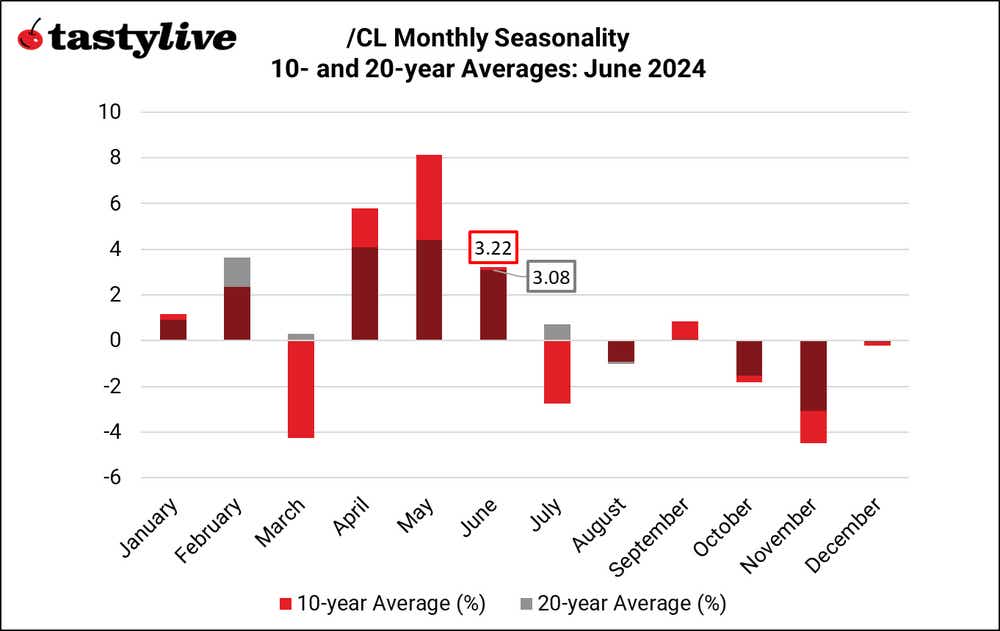

Monthly Seasonality in Crude Oil (/CL)

June is a very bullish month for /CL, on a seasonal basis. Over the past 10 years, it has been the third-best month of the year for the energy product, averaging a gain of 3.22%. Over the past 20 years, it has been the fourth-best month of the year, averaging a gain of 3.08%.

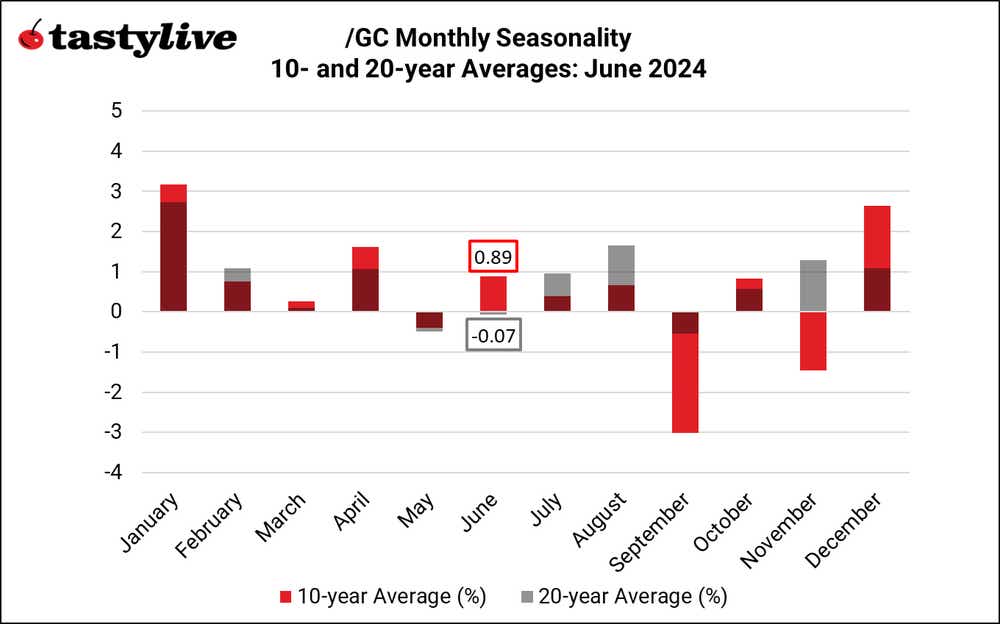

Monthly Seasonality in Gold (/GC)

June is a mixed month for /GC, on a seasonal basis. Over the past 10 years, it has been the fourth-best month of the year for the precious metal, averaging a gain of 0.89%. Over the past 20 years, it has been the third-worst month of the year, averaging a loss of 0.07%.

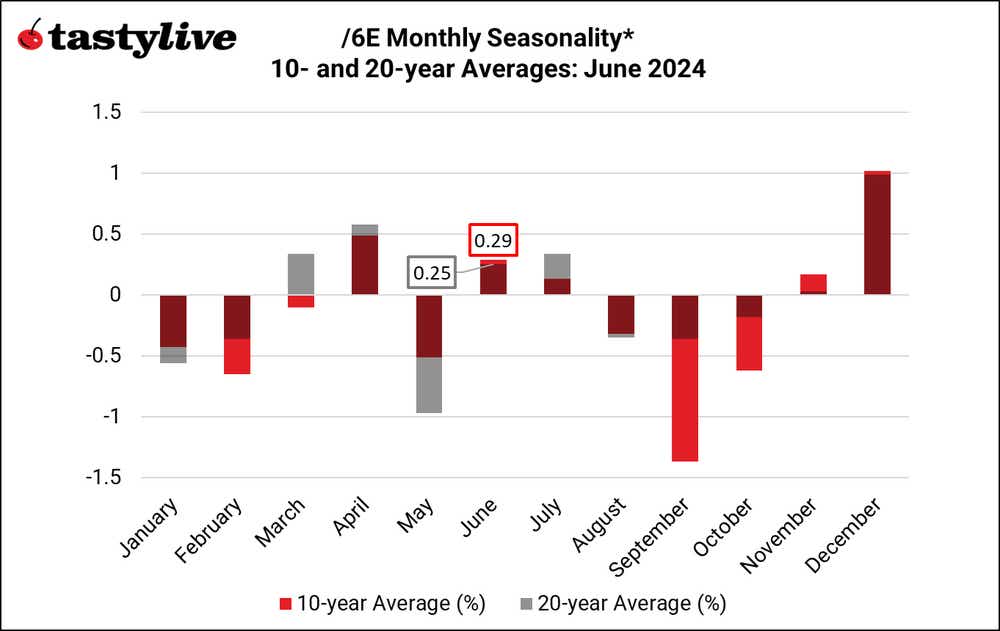

Monthly Seasonality in Euro (/6E)

June is a bullish month for /6E, on a seasonal basis. Over the past 10 years, it has been the third-best month of the year for the pair, averaging a gain of 0.29%. Over the past 20 years, it has been the fifth-best month of the year, averaging a gain of 0.25%. Note: the time series for euro futures (/6E) does not extend beyond 2018; the data series has been backfilled using EUR/USD spot rates as a proxy.

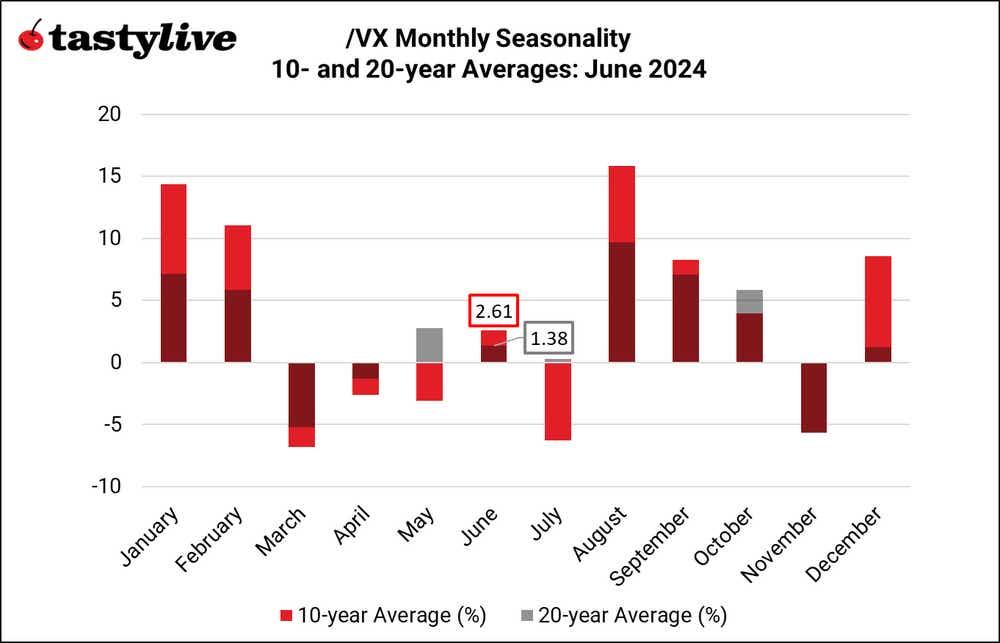

Monthly Seasonality in VIX (/VX)

June is a slightly bullish month for /VX, on a seasonal basis. Over the past 10 years, it has been the sixth-worst month of the year for volatility, averaging a gain of 2.61%.

During the past 20 years, it has been the sixth-worst month of the year, averaging a gain of 1.38%.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.