Multiple Ways to Trade the S&P 500

Multiple Ways to Trade the S&P 500

By:Kai Zeng

Let’s compare SPY ETF, SPX index and ES futures options for trading volume, tax benefits and capital requirements

- While three products offer excellent liquidity in options trading, SPY excels as the most versatile underlying, making it the standout choice overall.

- SPX and /ES futures are larger products better suited for medium to large accounts, unless options strategies have well-defined wings.

- Futures products like /ES have a distinct method of calculating BPR, offering greater efficiency with the potential for a higher ROC, though they come with higher volatility.

Nvidia (NVDA), one of the market's most valuable and actively traded stocks, saw a notional value of $42.1 billion exchanged over the past 30 days. The S&P 500 ETF, SPY, slightly surpassed NVDA with a notional value of $42.8 billion.

The S&P 500 can be represented through various trading vehicles, including SPY (ETF), SPX (Index), /ES (Index Futures) and /MES (Mini Futures). As a favorite among indices, we delve into the differences in trading these options.

Though alternatives like XSP, IVV and VOO are available, they currently lack highly liquid options markets, so we will concentrate on the most popular three options.

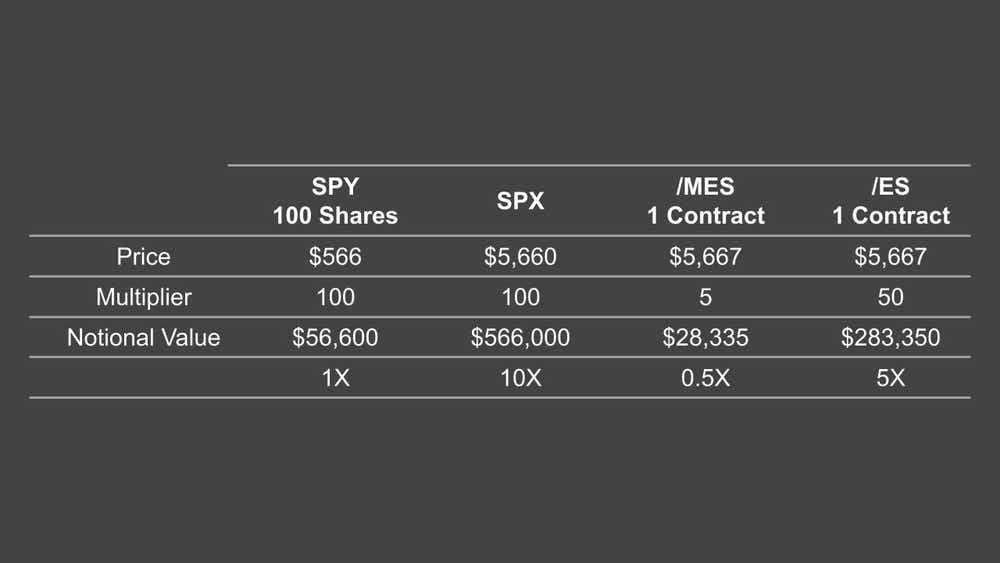

While SPY and futures products are directly tradable, SPX is a cash index and cannot be traded directly. However, options are available for all three. When comparing notional value, SPX is 10 times larger than SPY and nearly twice as large as /ES, while /MES, designed as a mini futures product, has the smallest notional value.

SPY leads in trading volume, outperforming the others by a significant margin. Despite being relatively less expensive, SPY consistently holds a higher average daily notional trading value compared to /MES, /ES, and SPX.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

The high trading volume in SPY contributes to tight bid/ask spreads in its options, providing more efficient pricing for retail traders.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Although trading SPX requires nearly 10 times more capital or Buying Power Reduction (BPR) than SPY, their credit-to-BPR ratios remain similar because of a common formula used for BPR calculation. Futures products, however, benefit from a unique ratio, offering more efficiency as they use SPAN margin, leading to a higher potential return on capital (ROC).

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

An additional advantage of trading SPX and futures options is the tax benefit. They qualify for special treatment under the Internal Revenue Code, where gains or losses from these contracts can be classified as 60% long-term capital gains and 40% short-term capital gains regardless of the holding period.

The following table outlines the advantages and disadvantages of these four products.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.