FOMC Preview: No Rate Hike, But Stocks May Get Bruised Anyway

FOMC Preview: No Rate Hike, But Stocks May Get Bruised Anyway

By:Ilya Spivak

The Federal Reserve might spook stock markets despite opting against another interest rate hike, but the U.S. dollar may struggle to find lasting support.

- The Federal Reserve will almost certainly keep rates on hold this month.

- “Higher for longer” messaging might be more assertive than expected.

- Stocks may be spooked but the U.S dollar might struggle to capitalize.

It is tempting to write off this week’s monetary policy announcement from the Federal Reserve as a non-event. That’s probably a mistake.

The U.S. central bank’s rate-setting Federal Open Markets Committee (FOMC) is expected to keep the target range for its main federal funds rate unchanged at 5.25-5.50%. The latest rate hike was issued in July. The priced-in probability of another one in this tightening cycle is 40%, implying the markets see rates as having peaked already.

The first cut is expected no later than July, with 75 basis points (bps) in cumulative easing on the menu by January 2025.

Fighting inflation: Fed talks, markets listen

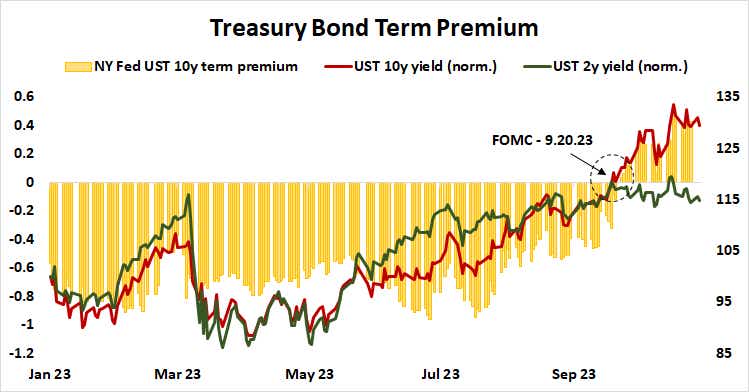

Officials opted to hold fire in September but their message that rates will remain “higher for longer” from here—to ensure inflation continues to march lower—spooked the markets. The updated forecasts published alongside that policy announcement lifted expected rates higher by 50 bps for 2024.

In a speech at the Economic Club of New York two weeks ago, Fed Chair Jerome Powell signaled that the surge in Treasury bond yields after that revelation may have done enough to tighten financial conditions without further action. That followed a pointed dovish shift in other policymakers’ public pronouncements.

With the messaging thus sending a clear and pointed message, it seems tempting to write off November’s FOMC outcome as little more than a restatement of what is already known to markets. It might prove to be more worrying for investors if Mr. Powell and company remind the audience of their designs on the labor market.

Fed rates outlook: fireworks cancelled?

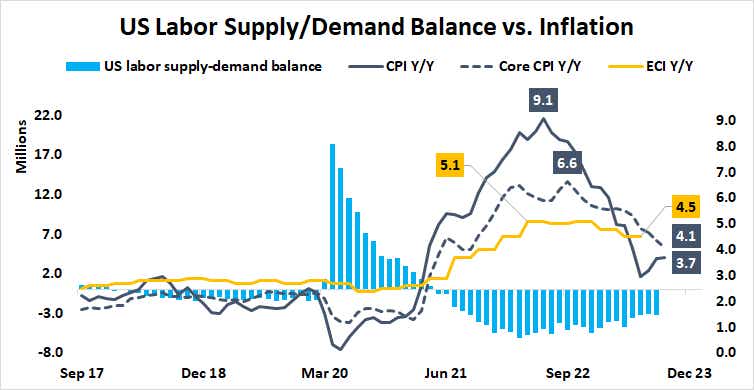

The central bank has suggested that it wants to see wage agreement resets (i.e., layoffs) to help squeeze sticky inflation out of the service sector. Two-year inflation expectations priced into the bond market—reflective of the Fed’s policy action window–have perked up in recent weeks, so they might be moved to reiterate this point anew.

Stock markets might shudder if the message from officials suggests they intend to wait for a meaningful rise in the unemployment rate before the “higher for longer” regime is abandoned, and easing can commence. The U.S. dollar may be unable to capitalize however as capital flows begin to favor markets where policy support seems closer at hand.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.