FOMC Minutes Preview: A Hawkish Tone Threatens Stock Markets

FOMC Minutes Preview: A Hawkish Tone Threatens Stock Markets

By:Ilya Spivak

An ISM report has already made stocks swoon while Treasuries and the dollar jumped higher

- Strong ISM service-sector data argues for slower Fed rate cuts.

- The December FOMC meeting minutes may strike a hawkish tone.

- Wall Street is struggling as bond yields continue push higher.

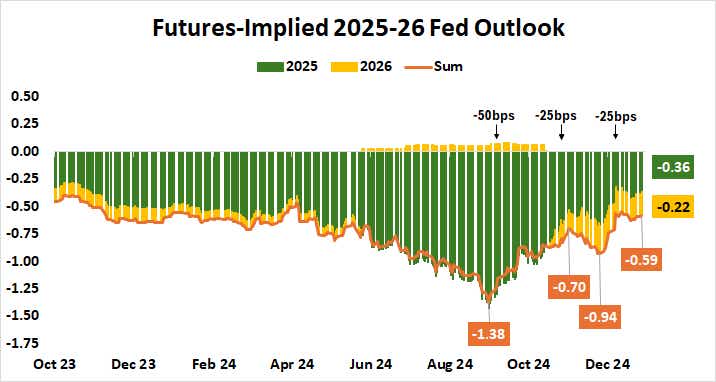

At first, the Federal Reserve seemed to be replaying September with last month’s monetary policy update, albeit in reverse. Markets pressured the U.S. central bank to begin cutting interest rates since April as cooling economic data fed fears of recession. Policymakers finally acquiesced five months later with a big 50-basis-point (bps) reduction.

Moreover, officials envisioned generous stimulus to follow. They penciled in 150bps in further easing, with a third of that destined for the last two policy meetings of 2024 and the rest spread over 2025. However, the economy was back on the upswing by that time, and markets judged the action as excessive.

Has the Federal Reserve misjudged the U.S. economy?

As a result, bond yields and the U.S. dollar sailed higher as traders laid on bets that the Fed will be unable to deliver on its dovish myth-making, pulling policymakers toward a hawkish pivot. That arrived in December. The rate-setting FOMC committee slashed the expected 2025 rate cut tally in half to 50bps and traced a slower path to getting there.

Once again, Fed Chair Jerome Powell and company seemed to be a step behind the economy’s gyrations. Whereas they looked too dovish in September as the economy warmed, they seemed to have overcorrected to the hawkish side in December as it appeared to be cooling once again.

Stock markets are struggling as interest rates go up

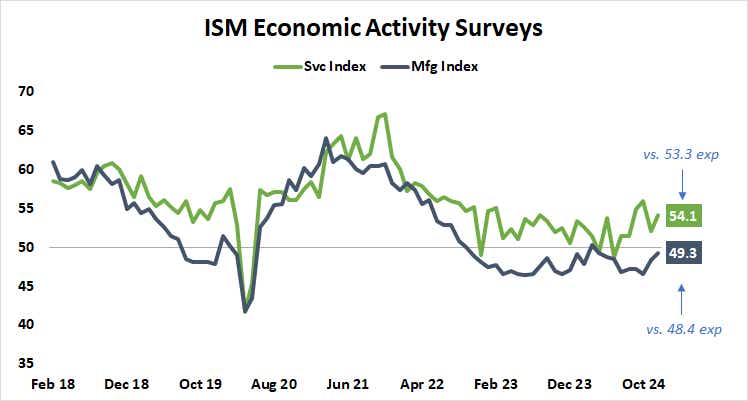

Strong service-sector data from the Institute of Supply Management (ISM) reopened the debate. It showed that activity growth accelerated faster than expected in December from a three-month low in the previous month. What’s more, it put services price growth at the fastest since February 2023.

For their part, Fed officials have flagged increased economic data volatility in recent months and stressed the importance of looking through it to focus on underlying trends. This probably amounts to a broadly hawkish tone in minutes from December’s FOMC meeting due this week. The ISM data may mean the markets are inclined to believe them.

This amounts to a potent risk for Wall Street. Stocks swooned across the major U.S. equity benchmarks as Treasury bond yields jumped higher alongside the U.S. dollar after the ISM report crossed the wires. More of the same may be ahead if hawkish FOMC minutes keep rates ticking upward.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.