Stocks and the Dollar May Turn Lower on FOMC Minutes, U.S. Economic Data

Stocks and the Dollar May Turn Lower on FOMC Minutes, U.S. Economic Data

By:Ilya Spivak

Stocks and the U.S. dollar may fall together while bonds rise as investors rethink Fed rate cut bets

- Fed monetary policy expectations are likely to take center stage as 2025 begins.

- December 2024 FOMC meeting minutes are bein eyed for signs of hawkish conviction.

- Bonds may rise as stocks and the dollar fall on soft U.S. jobs and ISM services data.

Stock and bond markets inched lower in a holiday-shortened week as the calendar turned to 2025. Gold prices and the U.S. dollar kept to familiar ranges. Crude oil prices were a notable standout, rallying 4.8%. Bitcoin found a bit of relief as well, rising 4.1%.

Looking ahead, Federal Reserve monetary policy expectations are likely to take center stage. Analytics from Citigroup are signaling that U.S. economic data outcomes have cooled relative to forecasts since mid-November. Even financial markets pulled the central bank to pivot toward a more hawkish footing. This may inspire a reevaluation.

Against this backdrop, here are the key macro waypoints to consider in the days ahead.

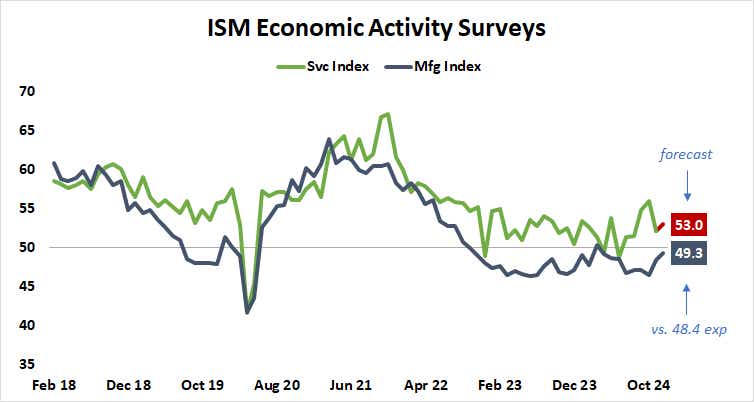

ISM services PMI data

Growth in economic activity in the U.S. service sector is expected to have picked in December. A gauge of the economy’s biggest engine of demand from the Institute of Supply Management (ISM) is penciled in for an uptick after dropping to a three-month low in November.

A relatively softer outcome echoing the recent cooldown in U.S. economic news-flow may signal the markets’ hawkish repositioning of Fed monetary policy expectations since mid-September has become overdone. That might set the stage for a bond rally as Treasury yields and the U.S. dollar backtrack.

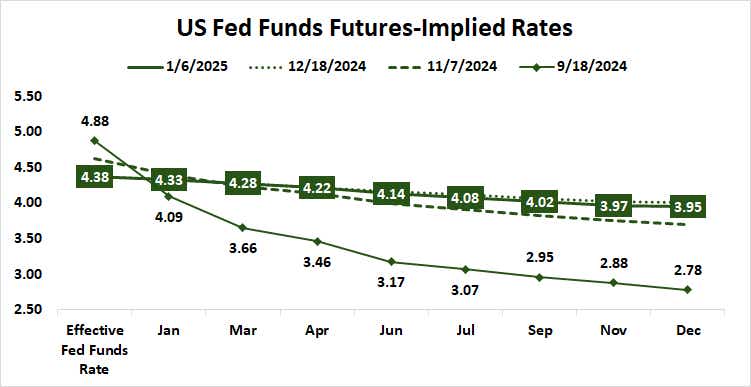

December FOMC meeting minutes

The U.S. central bank’s policy-making Federal Open Market Committee (FOMC) marked a decidedly hawkish turn in messaging last month, embracing the markets’ worries about reflation risk. Officials slashed their 2025 rate cut projection in half, envisioning just 50 basis points (bps) in easing compared with 100bps projected in September.

Traders will be keen to gauge the degree of conviction behind the rethink. If minutes from that sit-down suggest the Fed has become reluctant to offer swift stimulus—opting instead for hawkish gradualism after September’s dovish leap seemingly misfired—stock markets may wobble as bonds rise amid cyclical concerns.

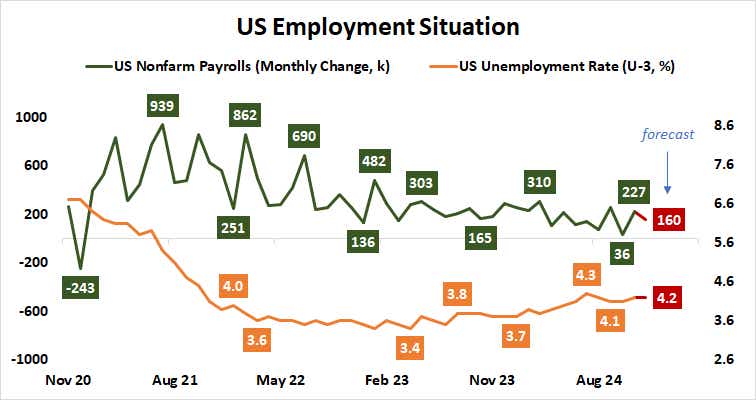

U.S. employment data

The closely watched monthly labor market report from the Bureau of Labor Statistics (BLS) is expected to show the U.S. economy added 160,000 jobs in December. The unemployment rate is expected to remain unchanged at 4.2%, matching the three-month high recorded in November.

As with the ISM report earlier in the week, a downside surprise that points to a cooler view of job creation may signal that market participants and Fed policymakers alike overcorrected as rate cut bets diminished and yields shot higher in the fourth quarter. Backtracking on some of those moves would likely follow.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.