Macro Week Ahead: FOMC Meeting Minutes, Jackson Hole Symposium and Global PMI Data

Macro Week Ahead: FOMC Meeting Minutes, Jackson Hole Symposium and Global PMI Data

By:Ilya Spivak

All eyes are back on the Fed and rate cut speculation after a blistering rebound in stock markets

Stock markets have roared higher, shaking off the panic at the start of August.

FOMC meeting minutes and the Jackson Hole Symposium are front and center.

August PMI surveys from S&P Global will update investors on the risk of global recession.

Stock markets raced higher last week, powering a brisk recovery from the brutal selloff at the start of August. The bellwether S&P 500 rallied nearly 4%, recording its single best weekly performance this year. The tech-tilted Nasdaq 100 added a blistering 5.3%.

Gold prices rose as Treasury bond yields and the U.S. dollar weakened. The Japanese yen stepped lower amid the risk-on backdrop. Crude oil eased lower as the geopolitical premium linked to elevated tensions between Iran and Israel appeared to deflate somewhat. Bitcoin continued to fall, losing 1.6%.

Here are the macro waypoints likely to shape what comes next.

Federal Open Market Committee (FOMC) meeting minutes

The publication of minutes from last month’s meeting of the Federal Reserve’s policy-setting Federal Open Market Committee (FOMC) will kick off a week rife with speculation about where the U.S. central bank is steering. The conclave made official a narrative pivot rolled out since early July that signaled the Fed has become as worried about unemployment as it is about inflation.

Fed Chair Jerome Powell began to preview the adjustment in semiannual Congressional testimony on July 9 and 10. A soft inflation reading seemed to bolster the adjustment just one day later, on July 11. That seemed to revive recession fears among investors, marking the top in global stock markets.

Since then, divergent results on big-ticket U.S. economic data have triggered sharp seesaw volatility. Markets plunged after a soggy jobs report poured gasoline on investors’ worries on Aug. 2, leading into an outright panic on Aug. 5. The markets snapped back sharply after the dust settled, helped along by upbeat retail sales numbers last week.

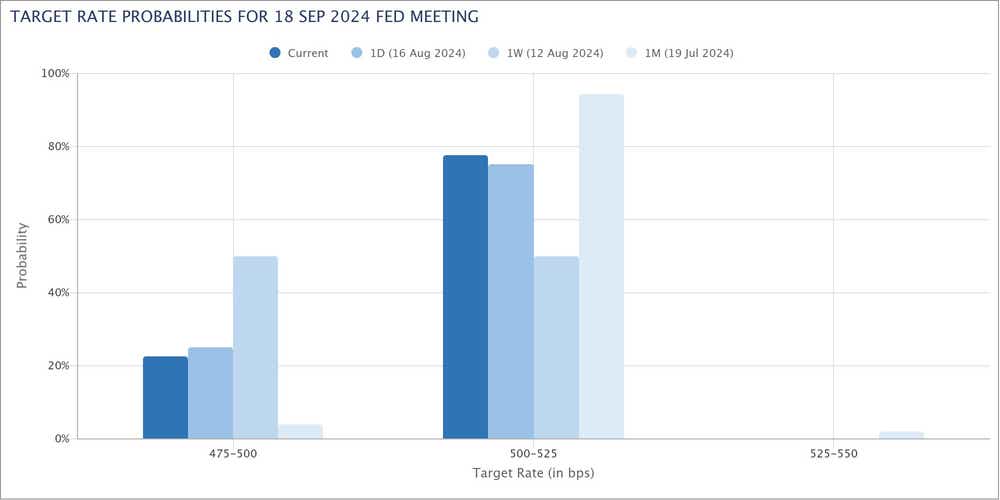

From here, market participants will be keen to size up just how much cyclical concern emerged at July’s FOMC discussions. At the height of recent turmoil, traders became convinced a 50-basis-point (bps) rate cut is on the way in September. They are now pricing in a mere 22.5% probability of such an outcome.

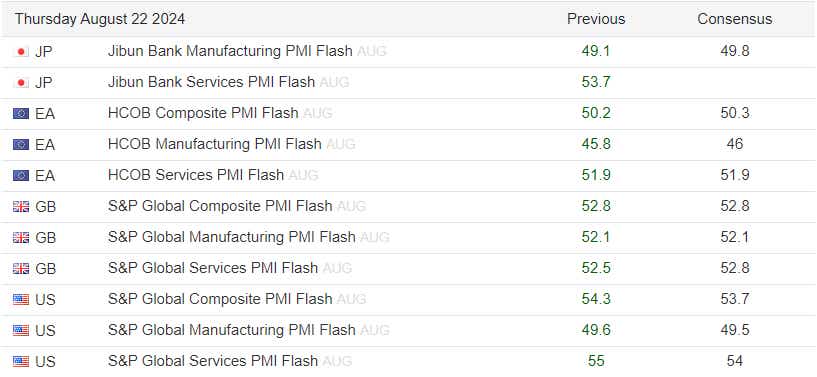

Global purchasing managers’ index (PMI) data

The next step in the markets’ thinking about recession risk comes from the August edition of S&P Global purchasing managers’ index (PMI) surveys. This will help active investors get a sense of global growth trends in a timelier way than gross domestic product (GDP) statistics that lag hopelessly behind events.

July marked the second consecutive month of slowdown for growth in the global manufacturing and service sectors. Analytics from Citigroup warn that worldwide economic data outcomes have increasingly disappointed relative to baseline forecasts since mid-April, suggesting August may mark another step in the wrong direction.

Fed Chair Powell speech at the Jackson Hole Symposium

The high point for this week’s macro news flow will come from Fed Chair Jerome Powell, who is set to deliver a much-anticipated speech at the U.S. central bank’s central bank symposium in Jackson Hole, Wyoming. The gathering often serves as an annual lens-setting exercise, giving the markets a broad trajectory for the Fed’s policy thinking.

Traders will be keen to get a sense of how ready policymakers seem to be to declare that inflation is trending lower with adequate momentum for a rate cut cycle. The cooling of the labor market is likely to be front and center in this conversation, with markets waiting to hear if the Fed sees enough there to trigger action.

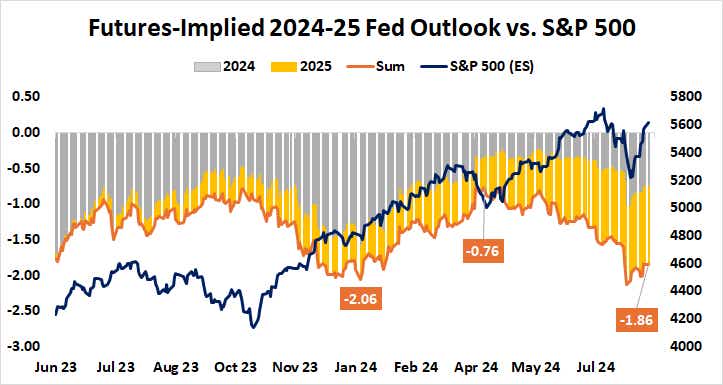

As it stands, Fed Funds interest rate futures price in 75bps in rate cuts for this year, and a further 110bps in easing for 2025. The first 25bps reduction is fully discounted for September’s policy meeting, with a further 50bps to be delivered in November and December. The 2025 stimulus is evenly split between the first and second halves of the year.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.