Can FedEx Rally After Quarterly Earnings?

Can FedEx Rally After Quarterly Earnings?

By:Mike Butler

The shipping company has missed four revenue expectations in a row, while beating three of the last four EPS estimations. What to expect?

- FedEx reports earnings on Wednesday, Sept. 20 at 3 p.m. Central Time. FDX stock has rallied three earnings reports in a row.

- Earnings per share (EPS) are expected to come in at $3.77 and expected revenue is $21.84 billion for the quarter.

- The shipping company has missed four revenue expectations in a row, while beating three of the last four EPS estimations.

FedEx (FDX) reports earnings this Wednesday at 3 p.m. Central Time. The company is expected to report lower EPS and revenue figures compared to the previous quarter. The stock opened 2023 at $147.97, and it is now sitting at a much higher price around $250 per share, up almost 70% on the year so far. The stock reached a 2023 high of $270.95 on July 31, which is well off its all-time high of $390.91 in May 2021.

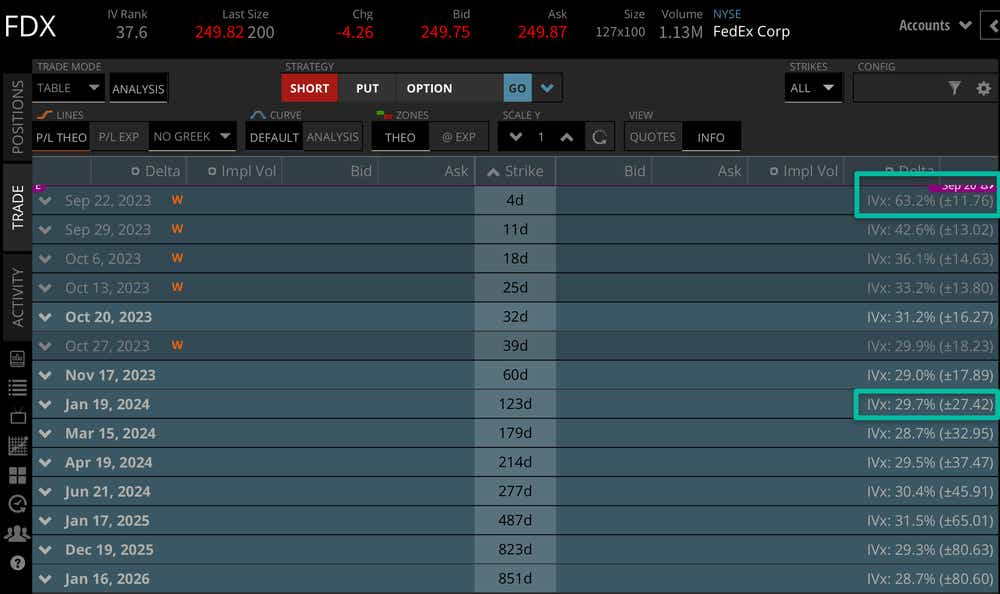

The stock has an expected move of +-$11.76 for this week based on the current implied volatility of the options market, which is a pretty small chunk of the current stock price. The market isn’t expecting too much from this earnings announcement with such a low expected move relative to the stock price, but we’ve seen crazier things happen in the earnings space.

With that said, the expected move through the January 2024 monthly options cycle is currently +-$27.42, which means this earnings announcement is about a third of the expected move priced into the rest of the year. There is some weight to the earnings announcement based on this analytic lens.

Bullish FedEx earnings case

The holidays are just around the corner, and the biggest focus for transportation companies like FedEx (FDX) and United Parcel Service (UPS) is the package volume projection for the year, and realization for the quarter. If FedEx can beat EPS or revenue figures, stay on par or exceed package volume estimates for the quarter, and say something positive about the holidays upcoming at the end of the year, we may see the stock react positively to the upcoming earnings call.

Bearish FedEx earnings case

FDX stock has trickled off of its 2023 highs amidst economic uncertainty, and the looming Fed announcement we also have on Wednesday before the market closes, so it will be interesting to see if the overall stock market reacts to what Jerome Powell has to say at 1 p.m. CST on Wednesday. FedEx has put the EPS figure in focus for the last few earnings reports, with a 24.60% EPS surprise reported on March 16. So, if it fails to generate any sort of positive revenue for the quarter, and misses EPS expectations, we may see the stock take a nose-dive.

If the overall stock market reacts violently to the Fed announcement a few hours before this earnings call, it will be interesting to see if FedEx earnings have the power to reverse the course of the market on a good or bad call – for example, if the stock market sells off hard after the Fed meeting, will FedEx have the ability to rally on a good report? And vice versa if the stock market rallies after the Fed meeting?

Check back in on Wednesday September 20 when FedEx reports quarterly earnings at 3pm CST!

We’ll be covering FedEx earnings trades in the options market on Options Trading Concepts Live at 11am CST, so join us then for some trade ideas as well!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.