Federal Reserve: December FOMC Rate Decision

Federal Reserve: December FOMC Rate Decision

FOMC, USD, SPX TALKING POINTS

- The Federal Reserve convened for the December rate decision amidst a backdrop of rising inflation, increasing the odds more rate hikes in 2022 and 2023.

- The expectation for today is for the Fed to make a hawkish policy shift. The big question is how many rate hikes the FOMC will signal for 2022. The expectation for faster tapering of asset purchases appears to be baked in to the equation at this point.

- This is a live article and will update as details and drivers flow from the statement released at 2PM ET and the press conference beginning at 2:30 PM ET. For the most recent update, scroll to the bottom of this article.

12:45 PM ET

We’re about an hour away from the December FOMC rate decision and markets appear to be harboring a hawkish expectation for the Fed at this meeting.

This would fly in stark contrast to the bank’s stance ever since Covid came into the equation. There was a brief period of hawkishness at the FOMC in late-2018 that quickly left markets after a 20% sell-off in the S&P 500 in Q4, 2018.

From that episode are a few items of note that remain relevant today: Despite markets showing pressure ahead of that December 2018 rate hike, the bank still hiked anyways. The way that they tried to buffer the matter was by forecasting two rate hikes in 2019 as opposed to the three they were previously forecasting.

So, from that, clear evidence of how the Fed uses the dot plot matrix to manage expectations. And another, the manner in which Chair Powell and the Fed stuck to their plan even in the face of bearish equity markets. And then, of course, how the Fed shifted course so quickly to cut rates three times in 2019 after hiking four times in 2018; this highlights how responsive the bank can be to risk-off market behaviors.

It seems that the last thing that the FOMC would want to do is roil equity markets, and this has been the case for some time.

THE EXPECTATION FOR TODAY

1:15 PM ET

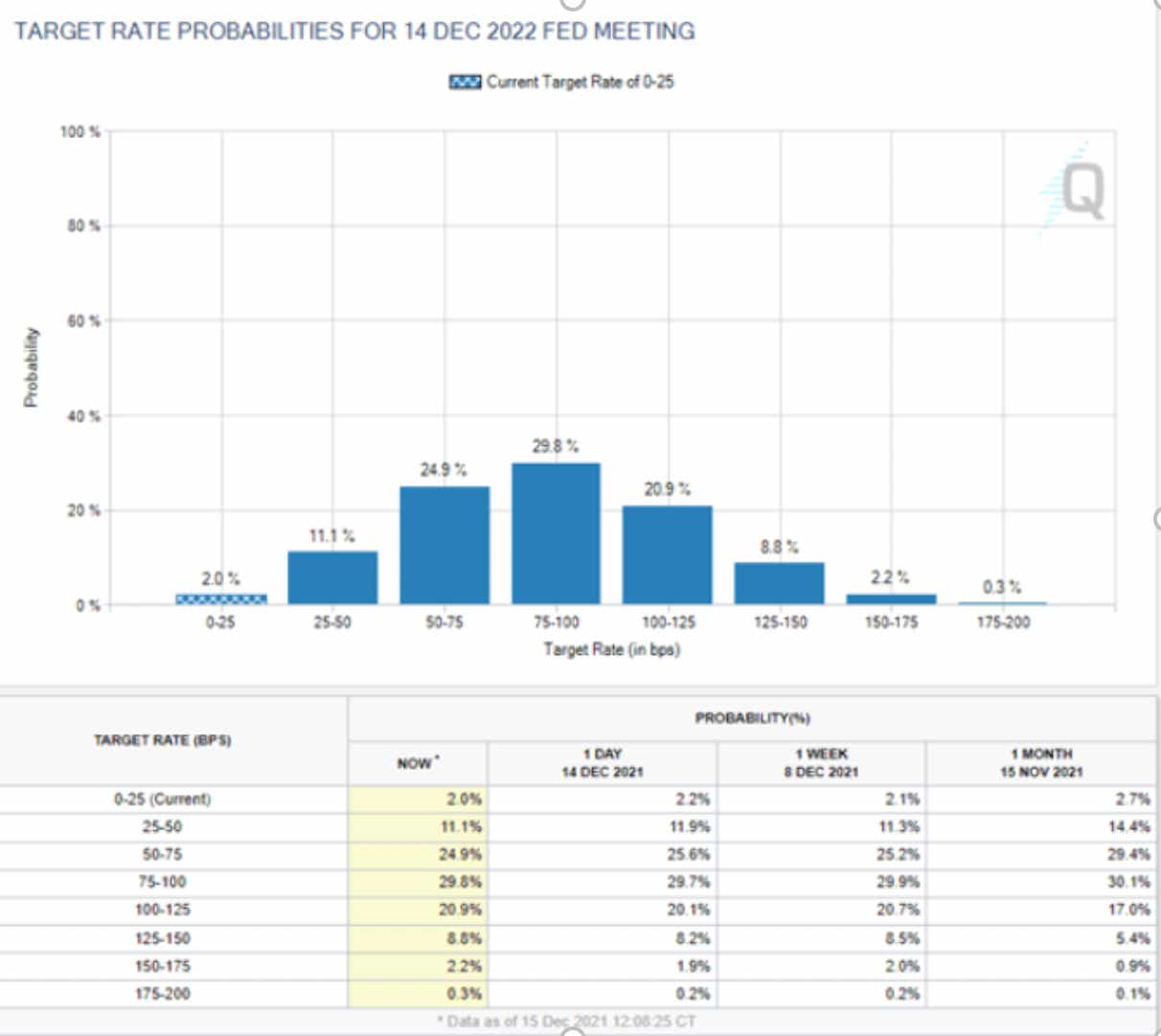

The wide expectation is that the Fed will make a hawkish shift today and going by rates markets, those expectations are fairly high. As of this writing, there’s a 62% probability of at least three rate hikes next year. And there’s a 32.2% probability of four hikes or more next year.

This is in stark contrast to the Fed’s dot plot matrix from the September rate decision that highlighted one possible hike in 2022.

TARGET RATE PROBABILITIES FOR DECEMBER, 2022 FOMC RATE DECISION

Federal Reserve: December FOMC Rate Decision

Chart prepared by James Stanley; data from CME Fedwatch

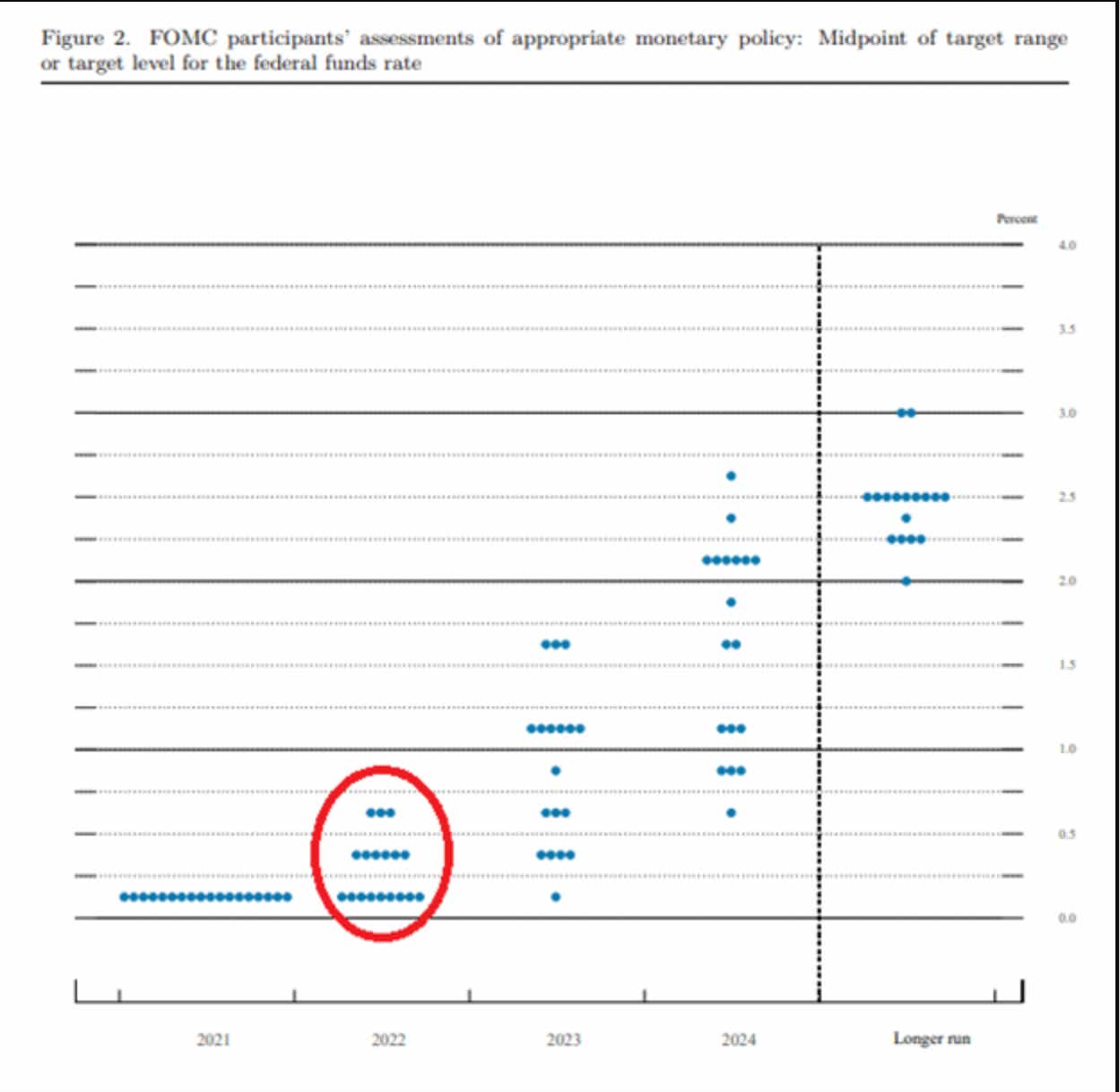

The most recent dot plot matrix from the Fed, issued in September, showed that the bank had a median expectation for one hike in 2022 along with three more in 2023.

SEPTEMBER FOMC DOT PLOT MATRIX

Chart prepared by James Stanley; data from the Federal Reserve

STATEMENT AND PROJECTIONS RELEASED

2:05 PM ET

The Federal Reserve has released their statement for the December rate decision. The bank is going to double the size of asset purchase taper from 15 to 30 Billion per month.

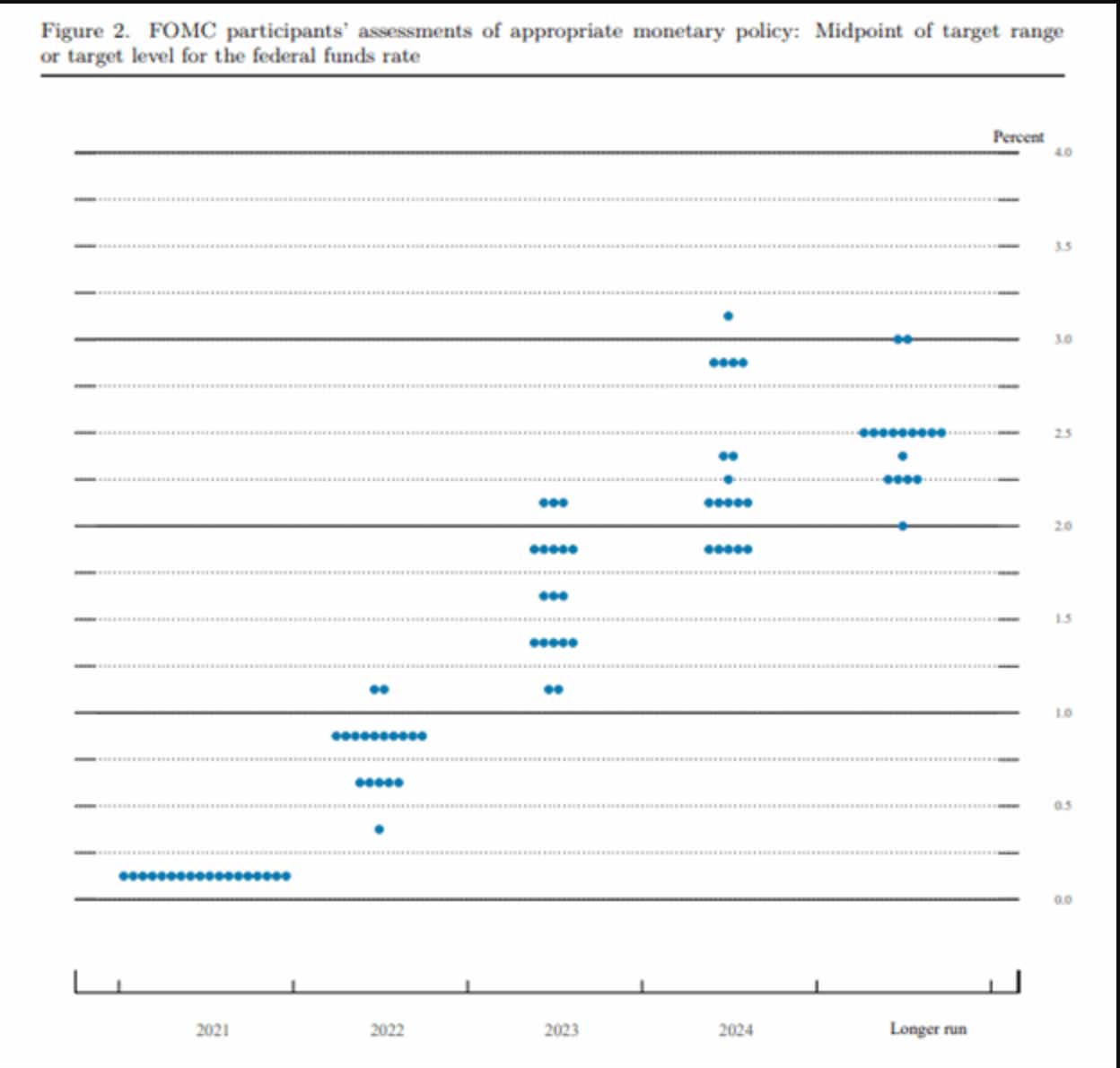

The Fed also increased expectations for rate hikes next year, with between two to three hikes for 2022. The updated Summary of Economic Projections (SEP) is below:

DECEMBER FOMC DOT PLOT MATRIX

Chart prepared by James Stanley; data from the Federal Reserve

IMMEDIATE REACTIONS

The US Dollar didn't want to wait for the FOMC statement as buyers began to push ahead of the release. A quick spike developed right after the statement had dropped, but that move couldn't hold as price action has pushed right back to short-term support, taken from prior resistance around 96.59.

I had talked about some of the major pairs sitting at significant support zones. Today's statement hasn't provided enough motivation for EUR/USD or GBP/USD to break down. But, there are rate decisions out of both economies tomorrow morning so this theme remains center-stage for now.

US DOLLAR FOUR HOUR PRICE CHART

Chart prepared by James Stanley; USD, DXY on Tradingview

STOCKS UP – S&P 500 BOUNCES

The Fed, at this point, appears to have threaded the needle by going hawkish but not so much so that market participants started to get freaked out.

The S&P 500 has put in another bounce from support, presser to begin in 10 minutes.

S&P 500 HOURLY PRICE CHART

Chart prepared by James Stanley; S&P 500 on Tradingview

USD/JPY 114 BREAKOUT

2:30 PM ET

As a sign of today’s drivers, USD/JPY has broken above the 114.00 level that had held as resistance for all of December so far.

This is a rate sensitive pair and higher rates can push the long side of the pair.

The presser is beginning now…

USD/JPY FOUR-HOUR PRICE CHART

Chart prepared by James Stanley; USDJPY on Tradingview

POWELL WARNS INFLATION TO REMAIN ABOVE 2% WELL INTO 2022

2:37 PM ET

In Powell's opening statement, a few remarks of note: Powell said that changes in the economic outlook support a faster taper of asset purchases. Meanwhile, Covid and supply constraints pose threats to the economic outlook.

He also said that demand remains quite robust and that we're still seeing fast economic growth, expecting inflation to remain above 2% well into 2022.

POWELL RATE LIFTOFF

With an eye towards equity markets, Powell opined that the Fed will leave rates near-zero until the US reaches full employment, which they expect to take place next year.

Stocks caught a quick bid on this after pulling back in the opening of his statement at the press conference.

The support level looked at around the 4625 level helped to hold the low.

S&P 500 5 MINUTE PRICE CHART

Chart prepared by James Stanley; S&P 500 on Tradingview

15 MINUTES IN

2:45 PM ET

We’re now 15 minutes into the presser and the takeaways thus far have been strength in stocks along with a tail developing on the topside of the US Dollar candle.

The big push point here appears to be the comment regarding rate lift off, where the bank isn’t looking to lift rates until the U.S. reaches ‘full employment.’

This is a very subjective metric and this could possibly give the bank an excuse to kick the can next year regarding rate hikes.

US DOLLAR 5 MINUTE CHART

Chart prepared by James Stanley; USD, DXY on Tradingview

US DOLLAR NOW DOWN SINCE THE STATEMENT RELEASE

2:58 PM ET

As indication of just how impactful the press conference can be, the US Dollar is now down since the statement was released at 2pm ET.

So, despite the Fed doubling the pace of asset purchase taper while warning of a possible 5-6 hikes over the next two years, the U.S. currency has given up all of the FOMC gains and then some, now falling back towards the prior range of 95.89-96.47.

That 96.47 spot is a long-term Fibonacci level that I’ve been following, and this was actually the final target from the Q4 technical forecast. But it’s now a big test for bulls as to whether or not the price gets defended.

US DOLLAR HOURLY PRICE CHART

Chart prepared by James Stanley; USD, DXY on Tradingview

STOCKS JUMPING LATE IN THE PRESSER

3:06 PM ET

Trends are becoming more clear at this point and it seems as though the Fed has successfully threaded the needle of going hawkish without creating too much fear from market participants. The big phrase that seemed to catch attention was the remark about lifting rates after evidence of full employment, which they expect sometimes next year.

The S&P 500 is now trading above resistance as the US Dollar continues to sell-off and pull back.

S&P 500 FIVE MINUTE PRICE CHART

Chart prepared by James Stanley; S&P 500 on Tradingview

DECEMBER FOMC TAKEAWAY

4:00 PM ET

We’re now at the US equity market close and this rate decision appears to have been a massive success for the FOMC. The bank took a hawkish tone for rate policy, warning of a possible 5-6 hikes over the next two years while doubling the pace of asset purchase taper.

The primary takeaway has been equity market strength, with the S&P 500 jumping back up towards the 4700 level.

S&P 500 HOURLY PRICE CHART

Chart prepared by James Stanley; S&P 500 on Tradingview

US DOLLAR TANKS DURING PRESSER

The US Dollar initially jumped on the release of the statement and the Summary of Economic Projections. But as Powell spoke, the Dollar began to sell-off and that move hasted throughout the press conference. The currency is now down on the day, and focus shifts to rate decisions out of Europe, the U.K. and Japan tomorrow.

US DOLLAR HOURLY PRICE CHART

Chart prepared by James Stanley; USD, DXY on Tradingview

GOLD

Gold prices initially dipped to go along with that US Dollar strength, but as the Dollar turned around so did Gold and Gold prices are now back above the 1770 level.

Be careful here, however, as the Fed has just signaled a series of possible rate hikes and that’s something that’s not usually conducive to the long side of Gold. But, as witnessed in the USD, the Fed didn’t exactly out-do the prior market expectations for rates so this could lead to continued topside near-term.

GOLD HOURLY PRICE CHART

Chart prepared by James Stanley; Gold on Tradingview

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.