Fed Officials Speak Out: 5 Developments to Interpret

Fed Officials Speak Out: 5 Developments to Interpret

By:Ilya Spivak

U.S. stock markets have pushed to record highs despite a significant downshift in Federal Reserve interest rate cut expectations. Here is what central bank officials expect to come next.

- Wall Street continues to power higher despite cooling Fed rate cut bets

- Fed officials signal easing is ahead, but it is likely coming later vs. sooner

- Disinflation may still demand economic pain, “soft landing” not secure

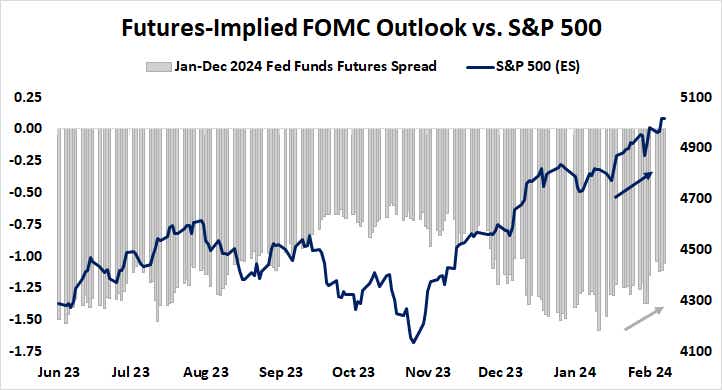

Stock markets have renewed their upward push, shaking off signs of timidity earlier in the week. Perhaps most tellingly, the bellwether S&P 500 has pushed to another record high above the closely watched 5000 figure even as the markets have adjusted down their expectations for Federal Reserve interest rate cuts this year.

Fed Funds futures now indicate 107 basis points (bps) or about 1% in easing on the menu for 2024. That’s down from 158 bps less than a month ago. This means that the markets have dropped two standard-sized 25 bps rate reductions from the baseline forecast.

Such changes might have roiled Wall Street as recently as November and December, when swelling stimulus bets powered stocks to explosive gains. Today’s resilience seems to suggest that traders have accepted diminished scope for policy support and decided that this need not undermine risk appetite.

Guidance from a flurry of speeches from Fed officials this week helped fill in the news-flow gap left a pause in high-profile economic data flow. Eight members of the central bank’s policy-steering Federal Open Market Committee (FOMC) took to the microphone this week.

They were:

- Federal Reserve Chair Jerome Powell

- Chicago Fed President Austan Goolsbee

- Cleveland Fed President Loretta Mester

- Minneapolis Fed President Neel Kashkari

- Boston Fed President Susan Collins

- Philadelphia Fed President Patrick Harker

- Fed Governor Adriana Kugler

- Richmond Fed President Thomas Barkin

Several key themes emerged from these speeches that illustrate the current thinking among U.S. central officials and define the lens through which they are likely to interpret incoming developments:

1. The Fed is cautious about ensuring inflation has been tamed before starting to lower interest rates…

- Powell: It’s unlikely the Fed will have the confidence to cut in March

- Mester: Policy is in a good place [and it would be a] mistake to cut rates too soon

- Kashkari: The FOMC has time to assess economic data before cutting rates

- Collins: [We need to see] more evidence to consider rate cuts

- Barkin: [I’m] very supportive of being patient to get inflation down

2. …but some amount of rate cuts are almost certainly coming this year.

- Powell: FOMC rate forecasts likely haven’t changed much since December [when they saw three cuts in 2024]

- Goolsbee: [I don’t want] to rule out a March cut

- Mester: [I’m] still expecting three rate cuts this year

- Kashkari: I see 2-3 cuts this year as appropriate right now

- Collins: [It will] likely be appropriate to ease later this year

3. While the economy appears to be relatively strong, the Fed sees the risk that ongoing disinflation will demand a slowdown.

- Powell: [I’m] not yet prepared to say that the U.S. has pulled off a soft landing

- Mester: [We] can’t count as much on the supply side to lower inflation

- Kashkari: [My] gut tells me that most disinflation has been from the supply side

- Barkin: Declaring victory is very enticing, but I won’t say that

4. Upbeat consumers and chipper financial markets may limit scope for Fed stimulus

- Kugler: Unexpected consumer strength could slow [path to progress on] inflation

- Barkin: [The] sentiment rebound [and] looser financial conditions pose a risk

5. The “neutral” setting for the Fed’s target interest rate – the so-called r*, where policy settings are neither restricting growth nor aiding it – may now be higher than the period before the COVID-19 pandemic.

- Mester: [I’m] open to the possibility that the neutral rate has risen

- Kashkari: The neutral rate may have increased [and current] policy is not too tight

- Collins: It’s possible that r* has increased [and there’s] a reasonable chance that rates will settle higher vs. pre-pandemic.

- Barkin: [It’s] conceivable that the neutral rate has risen post-pandemic

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.