FOMC Preview: Stocks May Turn Lower No Matter What the Fed Does

FOMC Preview: Stocks May Turn Lower No Matter What the Fed Does

By:Ilya Spivak

Stock markets are at risk as the Fed faces a narrow path to avoiding a misstep

- The markets now favor a jumbo 50 basis point interest rate cut from the Fed this week.

- Priced in expectations demand a dramatic dovish rethink from the FOMC.

- Stocks may be disappointed as officials struggle to walk a very narrow path.

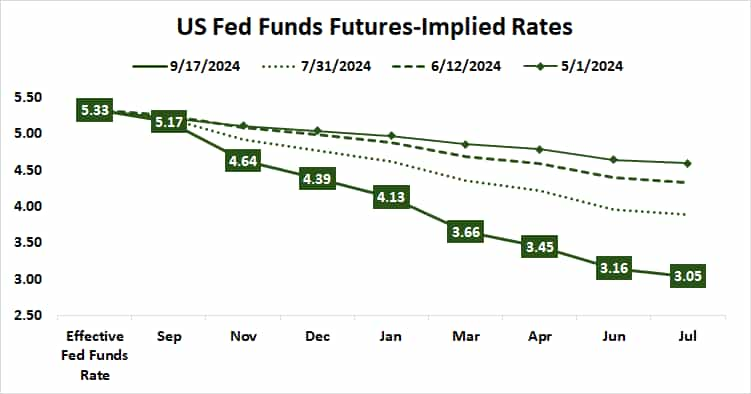

Wall Street has set a high bar for the Federal Reserve as it gears up to begin lowering interest rates after a three-year battle with inflation. Benchmark Fed Funds futures price in the probability of double-sized 50-basis-point (bps) rate cut at 63%. The likelihood of a standard 25bps reduction stands at 37%.

Moreover, the markets envision 94bps in stimulus before the calendar turns the page on 2024. This implies a tilt toward four regular cuts spread over the year’s three remaining meetings—this month as well as in November and December. That means a 50bps cut is seen as likely at one of them, even if the move doesn’t materialize this week.

Markets expect much more from the Fed than just a rate cut

Looking further afield, 135bps in cuts are penciled in for 2025. The Fed meets eight times a year, so that amounts to an average of 17bps per meeting. To put it another way, the probability of a 25bps rate cut at any given Fed meeting next year is 68%, all else being equal.

This is a lot more dovish than the forecast issued by the U.S. central bank in June, the last time it updated official prognostications. Officials anticipated just one rate cut in 2024, then four of them in 2025. There seems to be little doubt that a revision closer to the markets’ disposition is ahead.

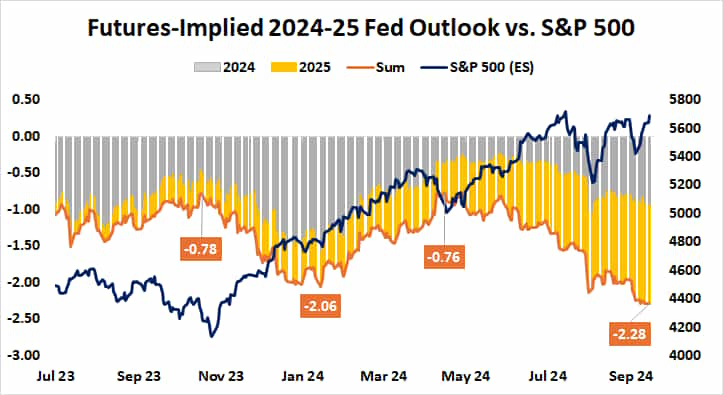

The key question for investors is whether Fed Chair Jerome Powell and company can deliver the right combination of policy change, forecast adjustment and forward guidance to appease twitchy financial markets. The path to such an outcome seems devilishly narrow as the rate-setting Federal Open Market Committee (FOMC) readies its verdict.

Stock markets may fall as FOMC action sours risk appetite

If the dovish pivot underwhelms, the markets may reason that the Fed will be too slow to lower borrowing costs in time to avoid an unwelcome economic downturn. If the central bank overcorrects, that might cause panic amid worries that a slide toward recession is underway already, and hapless policymakers are playing catch-up yet again.

On balance, this hints that of the many possible scenarios for what lies ahead, more outcomes bode ill for risk appetite than the alternative. Accordingly, the path of least resistance for stock markets seems to be pointed lower, while that of U.S. dollar favors strength against most major currencies (apart from the Japanese yen, perhaps).

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.