Do Stocks and Bonds Still Care About the Fed After Rosy U.S. CPI Data?

Do Stocks and Bonds Still Care About the Fed After Rosy U.S. CPI Data?

By:Ilya Spivak

Stocks and bonds will test their mettle as last week’s spirited rally searches for reasons to keep going

Traders await the FOMC meeting minutes after stocks and bonds cheered U.S. CPI last week.

The U.K. inflation report may set the stage to start Bank of England interest rate cuts.

May’s purchasing managers index (PMI) data may revive global slowdown fears.

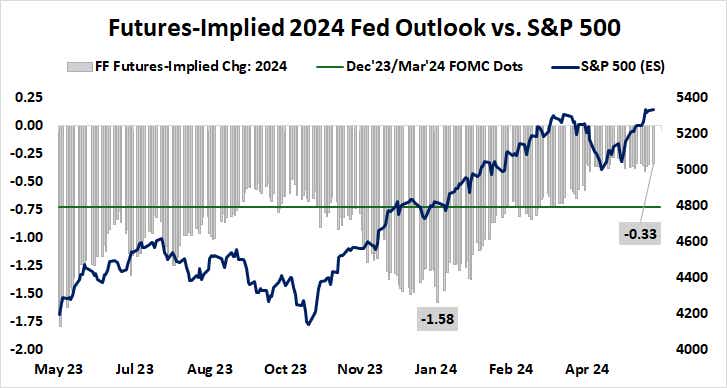

Stock markets continued to cheer last week, with the bellwether S&P 500 stock index and its tech-centered Nasdaq counterpart returning to record highs. That’s after U.S. consumer price index (CPI) data showed that disinflation resumed in April after two months of standstill.

Most critically, the core price growth measure resumed the march lower after getting stuck in February and March. It slid to 3.6% year-over-year, the lowest in three years. That appears to have anchored the consensus view that the U.S. central bank will issue at least once interest rate cut this year.

Treasury bond yields dutifully ticked lower across maturities, although a major break from recent ranges did not happen. Crude oil and gold prices pushed higher while the U.S. dollar weakened against most of its major currency counterparts. In a show of robust risk appetite, bitcoin surged over 10%.

Here are the macro waypoints that are likely to shape price action this week.

Federal Open Market Committee (FOMC) meeting minutes

Wednesday's release of minutes from the May meeting of the Federal Reserve's policy-setting committee is likely to take top billing on an otherwise sparse economic calendar this week.

The statement released after the conclave signaled officials’ frustration with stalling disinflation and a determination withhold rate cuts until adequate progress resumed.

Traders will be keen to weigh up the tone of the discussion around what to do about sticky prices, and whether the idea of resuming rate hikes has gained any traction. Speaking at the press conference following the meeting, Fed Chair Jerome Powell said current policy settings will become restrictive enough to cool prices if held over a longer period.

U.K. consumer price index (CPI) data

Analysts expect inflation in the U.K. to have plunged to 2.1% year-over-year in April, marking a three-year low and landing within a hair of the target 2% aimed for by the Bank of England (BOE). The central bank signaled a growing readiness to begin cutting interest rates when it met two weeks ago (as expected).

As it stands, benchmark SONIA interest rate futures price in the first 25-basis-point (bps) cut to arrive no later than August. A second one is on the menu by December. In all, the markets have priced in 55 bps in cuts this year, implying a 20% probability of a third reduction before the calendar turns to 2025.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Global purchasing managers index (PMI) data

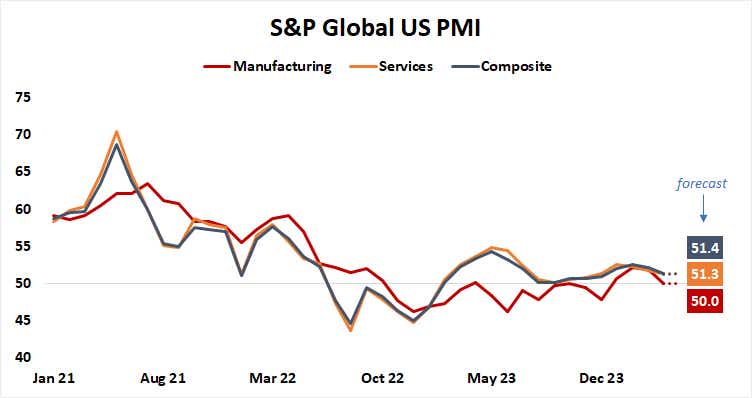

Economic conditions in the U.S. held broadly steady in May after a slowdown in April, according to expectations for incoming PMI data from S&P Global. Standstill in the manufacturing sector coupled with analysts expecting tepid growth on the services side to produce a modest pace of overall expansion.

Observers expect analog data from the Eurozone, the U.K., Australia and Japan to produce comparable results. Minor month-to-month adjustments are broadly projected to keep the pace of worldwide growth at an even keel.

However, analytics from Citigroup warn that U.S. as well as global outcomes have been weakening relative to forecasts over the past month. That may set the stage for disappointing results that could revive global slowdown fears.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.