Fed Hikes and the Banking Crisis: End of Story?

Fed Hikes and the Banking Crisis: End of Story?

Interest Rate Hikes are Finished. Now What?

The Federal Reserve delivered a 25-bps interest rate hike as expected at their May meeting, and in the process effectively signaled the end of their rate hike cycle with their main rate at 5.00-5.25%. It was just two months that Fed policymakers were suggesting that the main rate could rise as high as 6.00% prior to any discussions about pausing efforts. In the interim, the failures of SVB, Signature Bank, and First Republic clearly changed the Fed's calculus.

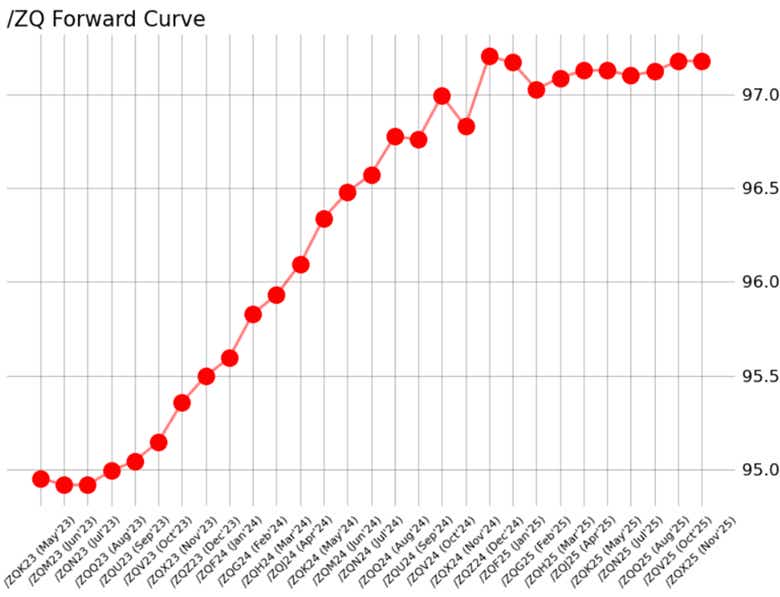

Look no further than the phrasing used in the May policy statement regarding weighing the cumulative effects of prior tightening efforts on the economy and financial system before any other hikes would be considered. One might say "cumulative effects" could translate to some of the recent bank failures. And yet, just because the rates hikes may be finished – according to both the Fed and market pricing, per /ZQ – there is no guarantee that other smaller and regional banks won't fail in the coming weeks or months.

Regional Banks May Still be in Trouble

While the failures of SVB, Signature Bank, and First Republic have been absorbed by broader markets without much widespread disruption (beyond the individual bank shares and corresponding ETFs), the reality of the situation is that no regulatory changes are likely in the near-term which could fundamentally alter the market's collective perception of the trouble that beleaguers smaller banks: asset-liability duration mismatch; unrealized losses on their balance sheet undermining their CET1; and a significant percentage of deposits north of $250,000 that fall outside of the FDIC's insurance purview.

No regulatory changes - through executive fiat or Congressional action - are likely in the near-term specifically because of the proximity to the debt ceiling. One might argue that any changes to FDIC insurance levels, for example, could be tied to a compromise around the debt ceiling debate, but would unlikely be treated as a separate, standalone issue in the next few weeks. In effect, none of the problems plaguing the smaller and regional banks have been solved, and sustainable solutions don't appear likely to come together before the month is over (it’s not sustainable for the bulge bracket banks to gobble up every smaller competitor, even for a song).

There are now some regional banks that are evolving in the unfortunate grey area of becoming zombie banks, whereby they aren't failed institutions outright, but they may not be able to stay operational without government support. This puts these smaller financial institutions on the path to receivership or being acquired absent significant regulatory changes at the federal level, particularly if the Fed maintains its main rate at an elevated level for a long time, allowing the asset-liability duration mismatch to persist, thus incentivizing more depositors to flee.

Regional Bank Stocks to Watch:

- IAT

- KRE

- KBE

- XLF

- WAL

- USB

- CMA

- PACW

- PNC

--- Written by Christopher Vecchio, CFA, Head of Futures and Forex

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.