The Expectancy of Trading Strangles: A Key to Profitable Trading

The Expectancy of Trading Strangles: A Key to Profitable Trading

By:Kai Zeng

Use this step-by-step guide to the expectancy ratio to improve your win rate and maximize returns

- Investors can use the expectancy ratio is a straightforward tool for estimating potential average profit or loss per trade.

- It highlights the advantages of trading in high IVR markets, where the risk/reward ratio is favorable.

- For traders using SPY strangles, high IVR conditions promise a better outlook, suggesting strategic timing in volatile markets can boost profitability.

It's important for novice traders to evaluate their strategies by using various metrics like average profit/loss (P/L), probability of profit, risk and volatility. These measures provide a snapshot of how strategies are performing.

However, there's another valuable metric to consider: expectancy. This statistical tool helps estimate the average amount you can expect to win or lose per trade, offering insight into how well strategies align with financial goals and risk tolerance.

The formula for expectancy is simple:

(Win Rate x Avg. Win) - (Loss Rate x Avg. Loss)

A positive expectancy ratio indicates a strategy is likely to be profitable over time, whereas a negative ratio suggests potential losses. The larger the positive ratio, the more profitable the strategy is expected to be. A strategy with a high positive expectancy is attractive because it suggests consistent profitability, while a negative expectancy might prompt you to reconsider your approach.

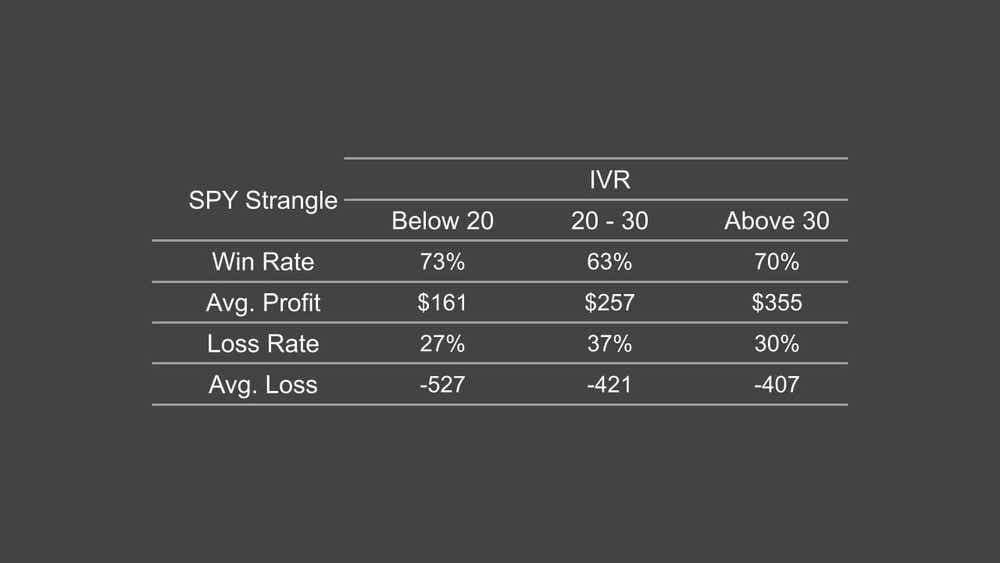

To illustrate expectancy in action, consider a study of the SPY 45-day 16 Delta strangles conducted over 20 years. This analysis categorized implied volatility rank (IVR) into three levels: below 20, between 20 and 30, and above 30.

As anticipated, trading in low IVR (below 20) markets showed higher success rates, but these trades resulted in the lowest average profits and the highest average losses. In contrast, trading when IVR exceeds 30 yielded opposite results, with higher average profits and lower average losses.

So, which scenario has the highest expectancy? Does each scenario offer the positive expectancy that traders prefer?

The next analysis revealed that trading in high IVR markets (above 30) provided a more favorable risk/reward ratio of approximately 3:1, with a 70% success rate. This indicates high IVR environments are advantageous for premium sellers, affirming that increased volatility can significantly enhance trading performance. Conversely, because of the higher average losses observed when trading in low IVR markets, the expectancy was below zero, highlighting the importance of strategic timing in volatile conditions.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.