Upbeat U.S. ISM and Jobs Data May Hurt Stocks, Boost Dollar on Slower Fed Rate Cuts

Upbeat U.S. ISM and Jobs Data May Hurt Stocks, Boost Dollar on Slower Fed Rate Cuts

By:Ilya Spivak

If the Fed is cutting rates and China is boosting stimulus, why are stock markets slowing down?

- Stock markets keep rising but the momentum is slowing despite supportive news.

- The euro may fall if Eurozone CPI inflation data boosts ECB rate-cut speculation.

- Upbeat U.S. ISM and jobs data may cool Fed stimulus bets, hurting Wall Street.

Wall Street eked out a third consecutive week of gains, but upward momentum has slowed despite a seemingly strengthening economic tailwind. The bellwether S&P 500 added 0.5% last week, following gains of 2.35% and 3.88% in the preceding two weeks, respectively. The tech-tilted Nasdaq 100 saw similar deceleration, rising 1%.

Shares roared higher in second week of September as Federal Reserve interest rate cut speculation reached fever pitch, with markets positioning for a double-sized 50-basis-point (bps) reduction. The upward drive slowed as the U.S. central bank delivered in line with expectations. It has now cooled further despite a stimulus surprise from China.

One reason for soggy risk appetite may be a worry about future capital costs. The markets have judged the onset of U.S. easing as likely to be inflationary: the yield curve steepened, gold and copper rose, and the dollar weakened. This implies that the Fed may have a higher floor on rates, just as a many firms move to refinance their debts.

The 2021-23 rate hike sequence is unique among previous tightening cycles since the advent of the modern financial system following the end of the gold standard in that firms’ net interest payments fell rather than rose. That’s because they grew flush with cash during the COVID-19 pandemic, delaying refinancing at rising rates by three to five years.

Fed Chair Jerome Powell seemed to add to market worries as he pushed back against traders’ dovish myth-making in a speech on Monday. He said the U.S. central bank is not in a hurry to cut rates, adding that risks to the economic outlook are “two-sided.” This visibly spooked the markets, as expected.

Against this backdrop, here are the macro waypoints likely to shape what comes next.

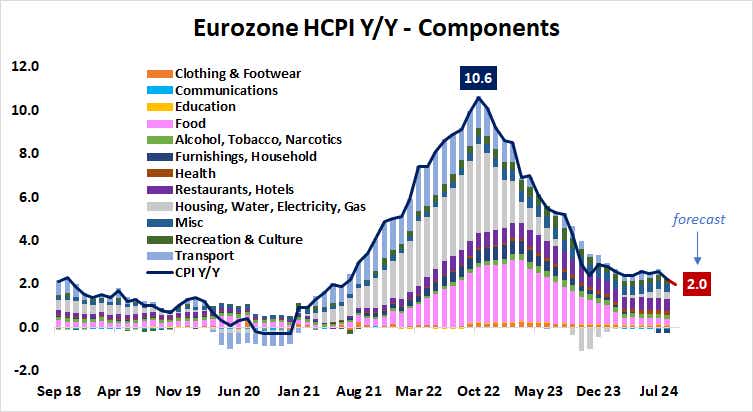

Eurozone consumer price index (CPI)

Inflation in the Eurozone is seen cooling further in September, falling to a three-year low of 2% year-on-year. Ominous purchasing managers’ index (PMI) data showed economic activity shrank again this month, scattering price pressures. Analog German data released ahead of the region-wide report showed faster disinflation than expected.

Soggy results may boost European Central Bank (ECB) rate cut speculation. As it stands, benchmark ESTR interest rate futures price in 47bps in cuts this year, implying that two more standard-sized reductions are almost certainly on the menu. If the CPI data helps nudge this tally higher, the euro is likely to face selling pressure.

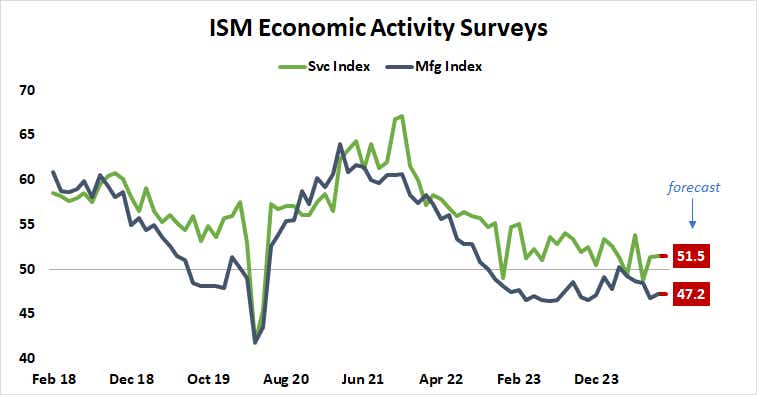

U.S. ISM purchasing managers index (PMI) data

Business activity surveys from the Institute of Supply Management (ISM) are expected to show steady performance from the U.S. economy in September. Ongoing contraction is in view for the manufacturing sector while services continue to grow, with the pace of change in both holding relatively steady for a third consecutive month.

On balance, this paints a picture similar to the S&P Global version of PMI statistics published last week. However, data from Citigroup suggests U.S. economic news flow has improved relative to median forecasts over recent weeks. If that foreshadows unexpected strength, a trimming of Fed rate cut bets may sting stocks and boost the dollar.

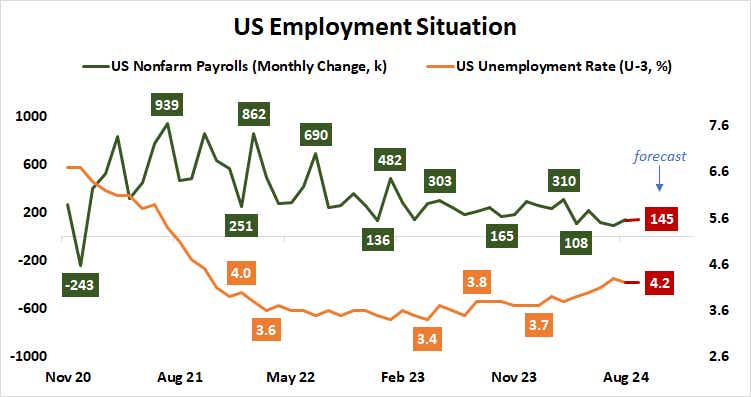

U.S. employment data

Steady progression is likewise expected from the labor market when September’s edition of official employment statistics is unveiled. The economy is seen adding 145,000 jobs to nonfarm payrolls, a barely noticeable uptick from August’s 142,000. The unemployment rate is expected to remain unchanged at for a third month at 4.2% straight.

Here, too, the markets’ reaction is likely to be fueled by the degree to which the realized results will influence traders’ Fed policy outlook. An upside surprise echoing the cheerier tone in U.S. economic news flow over recent weeks may spur on reflation bets, reducing scope for cuts next year. That might bode ill for stocks and bonds but help the greenback.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.