The Euro Is No Place to Hide as Fear of Recession Hits the Markets

The Euro Is No Place to Hide as Fear of Recession Hits the Markets

By:Ilya Spivak

Yes, the euro surged as global stock markets sank this week, but the gains are probably fleeting

The euro scored its best performance yet this year as stock markets crumbled.

Recession fears will not bypass the Eurozone as regional growth hits a roadblock.

The euro’s strength probably reflects panic-driven liquidation. It seems unlikely to last.

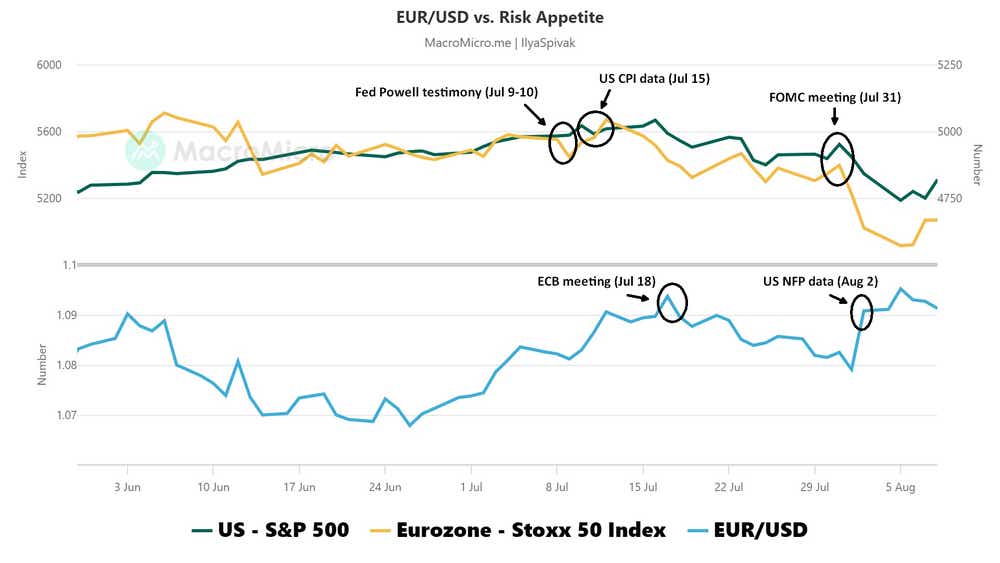

As financial markets shuddered amid a blistering sell-off at the start of the week, euro price action stood out. Sweeping liquidation supported the Japanese yen, which benefitted handsomely from the unwinding of carry trades. The U.S. dollar found decent support as well, flexing its typical anti-risk liquidity appeal.

Curiously, the euro joined these more traditional recipients of defensive capital flows on the upside.

The common currency put in a potent rally on Aug. 2 as softer-than-expected U.S. employment data fueled stock market losses amid gathering recession fears. It added 1.1% against the greenback, the biggest one-day rise this year. It scored another increase as the selling reached fever pitch on Aug. 5, touching an eight-month high.

Has the euro become a haven amid market chaos?

Such price action seems to beg the question of whether active investors view the euro as safe. The markets’ defensive stance since early July seems to have been triggered by a dovish tone shift at the Federal Reserve, with investors reasoning that the central bank’s growing sense of urgency about cutting interest rates points to perceived weakness in the business cycle and mounting risk of recession.

One might reason that the euro’s gains point to its appeal as a refuge in troubled times. Have the markets concluded that economic conditions in the currency bloc are so meaningfully superior to those elsewhere that euro-denominated assets represent attractive value? That seems unlikely.

The Eurozone economy is struggling to grow again

To be sure, the Eurozone economy has performed a touch better so far in 2024 than it did in the previous year. Gross domestic product (GDP) data shows output grew 0.3% in the first quarter, than repeated the trick in the three months to June. That’s notably stronger than the average of 0% growth in the preceding five quarters.

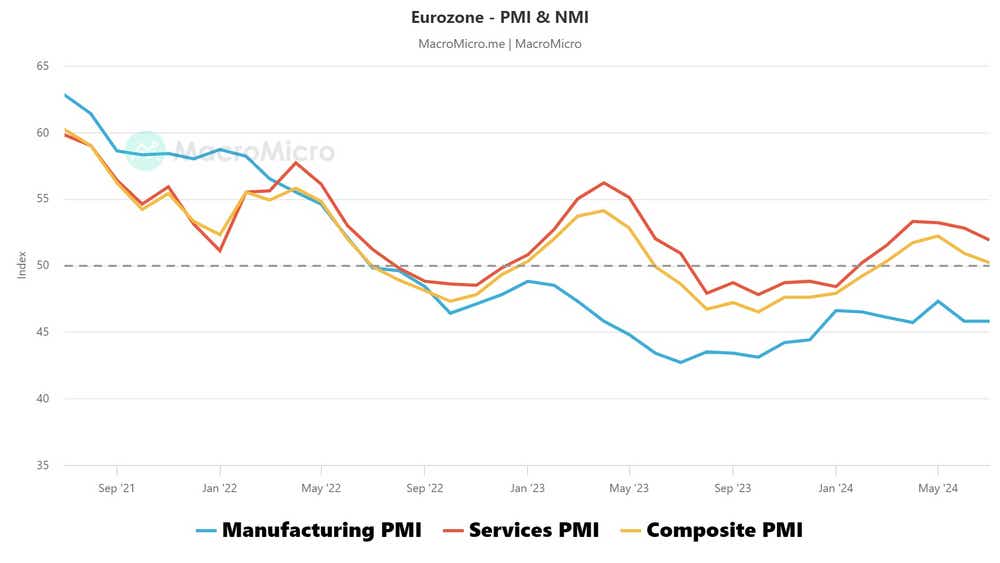

The shallow rebound seems to be fading, however. Timelier purchasing managers index (PMI) data shows that economic activity growth has been slowing for two months since peaking in May. As of July, it slumped back to near-standstill. A “nowcast” estimate from the IFO institute, a German think tank, sees a GDP drop in the third quarter.

Investors have noticed. The monetary policy outlook implied in benchmark ESTR interest rate futures has shifted from 42 to 64 basis points (bps) in remaining rate cuts from the European Central Bank (ECB) this year since recession fears emerged in early July. That’s 21bps more in easing, or nearly an extra standard-sized 25bps cut.

Euro gains may be fleeting as the pace of liquidation cools

No wonder the euro was trading lower with stock markets last month: the Eurozone seems to be caught up in the very same recession worries on display more broadly. What then of the currency’s explosive surge in the first days of August? Perhaps the pace of liquidation is the answer.

The euro is the second-most traded currency after the U.S. dollar, according to data from the Bank of International Settlements. Aug. 2 (Friday) and Aug. 5 (Monday) marked the worst two-day loss for the MSCI All-Country World index of global stock prices (ETF: ACWI) in over two years. The benchmark shed a cumulative 4.3%.

Such rapid capital flight from risk-seeking assets into the most liquid versions of cash might have put the euro near the top of the list of exit venues. The honeymoon might be short-lived, however. As rabid panic gives way to more “normal” de-risking akin to that of July, the euro may face renewed selling pressure.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.