Euro to Fall Against the Dollar if France's Election Brings More ECB Rate Cuts

Euro to Fall Against the Dollar if France's Election Brings More ECB Rate Cuts

By:Ilya Spivak

Polls suggest the centrist Ensemble bloc of parties led by Mr. Macron’s Renaissance is due for a drubbing

The battered euro is casting a worried eye on France’s national election.

Parliamentary gridlock might beckon deeper European Central Bank interest rate cuts.

Breaking 1.07 vs. the dollar may set the stage to hit a 10-week low.

The euro plunged alongside Eurozone stocks two weeks ago as French President Emmanuel Macron surprised markets with the announcement of a snap parliamentary election. The currency has since settled into an uneasy range against the U.S. dollar as the first round of voting looms on June 30. A second round will follow on July 7.

Polls suggest the centrist Ensemble bloc of parties led by Mr. Macron’s Renaissance is due for a drubbing. An average of polling data reported by The Economist has it scoring just 18% of the vote. Meanwhile, the right-wing National Rally is in the lead with 33%, and the left-wing New Popular Front is trailing close behind at 28%.

Mr. Macron himself is scheduled to remain in office until 2027. This probably means relative continuity on defense and foreign policy. However, a reshuffling of parliament may bring forward a prime minister from an opposing bloc and produce a legislature so fractured that domestic matters—including economic policy—become mired in gridlock.

After the French election: ECB to the rescue?

This comes at a tricky time. June’s purchasing managers index (PMI) data showed unexpected weakness in the French economy and that of the Euro Area at large. Economic activity in the bloc’s second-largest economy unexpectedly shrank at the fastest pace since February. Growth slowed to the grouping’s weakest since March.

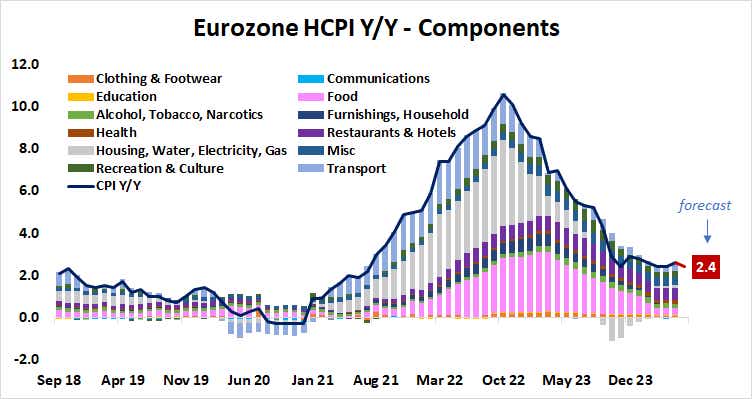

If fiscal policy is tied up in knots, the European Central Bank (ECB) will be on the hook to do more to support the economy with monetary policy. Consumer price index (CPI) data due early next week is expected to show inflation slowed this month, ticking down to 2.4% year-on-year. That may help the central bank find room for more stimulus.

As it stands, benchmark ESTR interest rate futures are pricing in 45 basis points (bps) in additional rate cuts this year, after the ECB began lower borrowing costs with a 25bps cut on June 6. A second such reduction is priced in by October. The probability of a third is implied at a commanding 80%.

Euro on weak footing against the U.S. dollar

Meanwhile, the policy outlook for the Federal Reserve seems to have stabilized. Incoming personal consumption expenditure (PCE) data—the U.S. central bank’s favored inflation gauge—appears unlikely to substantively change the baseline view of just one 25bps cut this year and four more in 2025.

This seems like a toxic mix for the euro. A break of support just above the 1.07 figure may open the door for another challenge of April’s slow at 1.0629. Extending still further below that may bring a test of the 1.05 figure as the downtrend in play since the start of the year continues. Clearing resistance at 1.0815 may herald a return above 1.09.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.