The Euro May Rise Against the U.S. Dollar as Local Inflation Ticks Higher

The Euro May Rise Against the U.S. Dollar as Local Inflation Ticks Higher

By:Ilya Spivak

The euro may continue to recover from a two-year low against the U.S. dollar, at least for now.

- The euro is trying to bounce after hitting a two-year low against the U.S. dollar

- An uptick on Eurozone CPI inflation data may help the euro extend its recovery

- Status-quo FOMC minutes, U.S. PCE figures might keep the dollar on defense

The euro popped higher against the U.S. dollar after last week brought the single currency to a two-year low. That followed two months of near-constant selling as the markets trimmed Federal Reserve rate cut expectations, sending the greenback broadly higher. Disappointing Eurozone PMI data added emphasis to the bearish argument.

The rebound now on display seems to follow from U.S. news-flow once again. President-elect Donald Trump nominated Scott Bessent, a long-time macro hedge fund manager, to the influential post of Treasury Secretary to the incoming administration set to take the reins in January.

The euro may find support if Eurozone CPI data tops expectations

The markets seemed to breathe a sigh of relief once the news came across the wires. Traders appeared to conclude that Mr. Bessent’s extensive, relevant experience will be a steadying influence in the incoming administration. That trimmed a degree of sovereign risk from interest rates, pushing them lower and eating into the dollar’s yield advantage.

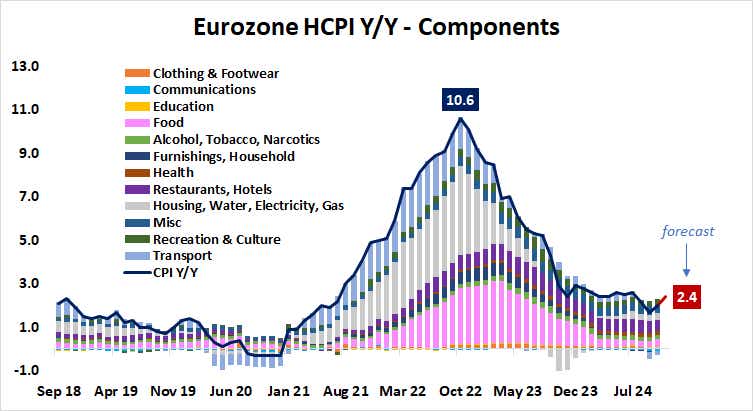

Whether the euro can sustain a larger recovery from here may hinge on a homegrown catalyst: November’s Eurozone consumer price index (CPI) data. It is expected to show that price growth accelerated to 2.4% year-on-year this month, marking the highest reading since July.

Analytics from Citigroup suggest that Eurozone economic data outcomes have steadily improved relative to forecasts over the past two months, so much so that surprise risk is now tilted toward outperformance. Weak PMI data notwithstanding, this may set the stage for a slightly warmer CPI print than economists anticipate.

Steady ECB vs. Fed rate cut expectation may help the euro rise

Traders are already geared up for another interest rate cut from the European Central Bank (ECB) at the year’s final policy conclave in December. Benchmark ESTR futures price the probability of a 25-basis-point (bps) reduction at a commanding 88%. A further 105bps in cuts is on the menu for 2025.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

While an uptick on a single month’s CPI data is unlikely to change the ECB’s trajectory in a major way, it may likewise leave sellers without a compelling new reason to press prices lower. The passing of event risk may thus mount to a modicum of relief onto itself if euro sellers’ speculative interest wanes and some tactical exposure is unwound.

A helping hand may come from the U.S. side too. Minutes from November’s Federal Open Market Committee (FOMC) as well as October’s personal consumption expenditure (PCE) data seem likely to reiterate the markets’ hawkish repositioning but offer little that is yet to be priced in. That may help the euro find room for a bounce.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.