SPY and Beyond: How Sector ETFs Can Enhance Your Investment Strategy

SPY and Beyond: How Sector ETFs Can Enhance Your Investment Strategy

By:Kai Zeng

Connections between assets weaken in a steady market, but grow stronger in a turbulent market

- Exchange-traded funds, or ETFs, provide exposure to whole industries, reducing risk associated with single stocks.

- That makes them a great diversification tool.

- Sector-specific ETFs often have higher price fluctuations than SPY, offering enticing opportunities for options sellers, with increased price fluctuations.

Exchange-traded funds (ETFs), like the SPDR S&P 500 ETF Trust (SPY), can help reduce the risk tied to investing in individual stocks by holding a collection of assets.

Trading ETFs enables you to diversify your investment portfolio further.

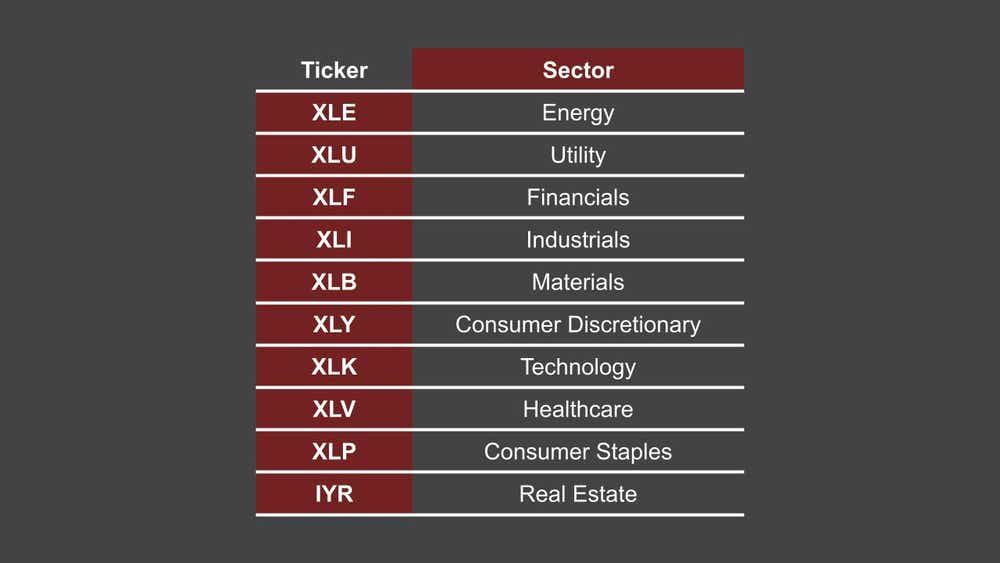

Over the past year, every sector has been in the green. The Financial Select Sector SPDR Fund (XLF) representing banks and the Technology Select Sector SPDR Fund (XLK) for tech companies have particularly shone, delivering returns over 20%, outperforming SPY most of the time.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

However, from a long-term viewpoint, the Energy Select Sector SPDR Fund (XLE) has historically underperformed, while XLK, the Health Care Select Sector SPDR Fund (XLV), and the Industrial Select Sector SPDR Fund (XLI) have generally posted strong results. SPY has outpaced most ETFs since the pandemic and from late 2023 to now.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Over the last 10 years, these ETFs have often shown greater price fluctuation than SPY, offering more trading opportunities for those who sell options.

For example, XLE, with the highest average price fluctuation, has underperformed and remained relatively stable over the years. This makes it ideal for strategies that benefit from stability, like strangles or iron condors.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Let's examine their relationship with the S&P 500 in different market conditions. We distinguish the periods as follows:

- Bull Market: The past 10 years, except 2020 to 2022

- Bear Market: 2020-2022

In a steady, growing market, the connections between assets tend to weaken.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Conversely, when the market is turbulent, these connections strengthen, meaning assets often move in the same direction.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

The energy sector through XLE and the utilities through the Utilities Select Sector SPDR Fund (XLU) have shown much lower correlations with other assets in both stable and volatile markets. This implies that XLE and XLU could provide better diversification for a portfolio focused on major indices.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.