Earnings Season Trading Strategies Amid Market Volatility

Earnings Season Trading Strategies Amid Market Volatility

Check out these bullish and bearish approaches to major stocks like Apple, Tesla and Coinbase

We asked two veteran traders for their opinions on the market—Tom “Sos Grande” Sosnoff and Tony “Bat” Battista.

Tom Sosnoff

Bullish Plays:

/ZB + /ZN: Long outright futures, backing it up with short puts

/6J + /6E: Short puts and covered calls in the mix

BA: Short puts paired with long call spreads

RTY - /ES: Pairs trade — long Russell, short S&P

Bearish Plays:

AAPL: Long put spreads

SPY: Selling call spreads

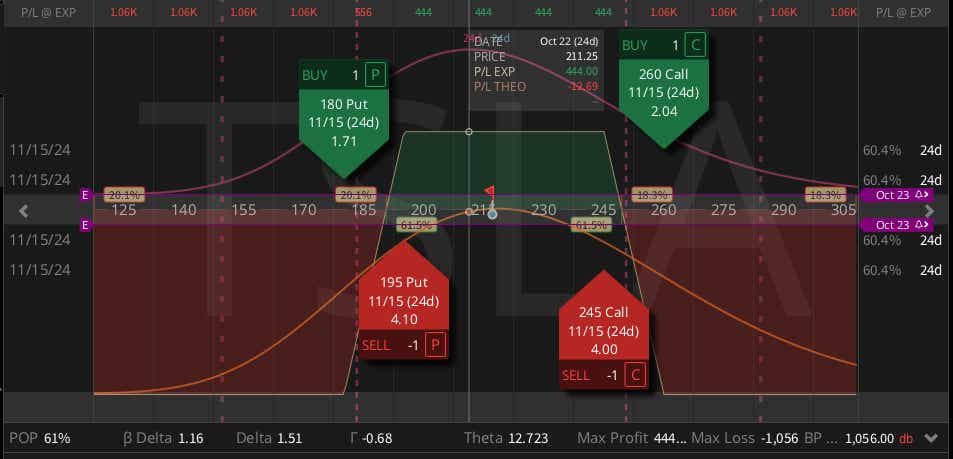

TSLA: Skewed short strangles

COIN: Short call spreads

With the election coming up, I'm capitalizing on the spike in implied volatility driven by uncertainty. The current price surge is all about the unknowns surrounding the outcome. This is a classic ‘buy the rumor, sell the news’ setup in action.

Tony Battista

I will most likely fade the market on the first move, believing it will be a head fake. In other words, whatever the initial reaction is, I’ll probably position myself in the opposite direction.

This Week’s Earnings Reports From Big Names

Here are some of the key companies scheduled to report earnings this week. Download here or click the picture below to get the full list.

Yeserday, Oct. 29: SoFi (SOFI), AMD (AMD), PayPal (PYPL), Alphabet (GOOGL), Snap (SNAP), Pfizer (PFE), Reddit (RDT), Chipotle (CMG), Visa (V), McDonald's (MCD), BP (BP)

Today, Oct. 30: Eli Lilly (LLY), Microsoft (MSFT), Meta Platforms (META), Coinbase (COIN), Robinhood (HOOD), Etsy (ETSY), Roku (ROKU), Carvana (CVNA), Starbucks (SBUX), Caterpillar (CAT), Sunnova (NOVA), Riot Platforms (RIOT), ADP (ADP)

Tomorrow, Oct. 31: Uber (UBER), Amazon (AMZN), Peloton (PTON), Intel (INTC), Mastercard (MA), Apple (AAPL)

Friday, Nov. 1: FuboTV (FUBO), Chevron (CVX), ExxonMobil (XOM), Wayfair (W), Dominion Energy (D), Charter Communications (CHTR)

Digital segment: "6 Skills for Active Traders"

How do you craft a strategy-based portfolio? Register to claim your digital collectible and be part of this event.

Two Trade Ideas

TLT ($216) Poor Man's Covered Call (DEC/NOV) $5.78 Debit

Tom Sosnoff’s long bonds here at the lows—using /ZB and /ZN futures. If you are looking to get a bit smaller, using TLT is a cost effective way to get lng bonds. A PMCC position provides a covered call type of risk profile, long an ITM 85 strike call in DEC as the synthetic stock position, with a short 93 call in the NOV monthly to offset the extrinsic value in the long.

Long /M6E (EURO) $1.0808

All currencies futures are denominated in U.S. dollars, which means a long currency position is synthetically short dollars. /M6E is the micro euro contract, much smaller than /6E and trades in $1.25 ticks. Sitting near recent lows, a long contract only uses around $400 in buying power per contract.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.