Earnings In Play

Earnings In Play

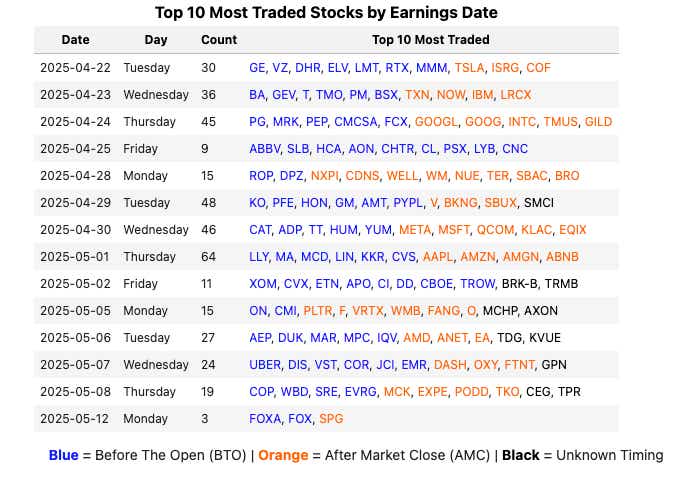

For this article, we grabbed the 10 most-traded stocks with earnings. We determined them by multiplying the volume by the price.

On the chart below, the blue stocks are expected to announce earnings before the open, while orange stocks are scheduled to announce after the close of the market.

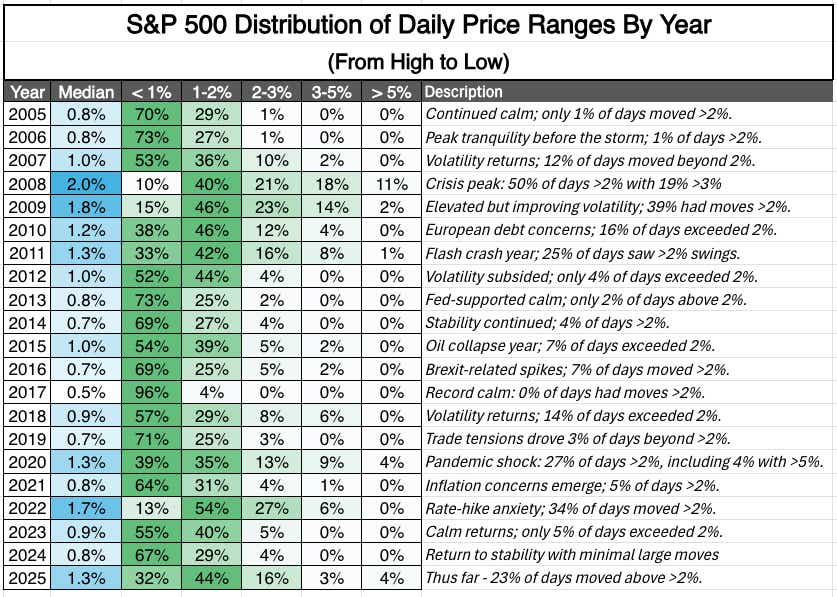

S&P 500 High-to-Low Ranges

What's particularly striking about 2025 is the return of extreme price swings. The data shows that 4% of trading days have experienced ranges exceeding 5%. This is a level of volatility not seen since the pandemic shock of 2020. These dramatic intraday swings indicate substantial market uncertainty.

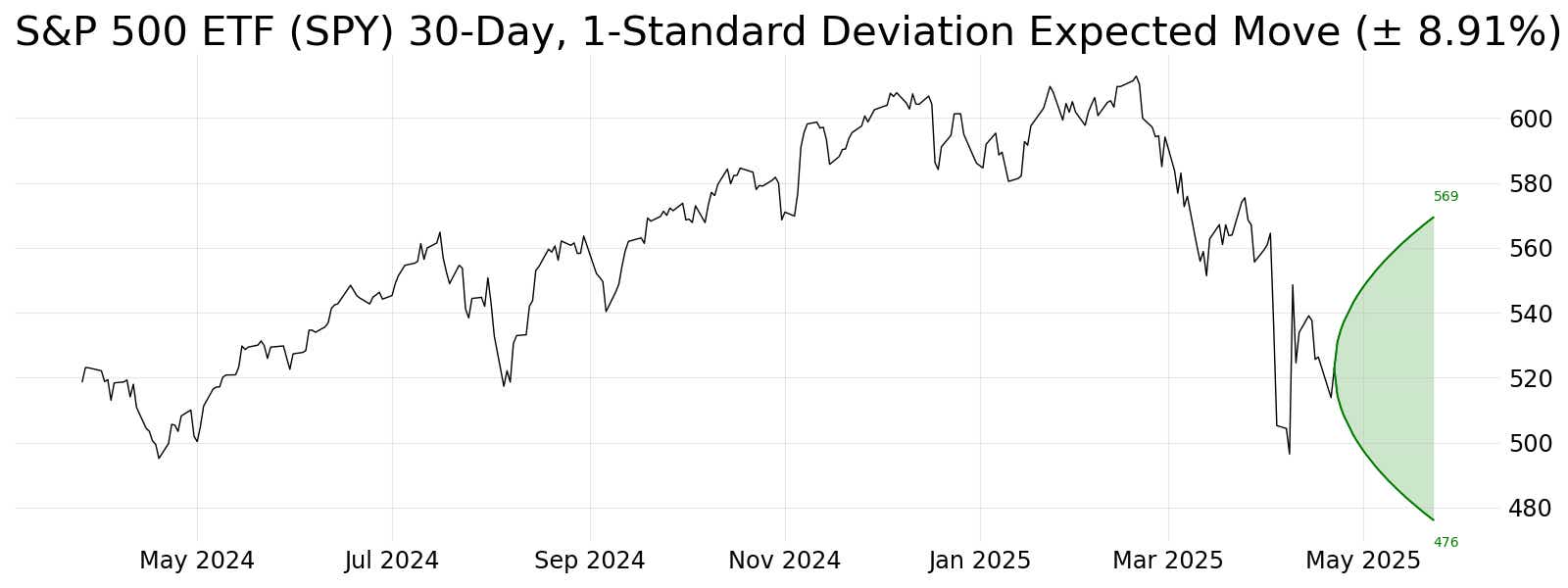

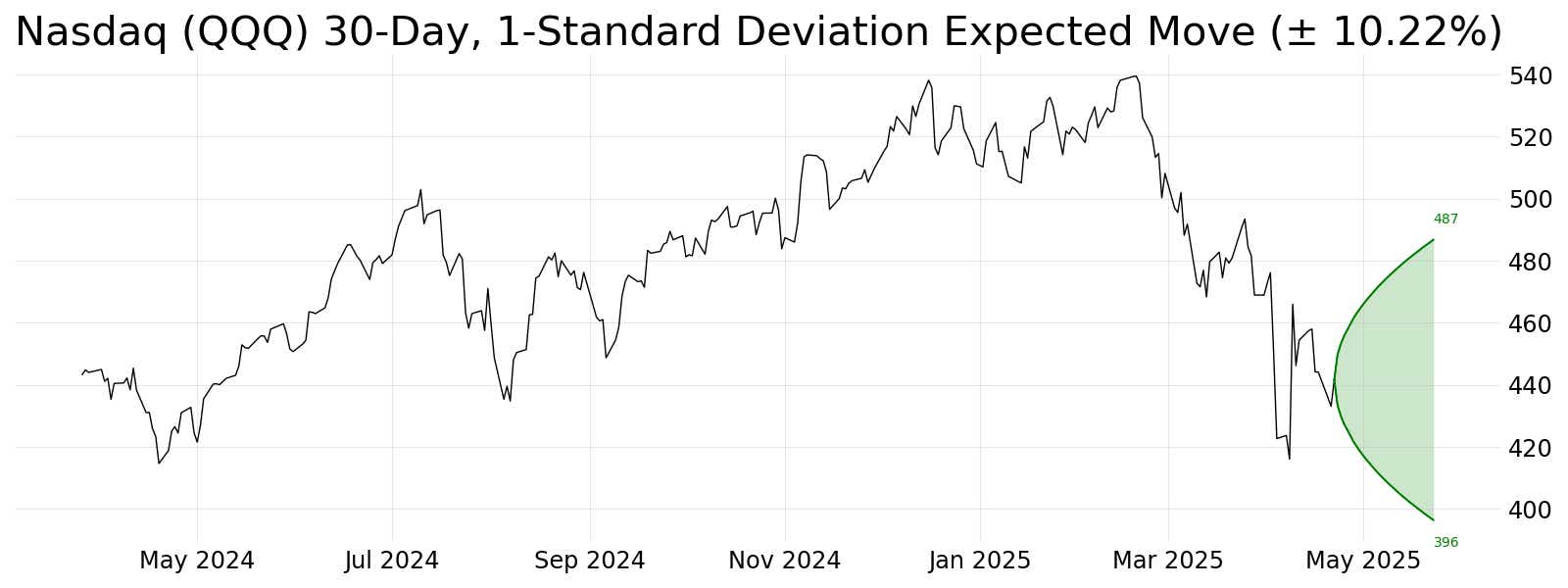

Implied Price Ranges

With the VIX at 30-day, the market projects quite a wide range of uncertainty of price movement. The downside expected move in the S&P 500 and the Nasdaq would reach lows not seen since April 2024.

Two trade ideas

GOOG ($150.18) Call Diagonal Spread (JUN/MAY) $5.54 Debit

Alphabet (GOOG) reports earnings after the close Thursday, the second of the Mag 7 stocks to announce quarterly results. (Tesla TSLA reported fter the close Tuesday). The stock is down 20% year-to-date with sentiment tanking on google search/AI. Maybe the bad news is already baked into the price? A call diagonal long the JUN 155 and short the MAY 165 nets 25 long delta for just $5.54.

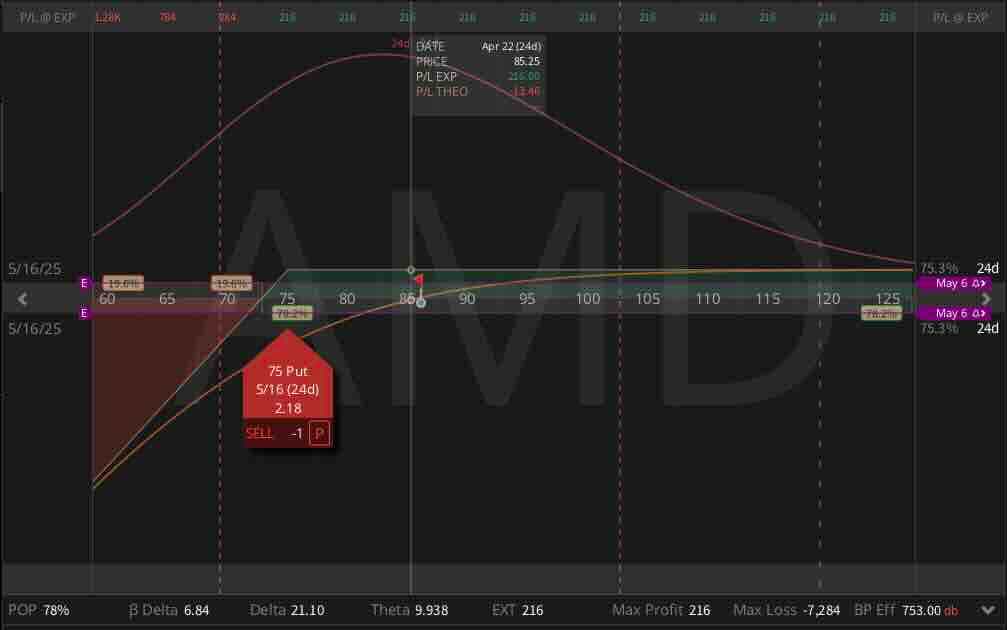

AMD ($86.06) Naked Short Put (MAY) $2.17 Credit

In the hype of the AI "froth,” Advanced Micro Devices (AMD) traded over $200 a share. Semiconductors have been one of the hardest-hit sectors, with AMD down almost 30% this year among other big names like Nvidia (NVDA) and Broadcom (AVGO) down similar amounts. AMD reports earnings on May 6, and if you think the worst might be behind us the 75 strike MAY put trades at around $2.17 with a breakeven back to near pre-pandemic prices.

Our newsletter even counts as "research" when your boss walks by. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s known best for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker. Open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.