The Market is Roaring Higher and Disney Isn't Really Taking Part

The Market is Roaring Higher and Disney Isn't Really Taking Part

By:Mike Butler

This year, the company’s stock has risen from the lows but not enough to regain the highs

- Disney is set to report earnings before the market opens Thursday.

- The company is expected to report an earnings per share of $1.11 on $22.49 billion in revenue.

- Both estimates are lower than last quarter, even though Disney exceeded both estimates.

- The Experiences segment will be under the microscope this quarter, as well as any guidance for 2025.

Disney earnings preview

Disney will report quarterly earnings Thursday before the market opens. DIS stock is finally in positive territory for 2024. After opening the year at $90.10, it’s sitting about 10% higher at around $99 per share. This has not been without volatility, though. The stock has reached a high of $123.74 and a low of $83.91 this year. Disney had a strong earnings report last quarter, beating earnings per share (EPS) and revenue estimates for the first time in three quarters.

Disney is now expected to report a reduced EPS figure of $1.11, and a reduced revenue figure of $22.49 billion in revenue on Thursday.

While DIS stock has recovered from the lows, it still has a way to go before re-touching 2024 highs.

Robert A. Iger, CEO of Disney, offered strong remarks in the last earnings call: “Our performance in Q3 demonstrates the progress we’ve made against our four strategic priorities across our creative studios, streaming, sports, and Experiences businesses ...”

He went on to day that “... this was a strong quarter for Disney, driven by excellent results in our Entertainment segment both at the box office and in DTC, as we achieved profitability across our combined streaming businesses for the first time and a quarter ahead of our previous guidance. Despite softer third quarter performance in our Experiences segment, adjusted EPS for the company was up 35%, and with our complementary and balanced portfolio of businesses, we are confident in our ability to continue driving earnings growth through our collection of unique and powerful assets.”

Disney has a strong brand name, and key metrics keep the entertainment giant afloat but investors clearly want to see a more positive trajectory for 2025 after falling so far from the stock price highs of earlier this year.

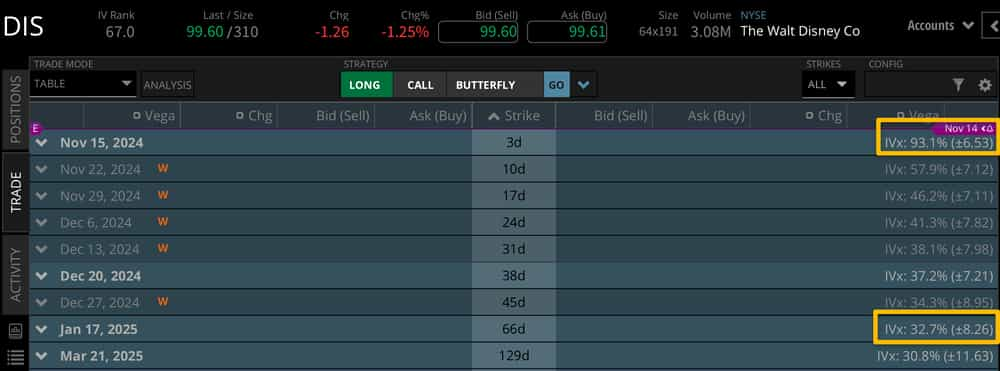

When we examine the implied volatility of DIS stock, we see a relatively high expected stock price move through this week's options expiration cycle. We can derive expected stock price moves from the options market, and in the case of Disney earnings we should expect a stock price range of +/- $6.53 for this week. This is about 6.5% of the stock price in notional value, which is in the middle of the road for most earnings announcements that fall between 5%-10% of the stock price. Looking to the end of the year, though, we see the December cycle has an expected stock price move of +/- $8.26. That means most of the implied volatility is being priced into this weekly options cycle, which is interesting.

Bullish on DIS stock for earnings

If you're bullish on DIS stock for earnings, you're looking for another EPS and revenue beat, with a strong forecast for 2025. There have been some volatile segments within the business this year, but a strong forecast and exceeding earnings estimates back to back could result in a strong stock price move—especially in this very bullish time we're in right now in the general market.

Bearish on DIS stock for earnings

If you're bearish on DIS stock for earnings, you're looking for more turbulence within the business sectors, and you're looking for results to fall short of estimates this quarter. The fact that the stock market is roaring higher and Disney isn't really taking part is somewhat telling of where investors are willing to park their cash.

Tune in to Options Trading Concepts Live tomorrow for an in-depth look at options trading strategies ahead of Disney earnings Thursday morning!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.