Can Iger’s Cost-Cutting Campaign Restore Disney’s (DIS) Magic?

Can Iger’s Cost-Cutting Campaign Restore Disney’s (DIS) Magic?

The Mouse House is slimming down—can a leaner Disney deliver for long-term investors?

After years of rising content costs and inconsistent financial performance, Disney has struggled to meet profitability expectations.

However, the return of Bob Iger as CEO has reignited optimism in the company.

Iger cost-cutting waste and optimization of operations has begun to show results.

Disney (DIS) has more or less dominated the entertainment industry for a century, but the company’s current challenges are leading investors to question its valuation. With a diverse business model spanning media, sports and theme parks, Disney has multiple paths to growth. Yet, competition in streaming, rising content costs and a heavy debt load have raised concerns.

Under the leadership of returning CEO Bob Iger, Disney appears to be making strides toward recovery, showing early signs of improvement in 2024. But is this enough? Its recent performance, ongoing struggles, hard-won milestones—like the resolution of Hulu’s future and a potential Marvel revival—could define the company’s path forward. Can its meet investor expectations and justify its elevated stock price? Let’s explore.

A diversified media powerhouse

Disney's business model spans a wide range of industries, offering the company a mix of revenue streams. Following a strategic reorganization in 2023, Disney now operates across three primary segments: Entertainment, sports and Eexperiences. The shift reflects efforts to stay competitive in an evolving media landscape by streamlining its portfolio.

The Entertainment division includes Disney’s traditional media assets like ABC and ESPN, as well as the direct-to-consumer (DTC) streaming platforms Disney+ and Hulu. With increasing investments in streaming, Disney has positioned itself as a direct competitor to giants like Netflix (NFLX) and Amazon (AMZN), highlighting its rising digital content ambitions.

The Sports segment is anchored by ESPN, a longtime leader in live sports broadcasting. Despite growing competition in sports streaming, ESPN remains a valuable asset because of its extensive rights deals with major leagues like the NFL and NBA.

Experiences, which include Disney’s world-famous theme parks, resorts and cruise lines, continue to serve as a crucial driver of revenue for the company. These attractions leverage Disney’s beloved franchises, transforming them into immersive, real-world experiences that deepen engagement with its entertainment offerings.

This broad and diversified business model provides Disney with multiple avenues for growth. But challenges remain (illustrated below), and the company’s prospects are critical in determining whether its valuation is justified.

Betting big on streaming

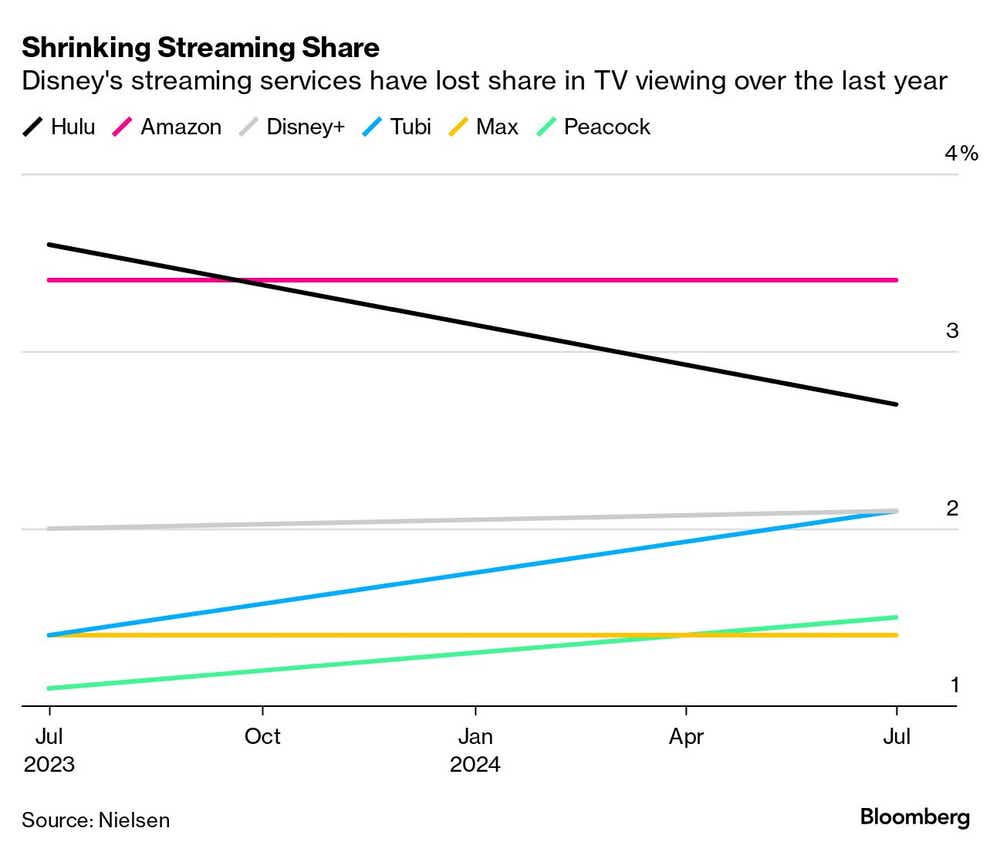

Disney’s streaming services, led by Disney+, are widely regarded as the company’s primary engine for growth. Since its launch in 2019, Disney+ has amassed a substantial subscriber base, positioning the company as a direct competitor to streaming giants like Netflix and Amazon Prime Video.

Streaming is crucial because it represents the future of content consumption, as viewers continue to shift away from cable and embrace on-demand, digital-first platforms. Disney’s vast library of beloved franchises—including Star Wars, Marvel and Pixar—gives it a distinct edge, enabling the company to build a robust catalog that attracts subscribers from various demographics.

In addition to this extensive content library, Disney is outspending its competitors on new content. In 2024, the company is projected to spend a staggering $25 billion on content creation, surpassing Netflix and Amazon, which are each expected to invest around $17 billion. This substantial investment underscores Disney’s commitment to maintaining its competitive position by offering exclusive, high-quality content that keeps subscribers engaged and loyal to the platform.

However, under the guidance of returning CEO Bob Iger, Disney is also becoming more strategic in its spending. While investing in content remains critical, Iger has emphasized the importance of paring back waste and optimizing operations. But instead of cutting back dramatically on production, the goal is to focus on high-impact projects that resonate with audiences and drive meaningful engagement, while eliminating unnecessary initiatives.

This leaner, more strategic approach is intended to keep Disney+ competitive in terms of both content offerings and profitability, ensuring the platform delivers premium experiences while still maximizing the bottom line.

Signs of recovery, but challenges remain

Bob Iger’s return to Disney came after a challenging period for the company. In 2023, Disney struggled with high content costs, competition in the streaming business and overall profitability issues. That’s underscored by the company’s financial performance in the quarter ending Dec. 31, 2023, when the company posted an operating loss of $138 million. This was an improvement from the $984 million loss in the same period during 2022, but still a loss as opposed to a profit.

In 2024, however, clear signs of improvement have appeared. For the first two quarters, Disney delivered stronger earnings. In Q2 2024, the company reported revenue of $23.2 billion, which marked a 3.9% increase year-over-year from Q1 2024, when revenue stood at $22.08 billion

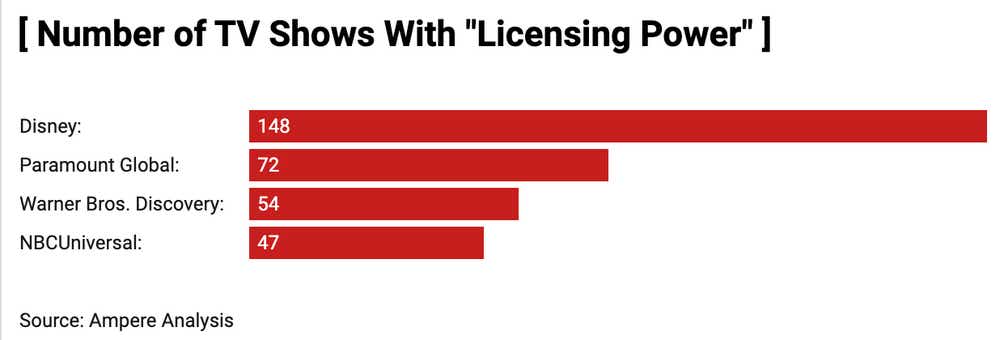

This progress reflects Iger’s strategic efforts to cut waste and make content spending more efficient, all while maintaining the experiences that define Disney’s brand. However, despite the improvement, challenges remain. Content sales and licensing, including theatrical box office revenues, remain volatile, with revenues from this segment dropping 40% in Q2 2024.

While Disney appears to be turning the corner, the company’s future will depend on strategic decisions management makes in the near term. Ultimately, the market will judge Disney on its ability to generate robust profits. Despite impressive growth in revenue over the years, Disney’s profitability has come under pressure, with net profit margins shrinking significantly from previous highs, as illustrated below.

Is the current valuation justified?

Disney’s price-to-earnings (P/E) ratio of 34 raises important questions about the company’s valuation, especially when compared to the industry average of around 20. Investors seem to have high expectations, likely influenced by the Iger’s return. During his previous tenure, Disney’s stock rose by over 400%, reflecting the success of strategic moves, such as the acquisition of Pixar, Marvel and Lucasfilm—as well as the launch of Disney+

However, the picture has changed. Over the last five years, Disney’s stock has dropped by about 30%, driven by challenges in streaming, costly content and the heavy debt load associated with the 21st Century Fox acquisition. Iger’s return has renewed optimism in the company because many believe his track record suggests he can guide the company through its current difficulties. But to justify the current price multiple, one could argue Iger must deliver a “best case” scenario, or something near it.

While early signs in 2024 have been promising, particularly with improvements in streaming profitability, Disney must demonstrate consistent success with its various divisions. Sustained growth will be key to validating the current valuation. Conversely, if the challenges that have weighed on the company in recent years persist, the stock may struggle to justify its elevated earnings multiple.

Hulu, Marvel and Disney’s road to revival

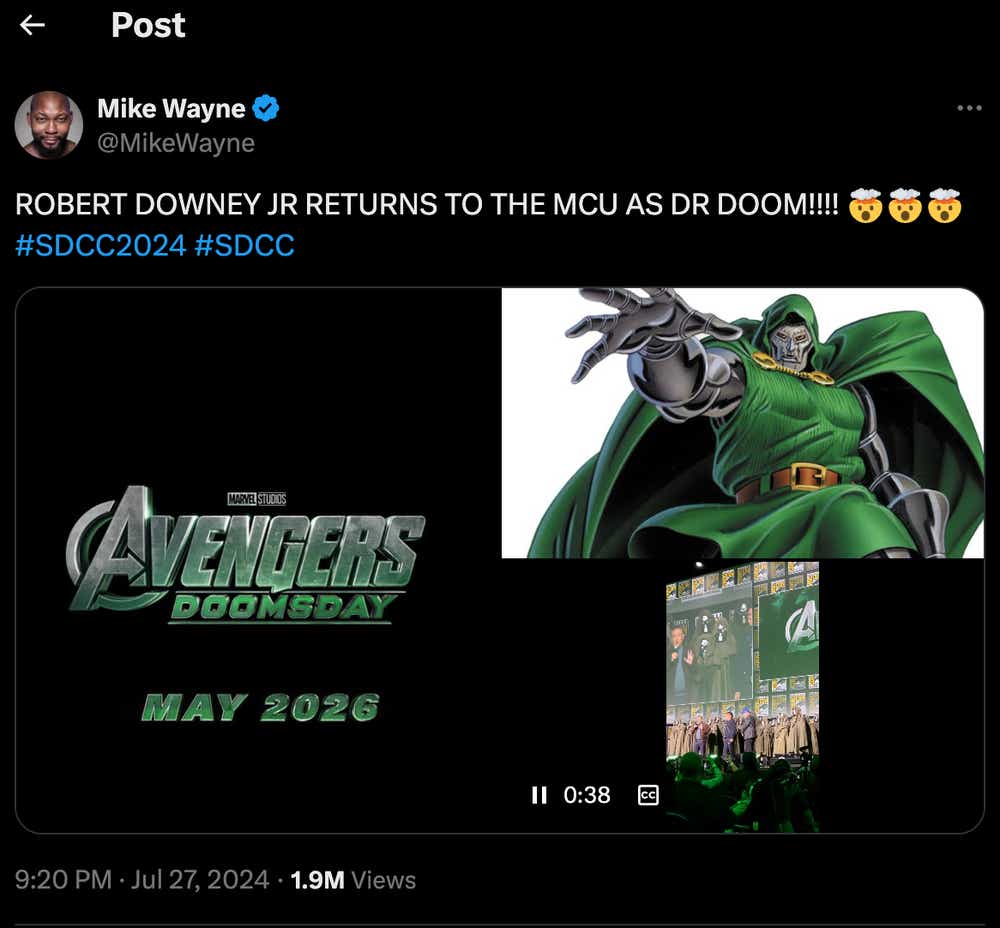

Looking at Disney’s future trajectory, two key narratives stand out: the future of Hulu and the return of Robert Downey Jr. to the Marvel franchise.

Disney owns two-thirds of the Hulu platform, with Comcast holding the remaining share. Disney is expected to acquire Comcast’s stake soon and has already paid around $8.5 billion toward the acquisition. However, the cost may rise. As part of an ongoing confidential arbitration, Disney could be required to pay as much as $5 billion more to complete the deal. Considering Disney’s campaign to cut costs, this added expense seems far from ideal.

On the other hand, securing full ownership of Hulu could significantly bolster Disney’s streaming strategy, enabling better integration with Disney+ and ESPN+. This would simplify bundling services and streamline operations, enabling Disney to compete more effectively with Netflix and Amazon Prime Video. However, the increased price tag raises concerns because some critics already believe Disney overpaid for 21st Century Fox.

On a brighter note, Disney recently announced the return of Robert Downey Jr. to the Marvel Cinematic Universe (MCU), a move that could reinvigorate one of its most lucrative franchises. Downey’s portrayal of Iron Man helped launch Marvel’s string of successes, and his return could reignite audience enthusiasm at a time when the MCU has faced some fatigue. His involvement is likely to bring renewed attention and excitement to the brand, marking a critical opportunity for Disney to leverage one of its most successful assets

Takeaways

Disney’s valuation reflects high expectations, driven largely by optimism surrounding Iger’s return and his ability to steer the company back to growth. The company’s diversified business model—spanning streaming, sports and experiences—provides a solid foundation, but there are still significant hurdles to overcome.

The streaming business, particularly Disney+, has started to turn a corner in 2024, with early signs of profitability. But to justify the company’s premium valuation, Disney must sustain this momentum, while navigating challenges, such as the Hulu acquisition and the revitalization of the Marvel franchise. If the company successfully leverages its potential, that could help validate the lofty expectations set by its current P/E ratio of 34.

At the same time, there’s no denying the risks. With streaming competition intensifying, unpredictable revenue in the content division and a heavy debt load, Disney’s ability to execute on opportunities is critical. Even with Iger at the helm, the company will still need to deliver consistent, tangible results to justify its current valuation.

Ultimately, Disney’s future hinges on smart execution—balancing cost-cutting with continued investment in high-impact content and leveraging its iconic brands to their full potential. If the company can navigate those challenges, it could prove its valuation isn’t just hopeful thinking, but instead a reflection of its promising long-term potential. We are cautiously optimistic the company will deliver for patient shareholders with a long-term outlook.

According to The Wall Street Journal, 32 analysts currently cover Disney, with 18 rating the stock a buy, five rating it overweight and eight rating it a hold. One analyst rates Disney shares a sell. Based on those 32 ratings, the average price target for Disney is roughly $110/share. The stock is up 1% year-to-date and currently trades for about $92/share.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.