Is Netflix (NFLX) Overpriced? A Deep Dive Into Its 2024 Financials and Growth Prospects.

Is Netflix (NFLX) Overpriced? A Deep Dive Into Its 2024 Financials and Growth Prospects.

The future looks bright at Netflix, but that might already be priced into the stock’s valuation

Netflix's impressive earnings and subscriber growth has made its stock surge, with the shares up more than 40% year-to-date.

The company is planning to stop reporting subscriber numbers next year, so investors will focus on engagement and revenue per user to assess its performance.

Despite leading the market, Netflix’s high valuation raises questions about whether the stock is overextended and whether setbacks could lead to a pullback.

Netflix (NFLX) has dominated streaming for a long time, and this has been another year of solid growth for the company. With subscriptions rising, earnings beating expectations and an expanding library of content, its stock has surged by more than 40% this year. But despite that momentum, some investors worry the company's valuation is overextended.

Let’s look at Netflix’s financial performance and explore its recent decision to stop reporting subscriber numbers next year—a bold move considering how closely investors have monitored that metric. We’ll also examine the company’s elevated price/earnings ratio (P/E ratio), currently around 42, and see how it compares to peers like Disney (DIS).

While Netflix continues to innovate and expand, we’ll consider whether the stock’s premium valuation is sustainable or if it’s time to reassess the company’s near-term prospects.

Robust subscription growth

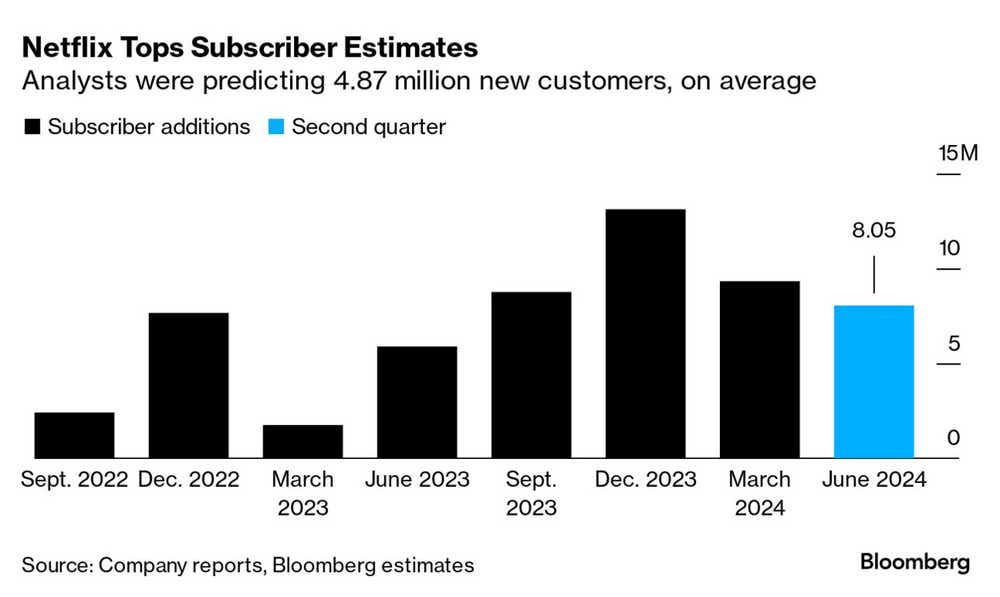

Investors have been watching the number of subscribers Netflix adds per quarter. Early this year, it continued to outperform on that front. As of July, the company reported approximately 278 million global streaming paid memberships, an addition of around 17 million since the end of last year. That healthy growth helps explain why its stock has surged by more than 40% so far this year.

What makes the subscriber figures especially compelling is Netflix’s ability to add new users while also rolling out advertising-focused subscription packages. These new tiers have not only diversified revenue streams but have also attracted new users, further strengthening its market position.

But the decision to stop reporting subscriber numbers adds an interesting twist to the narrative. It will be interesting to see how that affects earnings reports and which metrics the market will focus on instead. One possibility is “watch hours” (engagement hours) could receive more attention as a way to gauge viewer retention and the popularity of content. Regardless, investors will adjust their expectations and prepare for a new reporting structure.

Revenue and earnings remain strong

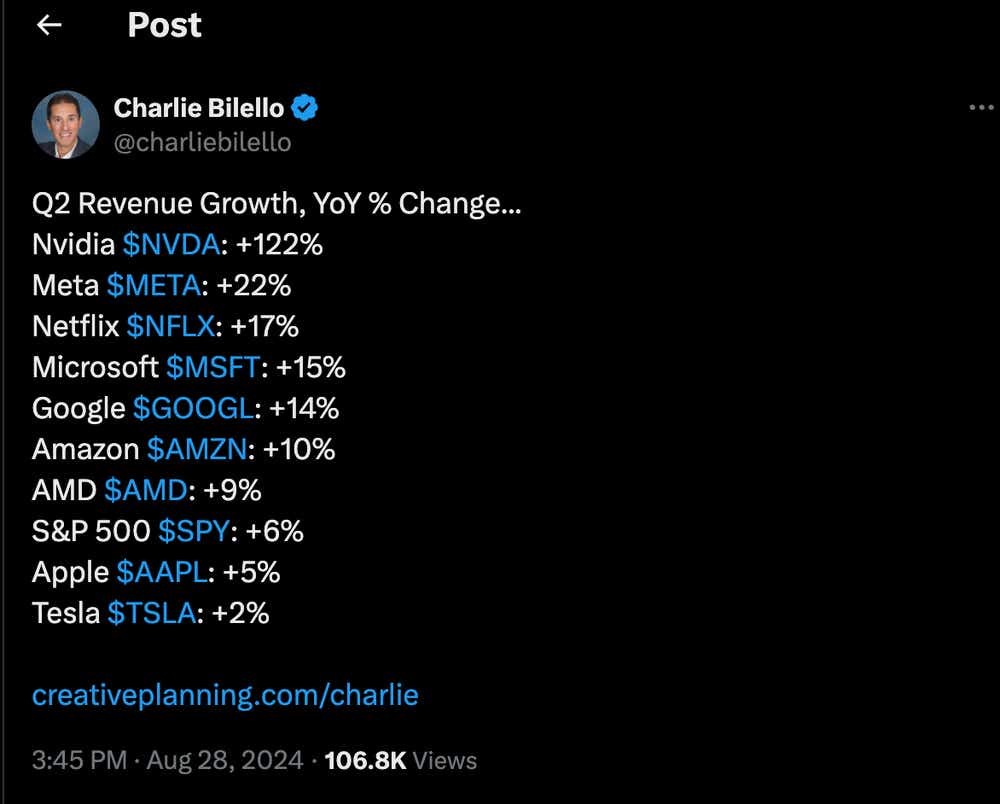

Besides the growth subscribers, Netflix has shown strong revenue and earnings gains this year, which has fueled the stock’s impressive performance. In Q2 2024, it reported revenue of $9.56 billion, slightly surpassing the consensus estimate of $9.53 billion and marking a nearly 17% increase from the same quarter last year.

Looking ahead to Q3, Netflix has guided revenue to $9.73 billion, a 14% year-over-year increase from Q3 2023. However, that’s slightly below analyst expectations, which may explain why shares dipped after the earnings release.

In addition, the 2% quarter-over-quarter revenue growth expected from Q2 to Q3 this year may have underwhelmed some investors.

On the earnings per share (EPS) front, however, Netflix has continued to outperform. In Q2, the company reported EPS of $4.88, well above the consensus forecast of $4.74. For Q3, Netflix expects EPS to rise to $5.10, again exceeding analyst expectations of $4.74.

Those figures show Netflix’s financial performance remains strong and is expected to stay robust in the near future.

Price/earnings (P/E) analysis

Netflix’s first-mover advantage in streaming has made it unique among media. By entering the market early and scaling rapidly, it grew into a global powerhouse by focusing on content streaming content creation. That makes it difficult to compare directly to its competitors, many of whom, like Disney+ and YouTube, are part of larger conglomerates where streaming is just part of a broader portfolio. For those companies, streaming isn’t the primary driver of revenue, fundamentally separating their business models from Netflix’s.

Disney, for example, has revenue from theme parks, merchandise, and legacy franchises like Marvel and Star Wars. Streaming, through Disney+, is just one piece of its overall business, and Disney can afford to operate it at a loss while profiting from other segments.S

YouTube, a subsidiary of Alphabet (GOOGL), generates revenue primarily through advertising, leveraging user-generated content that’s far less expensive to produce than Netflix’s premium shows and movies. As a result, YouTube doesn’t rely on subscriber growth in the same way Netflix does, making the two difficult to compare.

Netflix trades at a P/E ratio of around 42, significantly higher than the sector median of 20 and Disney’s P/E of about 34. This premium valuation reflects the market’s confidence in Netflix’s ability to sustain its growth trajectory. While Disney also enjoys a somewhat elevated P/E relative to the industry average, that’s likely because the stability and diversification provided by its various revenue streams, which offer investors long-term safety.

Netflix’s pure-play streaming model amplifies both its potential growth and its risk. Investors are willing to pay a premium because the company’s success is tied to continued expansion of its subscriber base, the rollout of new content and innovations like cloud gaming. However, this singular focus also means Netflix is more exposed to shifts in consumer preferences or competitive pressure in the streaming market. Disney can offset downturn in streaming by turning in a strong performance in its parks or media franchises, but Netflix doesn’t have that cushion.

Netflix’s elevated P/E ratio also signals expectations are high for the company. Setbacks or disappointments could have a significant impact on the underlying stock, because much of its potential is arguably already priced in.

Competitive differentiators

Moving beyond the traditional valuation comparisons, Netflix's content strategy also drives its premium valuation. Unlike Disney or YouTube, Netflix operates without relying on a massive legacy content library, which forces the company to innovate and produce new original content. That strategy not only keeps subscribers engaged but also positions Netflix as a global content creator, with shows like Stranger Things and The Crown becoming cultural phenomena.

What’s more, Netflix’s investment in producing data-driven content sets it apart from traditional competitors. The company’s sophisticated algorithms analyze viewing patterns and preferences, enabling the company to tailor content not just for the U.S. market but also for international audiences. That enables Netflix to make smarter decisions about its content spend, and it’s one reason investors value the company so highly. Its recent foray into cloud gaming showcases exactly that kind of innovation.

Netflix’s emphasis on international expansion has been crucial in maintaining its growth. With more than half of its viewers outside the U.S., it has invested in localized content for Latin America, Europe and Asia. Unlike Disney, which leverages its U.S.-based franchises for global appeal, Netflix’s is using its locally oriented approach to help gain a foothold in emerging markets.

Ultimately, Netflix’s high valuation reflects more than just subscriber growth—it’s also the combination of agile content production, data-driven innovation (including cloud gaming) and global expansion that continues to justify its price in the eyes of investors.

Investment takeaways

Netflix’s P/E ratio of 42 raises questions about whether the stock is priced too high given its growth prospects. While it has been a leader streaming and continues to expand its global footprint, recent moves—such as the decision to stop providing subscription data heading into 2025—introduce greater uncertainty about its future performance. This lack of transparency, combined with heightened competition and evolving market conditions, suggests the current valuation may be overly optimistic.

According to Morningstar, Netflix’s long-term fair value estimate is $440 per share, which implies a 24x earnings multiple based on its 2024 forecast. The Chicago-based financial services firm projects high single-digit revenue growth over the next five years, with margin expansion driven by maturing international markets and economies of scale. While recognizig Netflix’s growth potential, Morningstar argues the market’s current valuation overshoots expectations.

In our view, Netflix possesses strengths that include its international expansion, data-driven content strategies and entry into cloud gaming. But we also believe the P/E multiple of 42 is difficult to justify given the uncertainties ahead. We would assign a more moderate multiple, likely in the low-to-mid 30s, to reflect the company's growth potential but also factoring in the risk associated with its evolving business model and increased competition.

Ultimately, we see Netflix’s stock as overvalued relative to its long-term fundamentals, even though we believe the company remain a dominate player in streaming. Our fair value estimate is higher than Morningstar’s, but still below the current market valuation, suggesting the stock is trading at a premium that may prove challenging to sustain without continued outperformance in new subscribers.

Can Netflix’s stock continue to climb higher? Sure—especially if the current broader bull run persists. Market momentum could easily carry Netflix along for the ride, as enthusiasm remains high for growth stocks.

Yet that doesn’t mean investors should necessarily continue to chase the stock at these lofty valuations. The risk of overpaying for future growth is real, and while Netflix may continue to innovate and expand, the P/E multiple of 42 suggests a lot of success is already priced in. For cautious investors, waiting for a more reasonable entry point might be prudent.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.