Crude Oil Prices Surge

Crude Oil Prices Surge

As crude prices rise ahead of API and EIA reports, people under the age of 30 are confused by this image

- Crude oil prices (/CL) surge in mid-July as USD weakens.

- Forecasters see lower inventory, higher WTI prices.

- API and EIA weekly inventory reports on tap.

Crude oil prices surged about $1.59 per barrel, or 2.17%, on Tuesday as of mid-day trading, with West Texas Intermediate (WTI) crude futures (/CL) hitting their highest level since early June as traders see demand outpacing supply, while moves in the foreign exchange market support commodities.

Brent crude oil futures—the global benchmark—rose about the same in percentage terms through mid-day New York trading. The strength in energy is helping the S&P 500 (/ES) trade in positive territory, led by the energy sector—XLE, The Energy Select Sector SPDR Fund is up nearly 2%.

Traders weigh demand and supply outlooks as dollar fades lower

Energy traders see the oil market tightening in the back half of this year despite higher interest rates in the United States. The Paris-based International Energy Agency (IEA) said last month it expects global oil demand to grow by 2.4 million barrels per day (mb/d) this year, rising to 102.3 mb/d. That would mark a record high in demand.

China is driving much of that demand despite a less-than-stellar post-COVID recovery. And non-OECD countries are expected to offer 90% of demand growth, according to the IEA’s June Oil Market Report.

Meanwhile, a softer U.S. dollar is helping commodities across the board, including oil and natural gas. The greenback is losing its luster as the Fed approaches an expected end to its historic rate-hiking cycle, which is easing bond-selling pressure, and, thus, the upward force on yields.

That softness in yields, especially toward the front-end of the curve, is a tailwind for the U.S. dollar. Traders should keep an eye out for the upcoming CPI data to assess the dollar’s likely direction. That data will be followed up by several speakers, including three Federal Reserve Bank presidents: Raphael Bostic of Atlanta, Neel Kashkari of Minneapolis and Loretta Mester of Cleveland.

Inventory data key to trading short-term moves

While monitoring medium- and long-term forecasting models for crude oil is crucial to understanding the market, energy traders are a nimble group who trade on timely inventory data.

The American Petroleum Institute (API) will release its inventory report Tuesday, July 11, at 20:30 UTC. The consensus forecast calls for a 200,000-barrel build for the week ending July 7, which follows the prior week’s 4.3 million-barrel draw. Typically a reduction in inventory, especially when analysts expect a build, is bullish for price action.

On Wednesday, after the CPI data, the U.S. Energy Information Administration (EIA) will release its own inventory report for the same period. Expectations are the same, with the consensus showing a 200,000-barrel build. More often than not, the EIA report commands more market attention than the API report, but traders should monitor both when aiming to take a position.

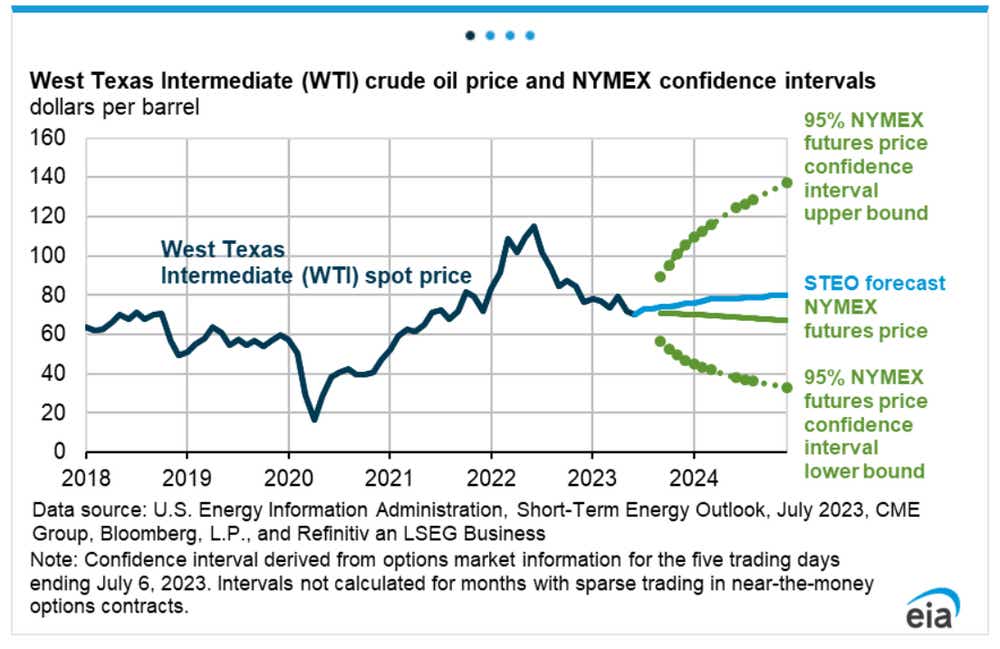

The EIA’s Short-Term Energy Outlook, released Tuesday afternoon, shows a forecasted $80 per barrel average later this year in the fourth quarter. That is about a 6.6% gain from current prices for WTI. The EIA attributes this to lower oil inventories in the next five quarters.

Crude oil technical forecast

Looking at the daily price chart, crude oil prices are set to close above the 100-day simple moving average (SMA), following a period of strength over the last several weeks that saw prices clear several key technical levels, including the 50-day SMA. These moves have coincided with a bullish crossover of the mid-line in the relative strength index (RSI) and the pseudo 50% Fibonacci retracement level from the April to May move.

Bulls are eying the 61.8% Fib and the 200-day SMA, which align with the early June swing high. A break above that level could clear the way for a technical breakout to possibly challenge the early April high around the $85.5 mark.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.