Crude Oil Prices May Top Soon as Prices Hit Four-Month High

Crude Oil Prices May Top Soon as Prices Hit Four-Month High

Traders are eying inventory amid Russian refinery attacks. Will prices continue to rise as the market tightens?

- Ukrainian drone attacks on Russian refiners underpin oil prices.

- Traders look to inventory reports after surprise oil and fuel withdrawals last week.

- Oil prices may trade sideways after an impressive run over the last month.

Crude oil prices (/CLK4) extended higher today to $83 per barrel, the highest since Oct. 20, as energy traders digested the potential impact on global supply from several attacks on Russian oil refiners by Ukrainian drone attacks.

Through this afternoon, /CLK4 was up 0.85%, bringing the commodity’s monthly gain to over 6%—the best performance so far since September 2023, when oil prices rose 8.56%. While the latest push higher is attributable to the developments in Russia, factors such as tightening supply in the U.S. and OPEC production cuts are helping to underpin the market.

U.S. supply showing signs of tightening

Last week, the American Petroleum Institute (API) reported a surprise crude oil inventory draw of 5.52 million barrels vs. an expected 400,000-barrel increase. The draw came alongside a rise in refining throughput, as confirmed by data from the Energy Information Administration (EIA).

However, despite the increased refinery rates, fuel products still saw large draws for the week, with gasoline stocks falling by 3.75 million barrels and distillates falling by 1.16 million barrels. Together, those declines suggest demand is increasing relative to supply, at least in the United States.

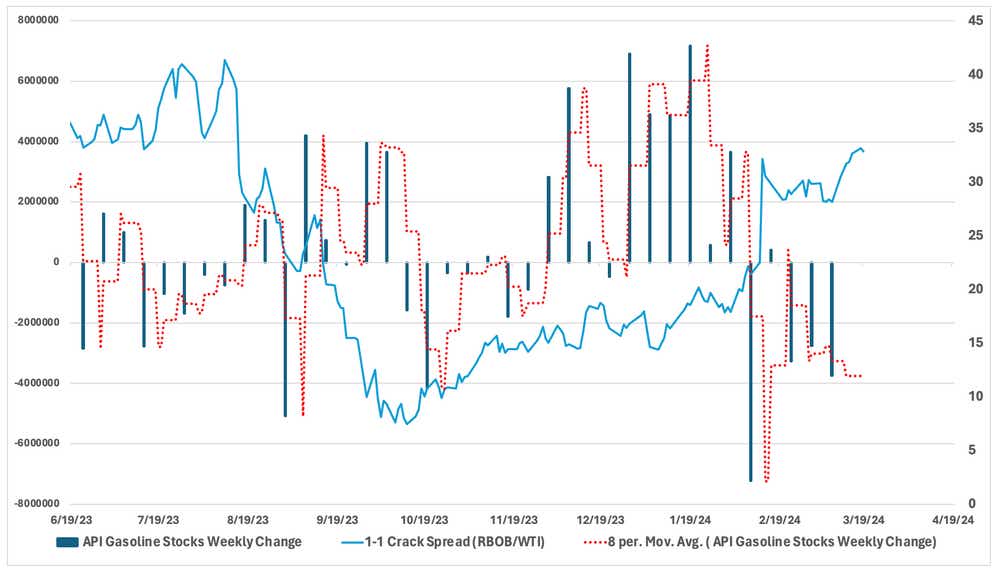

This has also boosted margins for refiners, evidenced by the crack spread between gasoline and crude oil. The chart below shows the relationship between the 1-1 RBOB/WTI crack spread and the weekly change in API gasoline stocks. Gasoline futures (/RBJ4) have risen nearly 40% from their 2024 low back in January, and prices are at the highest since August 2023.

The API and EIA will release their respective inventory reports over the coming days, and a few crucial details outside the headline numbers to look at are the refinery utilization rates and exports.

A recent rise in the price premium between Brent crude oil and WTI may increase export pressure on U.S. oil and fuels over the coming weeks. This could underpin prices even as rising refinery rates help catch up with fuel demand. The bullish scenario would see the refinery utilization rate remain steady while exports increase.

Trading crude oil

As noted earlier this month, oil prices should trade in the $81 to $84 range, and I believe that price range still holds true, given the fundamental backdrop of the market. With prices in that range, I’ll be looking to trade a sideways move in oil prices with an iron condor strategy. A potential trade to that tune would see the short strikes placed at 81 and 84, which would give a probability of profit (POP of 28% and a win/loss of +180 and -70.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.