Crude Oil Prices Fall Ahead of Key Inventory Reports

Crude Oil Prices Fall Ahead of Key Inventory Reports

Despite today’s drop, prices remain above the lows carved out earlier in May

- Crude oil prices fell today, bringing the commodity negative on the week.

- Energy Information Administration (EIA) inventory figures are in focus after API numbers.

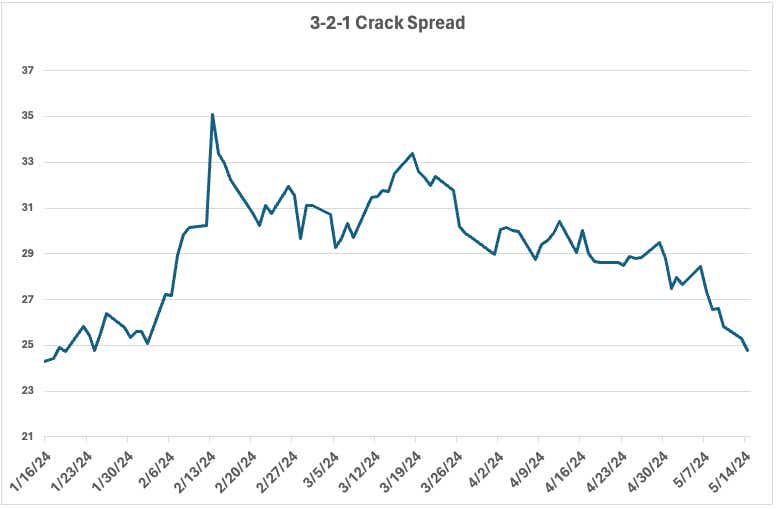

- Crack spreads are key to gauging where crude oil will head as demand for fuel slows.

Crude oil prices (/CLM4) dropped about 1.5% through mid-day trading, trimming all of its gains from the day before as traders reassessed the commodity’s supply and demand outlook.

Despite today’s drop, prices remain above the lows carved out earlier in May. While this is encouraging for a potential bottom, a break below recent support would likely drive prices down to the late February lows around the 76 level, or possibly lower.

The upside case on a technical basis isn’t all too encouraging, either, with recent highs from early April around the 87 level. The fundamentals, which we’ll discuss in this article, likely do not support such a run. Instead, a rebound has several areas of potential resistance before that—notably the late March lows around the psychologically imposing 80 handle.

Crude oil inventory

Today, the American Petroleum Institute (API) is set to report crude oil and fuel product inventory data for the week ending May 10. Analysts expect a draw on the headline crude figure of 1.35 million barrels. That follows a 509,000 barrel increase the week prior.

Fuel products saw another round of builds in last week’s data, with the API reporting a 1.5 million barrel build for gasoline and a 1.7 million barrel build for distillates, respectively. Building fuel stocks has come alongside slowing fuel demand.

According to the EIA, motor gasoline product supplied averaged 8.6 million barrels per day (bpd)—a 4% drop from a year ago. Distillate fuel product supplied averaged 3.6 million bpd—a 6.6% drop from a year ago. Product supplied can be used as a proxy for demand.

This drop in demand has pushed crack spreads to unfavorable levels for refiners, who will likely respond, if they haven’t already, with lower crude oil consumption—the main input for those fuel products. The crack spread represents the theoretical refining margin and is most simply explained as the spread a refiner pockets from buying crude oil and selling the fuel product refined (i.e., cracked) from that oil.

That said, we can put a greater focus on fuel product inventory in the upcoming EIA report to get a read on where the market is heading. Simply put, declining fuel products stocks are bullish, and increasing fuel product stock are bearish.

Trading crude oil

It’s hard to predict the exact reaction an inventory report will elicit, but if we follow the fundamental case around supply and demand outlined above then we can trade accordingly. If you believe crude oil has put in a short-term bottom but won’t have enough fuel to stage a comeback, even if inventory numbers are bullish, then an iron condor might be an appropriate play.

A hypothetical iron condor trade based on today’s option’s pricing would yield a max profit of $370 and max loss of $130 for a long 76 p/short 76.5 p and short 79.5 c/long 80 c iron condor for the June 14 strike.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.