Crude Oil Price Rises on OPEC, Russian Production Cuts

Crude Oil Price Rises on OPEC, Russian Production Cuts

Eyes forward to Friday's job numbers

- WTI crude oil (/CL) is resuming its uptrend.

- Extending the Saudi cut in oil production is driving action in the markets.

- The jobs report may reveal market motives for oil.

- The technical outlook oil prices remains supportive.

WTI crude oil futures (/CL) climbed higher in Thursday morning trading after Saudi Arabia committed to further production cuts. The de facto leader of OPEC, the Organization of Petroleum Exporting Countries, announced through its state media agency that the cuts will extend into September.

Riyadh and its allies are attempting to keep oil prices artificially high, as Gulf countries bolster domestic spending. Russia is also benefiting from the cartel’s cuts combined with its own as Moscow continues to rely on its oil revenues to feed its war machine. Putin has managed to sidestep the impact of Western sanctions by selling discounted oil to China and other countries outside the G-7 sphere of influence.

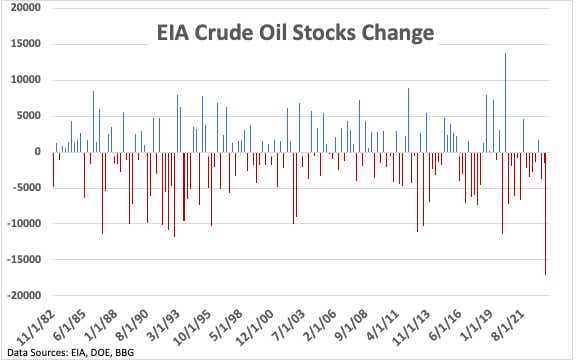

EIA data packs a big surprise

The Energy Information Administration (EIA) shocked analysts with its weekly inventory report, which showed a record drop in oil stocks on Wednesday. For the week ending July 28, the EIA reported a 17 million barrel draw, dwarfing the expected 1.3 million barrel decrease.

Despite the record withdrawal, oil prices declined following the data. That is likely explained by a broader de-risking across markets, thought by many to be caused by Fitch’s credit downgrade. However, the larger-than-expected headline figure in the ADP jobs numbers likely spooked the markets by devaluing the case for Fed rate cuts later this year or next, pushing yields and the dollar higher.

In any case, tomorrow’s job numbers via the non-farm payrolls report (NFP) will clarify the market's focus. The Bloomberg consensus expects to see 200,000 jobs added for July. If those numbers beat expectations and markets sell off—including oil—it would likely confirm that markets are more worried about demand being throttled by monetary policy than by cuts from OPEC.

WTI crude oil technical outlook

Oil prices are up nearly $2 per barrel, or 2.5%, retracing most of Wednesday’s down move. Overall, the upward trend in place since late June remains firm. A bullish signal from an impending crossover between the 50-day and 100-day simple moving averages (SMAs) may embolden bulls to push higher. The uptrend defined by a regression channel highlights strategic points that traders may want to trade this range—in other words, going long at the bottom range or going short at the top of the range.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.