Crude Oil Price Rally Pauses Amid Bullish Tailwinds

Crude Oil Price Rally Pauses Amid Bullish Tailwinds

The commodity’s rally has paused amid bullish tailwinds

- Crude oil prices pulled back 1% yesterday, pausing a multi-week rally with prices near $80 per barrel.

- Despite the pullback, oil remained on track to record its best monthly gain since September 2023.

- Yesterday’s selling came after a ceasefire dekal was struck between Israel and Hamas, which will put a pause on fighting in the region. Houthi rebels in the Red Sea are expected to halt their attacks on vessels in the Red Sea. The news is driving a profit-selling event as those geopolitical risks subside.

Supportive backdrop remains in place for crude oil

Crude oil prices (/CLH5) still enjoy a rather supportive backdrop. In fact, U.S. crude oil inventory levels dropped to their lowest level since April 2022, according to a report released Wednesday by the Energy Information Administration (EIA). The 2 million barrel reduction reported last week brought crude inventories to 6% below the five-year average for this time of the year, according to the EIA.

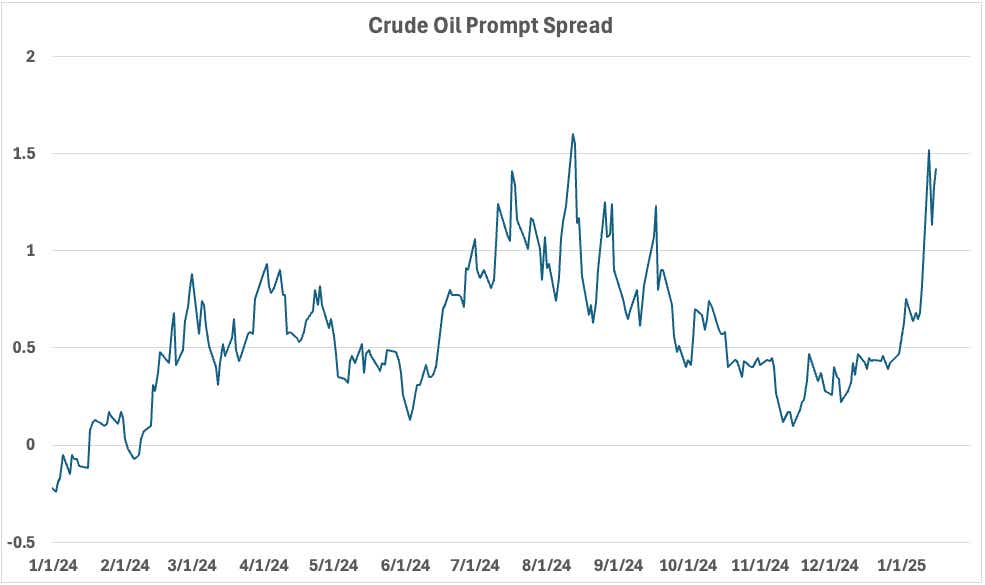

The tightness in the oil market was reflected by the prompt spread in crude oil futures, with the difference between the current contract and the next month’s contract trading at $1.33, which is near the highest levels traded since August 2024.

Still, other metrics, such as crack spreads, remain fragile. They represent the margin refiners earn when buying crude oil and selling a fuel product made from that oil. The failure of crack spreads to rally alongside the prompt spread raises concern because it represents a disconnect somewhere in the market. That said, for oil prices to make another substantial leg higher, crack spreads will likely need to rally.

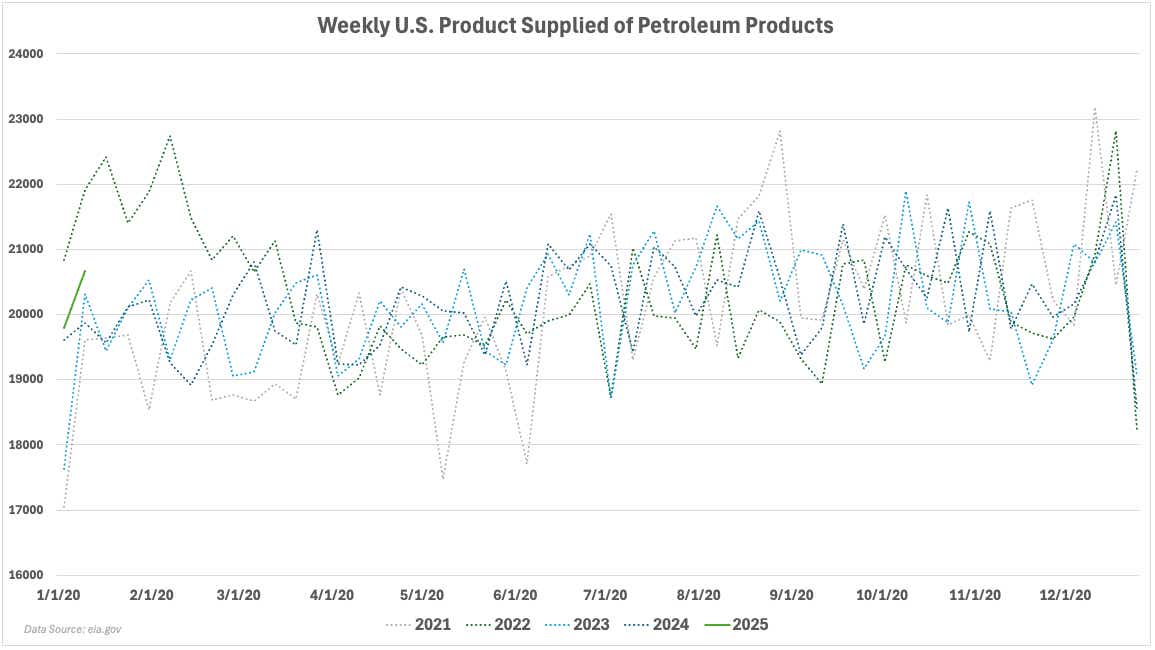

One particularly bullish development in 2025 is the product supplied of petroleum products, which is often seen as a proxy for consumption because it measures products that exit the supply chain before distribution. Product supplied of petroleum products rose to 20.7 million barrels for the week ending Jan. 10. That marks the strongest start for the consumption proxy since 2022.

Trading crude oil

Crude oil prices failed just below the April swing high. That said, further consolidation may be in order. A drop back to the 76 level—which corresponds well with the October swing high and the 78.6% Fibonacci retracement from the April to September move—offers a potential support level.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.