Crude Oil Futures Remain Rangebound

Crude Oil Futures Remain Rangebound

The past seven months of crude oil pricing have provided mean-reversion and trend-following swing traders with a predictable trading channel.

- It’s been a disappointing year for /CL, which has been unable to break out of two distinct multi-month ranges.

- The "positives" for crude oil (signaling increased demand or reduced supply) have not proved to be lasting catalysts.

- The overhang of negative sentiment regarding global growth has led traders to believe crude oil prices will be going nowhere fast over the next several months.

Market update: crude oil down -13.61% year-to-date

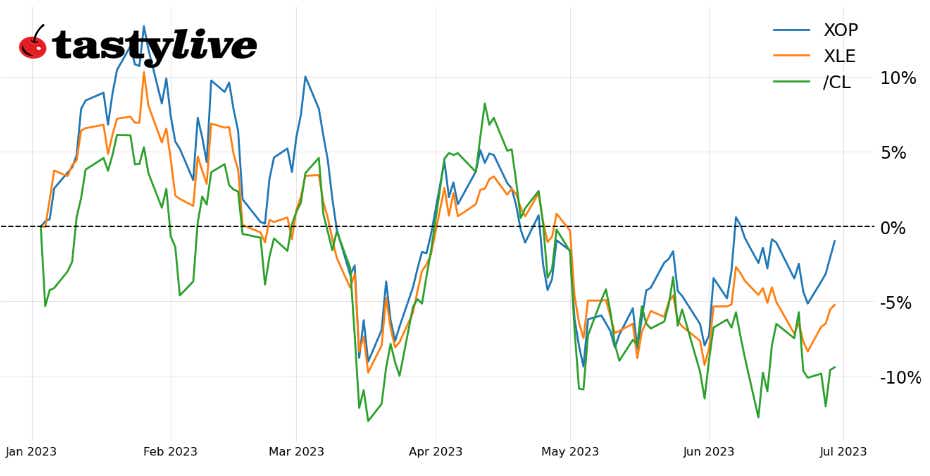

The first half of 2023 did not prove fruitful for energy markets, particularly crude oil prices and companies that extract, refine, and/or sell oil or its byproducts. Even last year’s clear sector winner in equity markets, energy (XLE, up +57.6% in 2022), is off by -8.43% this year.

Despite Russia’s war in Ukraine pressing forward, threats from OPEC+, and an announced Saudi production cut for July, ongoing global recession concerns have dampened enthusiasm for the growth-sensitive commodity. The "positives" for crude oil (signaling increased demand or reduced supply) have not proved to be lasting catalysts.

China’s lack of vigor post-reopening, aggressive rate hikes by the Federal Reserve and other G7 central banks, and the threat of stagflation in the Eurozone and the UK have all proved more significant factors in recent months, offsetting whatever "positives" may have emerged in the news.

Unfortunately for crude oil, even as the U.S. economy continues to beat back recession expectations, the overhang of negative sentiment regarding global growth has led traders to believe that crude oil prices will be going nowhere fast over the next several months:

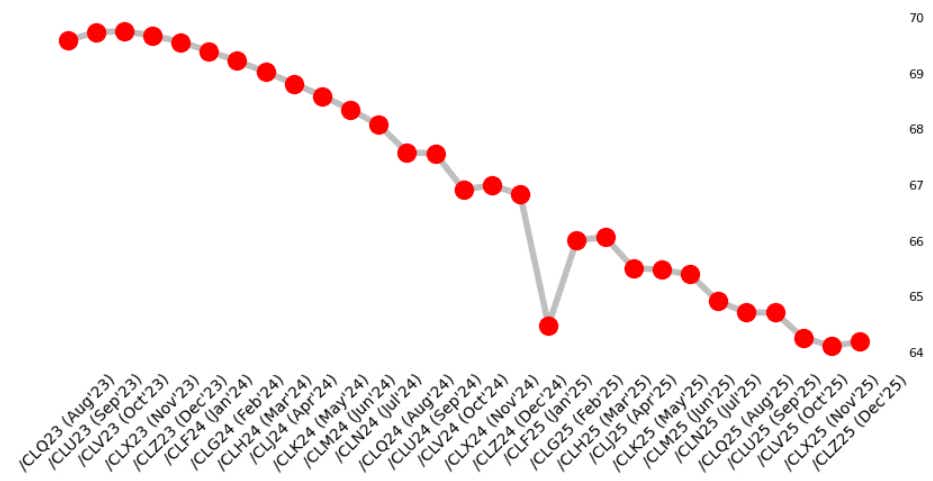

/CL Crude oil futures forward curve (August 2023 to December 2025)

The /CL term structure is in backwardation, whereby longer-dated expirations are trading at a lower price than shorter-dated expirations. Focusing in on the next several months, the futures market is pricing the December 2023 expiration at 69.76 – a mere 6 cents below the price of the August 2023 expiry.

While futures prices are not predictors of spot prices (and research suggests the relationship actually flows from spot to futures), the current /CL forward curve is indicative of a market that feels the supply-demand dynamic is fairly balanced for the foreseeable future, with risks tilted lower.

/CL Crude oil price technical analysis: daily chart (November 2022 to January 2023)

The technical structure of /CL reinforces the view set forth by the futures forward curve: this has been a rangebound market and there is little compelling evidence to suggest that the range will be broken in the near-term. For viewers of Futures Power Hour, this may not come as a surprise, as we’ve been operating around the premise of rangebound /CL prices for several months now.

Until something changes, don’t fix what’s not broken: 63 to 83 remains a viable trading range, carved out starting in November 2022; and if you're a bit more aggressive, 66 to 76 has contained price action since the beginning of May 2023 (via short straddles or an iron condor).

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multi-national firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.