Crude Oil Sinks on Industry Reports: Are Prices Oversold

Crude Oil Sinks on Industry Reports: Are Prices Oversold

Crude Oil Prices Hit the Lowest Level Since Late 2021

Crude oil prices (/CL) hit the lowest levels since late 2021 after a 4% drop on Wednesday, which brought its weekly loss to more than 10%--the biggest decline of the year. The drop comes amid broader market turmoil stemming from Credit Suisse and other distressed banks, suggesting that today’s drop may not be entirely related to fundamental forces across the energy market.

Still, the fundamental backdrop for oil bulls has slowly but surely deteriorated over the last several months. The Federal Reserve and its interest rate hikes have made progress in fighting inflation, but at the cost of economic activity. On Wednesday, the Federal Reserve’s New York Empire State Manufacturing Survey revealed a sharp slowdown, with much of the weakness coming from new orders and shipments. That bodes poorly for economic demand, and although the labor market remains strong, there is evidence that manufacturing—an oil-intensive industry—is losing steam.

International Energy Agency (IEA) Report Shows Russia Production Remains Strong

The European Union’s ban on Russian oil and petroleum products combined with the G7’s price cap has so far failed to throttle Russia’s production in a meaningful way, according to a new report from the Paris-based International Energy Agency. While the IEA report shows a bite to Russia’s revenue, dropping from over $14 billion in January to under $12 billion in February, Moscow is still pumping near pre-war levels.

China and other Asian countries have soaked up Russia’s discounted oil, allowing Moscow to sidestep the impacts of EU and Western sanctions. That, and other economic headwinds, have helped push oil prices lower despite the IEA seeing more global demand later this year as China continues to reopen.

EIA Reports a Weekly Inventory Build, Putting More Pressure on Prices

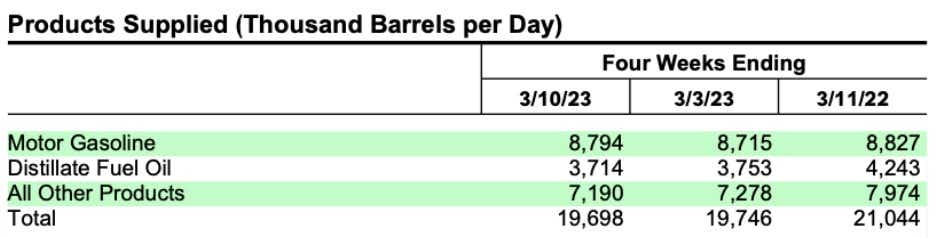

The U.S. Energy Information Administration (EIA) reported a 1.55-million-barrel increase in commercial crude oil stocks (a figure that excludes the Strategic Petroleum Reserve) for the week ending March 10. That was more than the 1.18-million-barrel build that analysts were expecting. That build puts U.S. crude inventories 7% higher than the five-year average. The EIA report also showed a 6.4% year-over-year decrease in total products supplied over the last four-week period, highlighting a drop in implied demand. Overall, a bearish report for the commodity.

Price Action May Show Oversold Conditions

This week’s sharp price drop would usually command more attention if it weren’t for more “news-worthy” events occurring in the banking space. However, the daily chart on crude oil shows an oversold indicator coming from a cross below the 30 mark in the Relative Strength Index (RSI). That said, prices may be due for a short-term correction before resuming the downward trend.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.