CPI Watch: Stock Markets May Jeer Anything But Goldilocks Inflation

CPI Watch: Stock Markets May Jeer Anything But Goldilocks Inflation

By:Ilya Spivak

Stocks may get jittery if the U.S. CPI data veers away from forecasts … in either direction

- Stock markets cooled and the U.S. dollar rose despite a dovish turn in the Fed outlook.

- All eyes on July CPI inflation, with markets expecting the first rise in 13 months.

- Surprises one way or the other may trigger “risk-off” response amid growth concerns.

Price action on Wall Street and the global currency markets hints at early signs of regime change as all eyes turn to July’s much-anticipated U.S. consumer price index (CPI) inflation data.

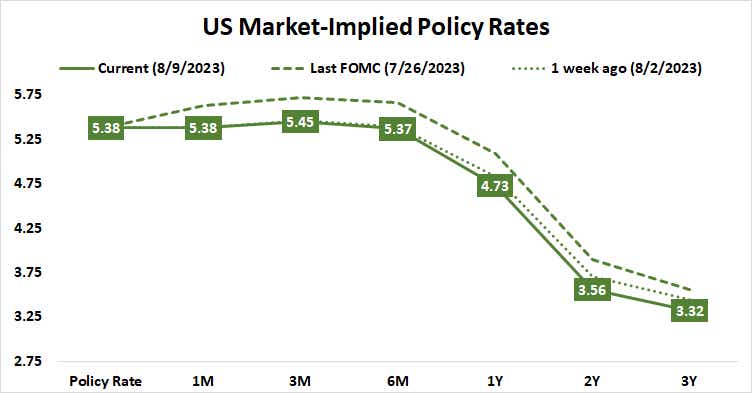

Fed policy expectations for the remainder of 2023 have hardly budged. Markets anticipate that June marked the end of the U.S. central bank’s blistering rate-hike cycle started in March last year, with easing expected to begin sometime between March and May 2024.

Stocks soggy, dollar higher despite cooling Fed outlook

The rates path implied in federal funds futures suggests that the narrow probability of another 25-basis-point hike has inched lower since the policy-setting FOMC committee last met on July 26. Flattening has been more pronounced along the priced-in trajectory beyond the six-months-forward point. In all, this marks a bit of dovish tilting.

Such changes might have cheered equities and weighed on the U.S. dollar as recently as a month ago. That has pointedly changed. The bellwether S&P 500 stock index has declined while the greenback has marked higher since the start of August, hinting that “risk-off” price dynamics are emerging.

This may be speaking to increased concerns about recession risk. The Fed estimates that it can take 12 to18 months for the impact of a single rate rise to be fully absorbed into the economy. So, pressure from the bulk of last year’s outsized 50- and 75-basis-point rate hikes ought to be appearing right about now.

Markets may jeer inflation surprise, regardless of direction

The CPI report is expected to show that the headline inflation rate rose for the first time in thirteen months in July, hitting 3.3 percent year-over-year after dropping to 3.0 percent in June.

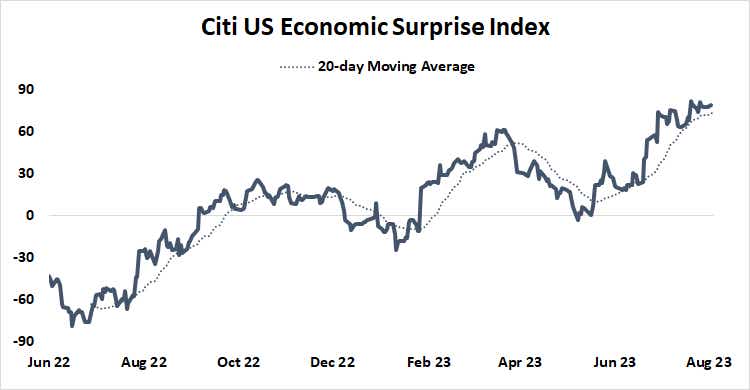

U.S. economic data has tended to outperform relative to expectations since mid-May, implying that analysts’ models are tuned too dour relative to reality and setting the stage for an upside surprise. Such a result might inspire markets to reprice policy bets and push out the start of the easing cycle deeper into next year. A risk-off response to such a “higher-for-longer” adjustment seems probable if growth concerns are creeping to the forefront for investors.

The likely reaction in the event of a miss—a lower CPI print than baseline forecasts are envisioning—is a more curious scenario. If price action since the start of August is indeed the beginning of regime change, then a cool-off in pricing power might well be taken as indicative of economic slowdown. So, this too might leave the markets in a risk-off mood, leaving stock market bulls with a razor-thin opening to celebrate.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.