U.S. CPI Preview: Will Stock Markets Finally Find Fuel in Inflation Data?

U.S. CPI Preview: Will Stock Markets Finally Find Fuel in Inflation Data?

By:Ilya Spivak

Will U.S. inflation data do more for Fed speculation than Chair Powell?

- Fed Chair Jerome Powell deftly managed semi-annual testimony in the Senate

- All eyes now turn to U.S. CPI inflation data, where modest progress is expected

- Signs of rate cut delay now may keep longer-term rates marching downward

Federal Reserve Chair Jerome Powell managed to walk a fine line in the first round of semi-annual testimony to the U.S. Congress this week. The central bank chief appeared before the Senate banking committee first and will be due for a repeat performance in the House of Representatives tomorrow.

On rates, Powell said there is no need to be in a hurry to adjust policy, with a view to making more progress on bringing down inflation. He added that rates can stay higher for longer if the economy remains strong and inflation does not move toward 2%. Meanwhile, concerns about the labor market have diminished considerably from mid-2024.

Fed rate cut expectations steady after Powell testimony

Treasury bond yields inched modestly higher following Powell’s remarks while stocks rebounded from earlier losses to trade little-changed. The U.S. dollar strengthened against the rates-sensitive Japanese yen but mostly weakened elsewhere as improving risk appetite undercut the desire for haven liquidity.

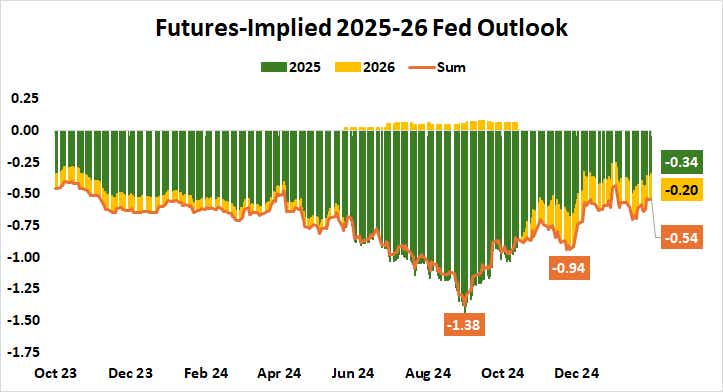

The priced-in outlook on the easing cycle’s trajectory as it is priced into Fed Funds interest rate futures shifted to a slightly more hawkish setting, but the status quo was ultimately little-changed. Traders have discounted 55 basis points (bps) in cuts by the end of 2026, amounting to about half of the Fed’s 100bps projection in December.

The spotlight now turns to U.S. consumer price index (CPI) data as the next major inflection point. The headline reading is seen holding unchanged at 2.9% year-on-year for a second consecutive month, but the core measure excluding volatile food and energy prices is projected to inch down to 3.1%. That would be the slowest since April 2021.

Will U.S. CPI data move the stock market?

Leading purchasing managers index (PMI) data endorses the likelihood that cost pressures eased a bit last month. Moreover, analytics from Citigroup suggest U.S. economic data outcomes have anchored close to baseline forecasts since the beginning of the year, implying that surprise risk is relatively low.

.png?format=pjpg&auto=webp&quality=50&width=758&disable=upscale)

This may endorse Powell’s gradualist guidance. It may also encourage the idea that delaying stimulus now may translate into deeper cuts downwind, as the recent drop at the long end of the yield curve appears to anticipate. The latest lurch lower follows last week’s surprisingly weak U.S. service-sector data.

Whether this translates into directional conviction for Wall Street probably depends on whether equity investors are prepared to get worried about the business cycle. Indecision has been the name of the game for over two months. The bellwether S&P 500 has drifted sideways in a choppy range since setting a high in early December.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.