Country ETFs, Earnings and High-IV Options Trading Opportunities

Country ETFs, Earnings and High-IV Options Trading Opportunities

From Mexico ETF's decline to AMZN and SLV trade strategies. Which sectors show high IV as Google and SNAP prepare for earnings?

Below are some of the more popular country-wide exchange-traded funds (ETFs). See the total returns from 2020 to today. They are also broken down year-by-year.

Mexico (EWW) was a major underperformer in 2024-now down more.

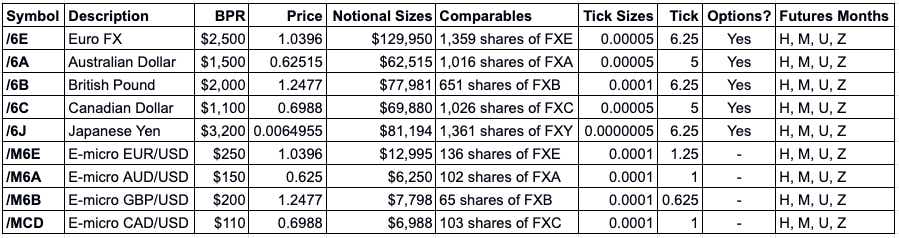

Currency Futures

The U.S. dollar has been strong and volatility has been relatively high. These symbols can be traded on the tastytrade platform.

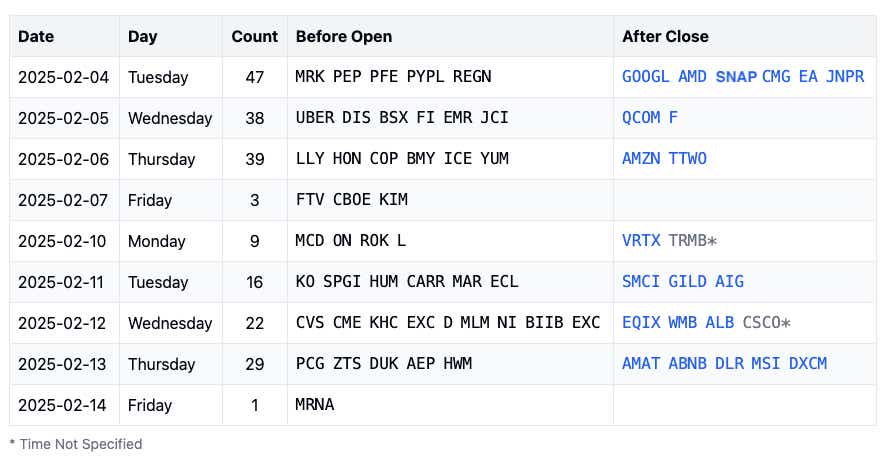

Earnings Watch

Alphabet (GOOGL) and Snap (SNAP) are expected to report earnings after the market close today, Feb. 4. SNAP might be interesting because of the potential TikTok ban.

Companies reporting earnings tomorrow, Feb. 5, include Uber (UBER), Disney (DIS) and Qualcomm (QCOM).

See the rest below:

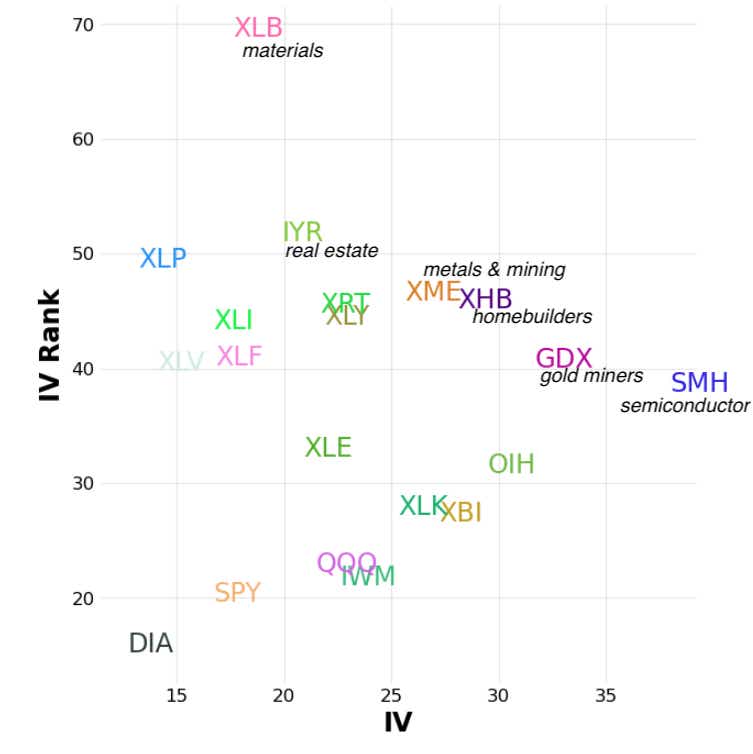

Looking at IV Ranks of the Sectors

Below are some interesting sector ETFs that we are following. Ideally, we like looking at ETFs with high levels of IV and IV Rank. The symbols we've listed below are what we are looking at:

XLB (materials)

IYR (real estate)

XME (metals & mining)

XHB (homebuilders)

GDX (gold miners)

SMH (semiconductors)

Two trade ideas

Amazon (AMZN) ($241) Call Diagonal Spread (FEB7/MAR) $6.89 debit

Alphabet and Amazon are the next Magnificent Seven stocks to report earnings on Feb. 6 and Feb. 4, respectively, after the market closes. Both stocks have been chopping around at highs, with both sitting at around a 2.5 trillion in market cap. If you think the rally will continue, you'd assume one or both would lead the way. Long the MAR 250 call with a short call at 260 in the front weekly provides around 10 long delta, positive gamma and some short-term positive theta.

SLV ($29.17) ZEBRA (MAR) $3.60 debit

Silver and gold have both had significant runs during the last week, with silver up more than 10% since the start of the year. If you think it might cool off from here, a zebra is a synthetic stock position at a fraction of the buying power. Long 2x of the 31 puts and short 1x of the 29 puts provides roughly -100 short delta for just $3.60 debit.

Subscribe to Cherry Picks to be Cool. We’re OK with grifters, but to be on our good side subscribe to our newsletter.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.