Great Expectations for Costco Earnings Preview—Stock Split Ahead?

Great Expectations for Costco Earnings Preview—Stock Split Ahead?

By:Mike Butler

Costco will report quarterly earnings after the stock market closes on Thursday.

The popular wholesaler is expected to announce earnings-per-share of $5.08 on $80.03 billion in revenue.

Both estimates are way up from last quarter's results, which were $3.78 and $58.52 billion, respectively.

Information regarding increased membership fees will likely be a focal point for this earnings call.

Costco Earnings Preview

One of the few household company names left to release quarterly earnings is Costco (COST). On Thursday after the market closes, quarterly earnings will be released, and investors have great expectations.

Costco is expected to report an earnings-per-share (EPS) of $5.08 on $80.03 billion in revenue, up from EPS of $3.78 on $58.52 billion in revenue just a quarter ago. After announcing a $1.16 dividend in July, Costco also announced membership fees are going up.

Here’s an excerpt from the press release: "The company also announced that, effective Sept. 1, it will increase annual membership fees by $5 for U.S. and Canada Gold Star (individual), business, and business add-on members. With this increase, all ... will pay an annual fee of $65. Also effective September 1, annual fees for Executive Memberships in the U.S. and Canada will increase from $120 to $130 (Primary membership of $65, plus the Executive upgrade of $65), and the maximum annual 2% Reward associated with the Executive Membership will increase from $1,000 to $1,250. The fee increases will impact around 52 million memberships, a little over half of which are Executive."

It will be interesting to see how increased fees may play a role in forecasting for the rest of the year and into 2025, with such a sharp increase in earnings estimates this quarter.

COST stock has had a stellar 2024, opening the year at $655.58, and its hovering around $900 per share today—near the highs of the year. When the markets were selling off aggressively in early August, Costco's stock price was moving to the upside. It could be seen as a safe haven for investors when consumers are looking to cut costs in volatile times.

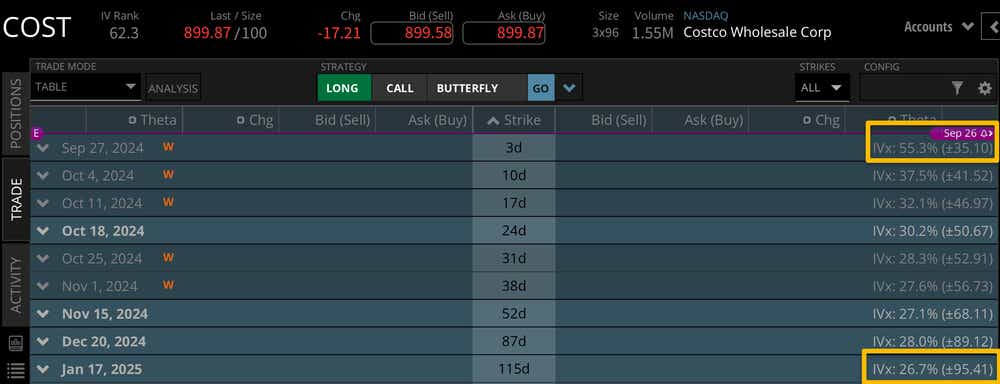

Costco is up over 37% on the year, sitting close to all time highs. The implied volatility is relatively low compared to other popular ticker symbols that have already released earnings. Looking at the expected stock price move this week, we can see a +/- $35.10 implied move for the next few days.

This is just over 3% of the notional value of the stock price, which is very low considering most popular stocks land in the 5%-10% range for earnings. Looking to the end of the year, we can see a +/- $95.41 expected stock price move priced into the January 2025 expiration cycle, which means this earnings report accounts for just over a third of the expected stock price move through the end of the year.

Bullish on Costco for earnings

Earnings participants who are bullish on Costco for earnings may be looking for a surprise announcement like a stock split, paired with an earnings beat on elevated earnings expectations. We've seen popular names like MicroStrategy (MSTR), NVIDIA (NVDA), Chipotle (CMG) and Broadcom (AVGO) split this year. And while a bullish run doesn't always follow a split, it certainly draws attention to the stock. With Costco near all-time highs, they'll need to post a strong earnings report if we're to expect the stock price will open higher on Friday morning.

Bearish on Costco for earnings

Costco bears are looking for an earnings miss, and maybe a temperance of membership performance after the price hike. Could the price hike deter members from continuing their memberships? Any sort of negative data could result in a bearish move in the stock price on Friday morning.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.