Costco Earnings: Can a Potential Stock Split Boost Price

Costco Earnings: Can a Potential Stock Split Boost Price

By:Mike Butler

5% price move projected as the stock trades near all-time highs

- Costco reports quarterly earnings Thursday, after the stock market closes, and the stock could split soon, making it more affordable.

- The company is expected to report earnings-per-share of $4.08 on $63.03 billion in revenue.

- The chain will continue to lean on high membership renewal rates and store expansion plans.

Costco (COST) will report quarterly earnings after the market closes Thursday, and the stock price is trading near all-time highs at around $1,050 per share. The wholesaler will look to continue posting strong earnings figures for the quarter, and many investors are wondering whether we'll see a stock split.

The company is expected to report earnings-per-share (EPS) of $4.08 on $63.03 billion in revenue. It has exceeded EPS estimates four quarters in a row but has had a spotty revenue estimate record, missing half of the reports in the same period.

Last month, Costco released its January sales report, and the numbers looked good—a net increase of 9.2% compared to last year. While inflation and stagflation worries remain high, consumers will always look to pinch pennies where they can. The company offers that to consumers by way of bulk purchasing everyday items.

A not-so-surprising fact about Costco is the membership retention rate, which is over 90%. That means when people sign up, they don't usually leave. Combine that with an effort to continue expanding internationally and domestically, and you've got yourself a nice sustainable business model.

On the last earnings call, Costco reported a 7.8% membership income growth rate along with a 90.4% global membership renewal rate. Three new stores were built in the U.S. and Canada, with another three built internationally. Costco estimates its 890 stores will grow to 916 by the end of FY ’25.

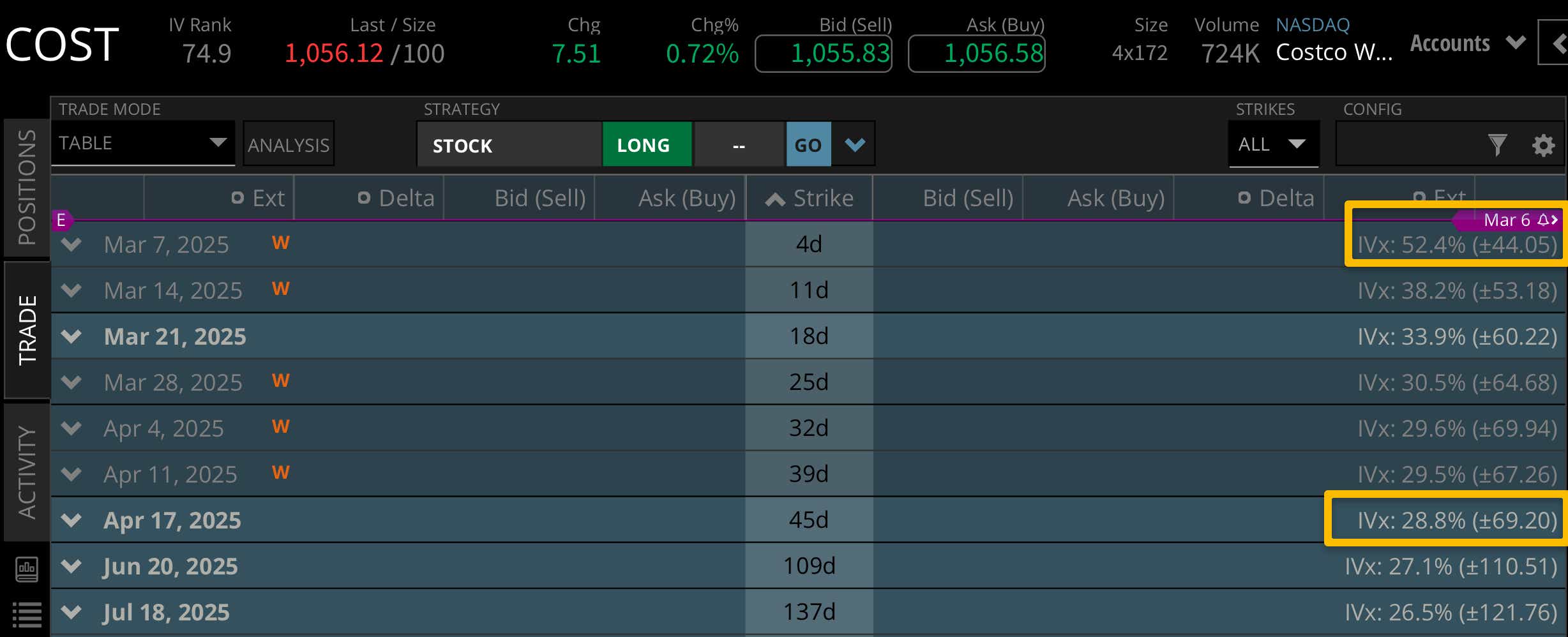

Looking at the implied volatility of the options market enables us to see how options prices reflect the uncertainty of the binary event that is Costco's earnings announcement this week. Surprisingly, there is only a +/- 5% stock price move projected for this earnings call. The implied stock price move is +/- $44.05 from the current price of $1,050 per share.

That puts Costco on the lower end of the implied volatility range for most companies that reflect around 5%-10% of the notional value of the stock price. Low implied volatility means the market isn't projecting anything too crazy to happen with COST stock, regardless of whether the report is good or bad.

Looking to options cycles later this year, we see the April options cycle has a +/- $69.20 expected stock price range. That tells us that even though the overall implied volatility for Costco earnings is low, this week's implied movement still accounts for over 60% of the implied price range over the next 45 days.

Bullish on Costco stock for earnings

If you're bullish on COST stock for earnings, you're looking for continued strength in EPS and revenue figures for last quarter. With the stock trading near all-time highs, it seems necessary for a double earnings beat if we're to see the stock soar to new highs. Costco exhibits very low implied volatility for this earnings call, which means the market isn't expecting anything too surprising. Some might say this creates some stability around the current stock price, but we've seen crazy things happen during earnings announcements before. I'm speculating on a stock split announcement at some point this year, and if that happens we could see the market react favorably to the news.

Bearish on Costco stock for earnings

If you're bearish on COST stock for earnings, you're looking for some weakness in the forecast for 2025, an EPS miss, revenue miss or a combination of all three factors. Costco is a strong brand with strong consumer confidence, so it would really take something rattling to see the stock drop in a dramatic way this week.

Tune in to Options Trading Concepts Live at 11 a.m. CST on Thursday for some options trading strategy ideas ahead of earnings announcements after the market closes from Costco and Broadcom (AVGO).

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.