Exploring Index Correlations for Smarter Investments

Exploring Index Correlations for Smarter Investments

By:Kai Zeng

Understanding correlations among major indexes and the implications for options strategies is crucial.

The behavior of the S&P 500 (SPY), NASDAQ 100 (QQQ), Russell 2000 (IWM), and Dow Jones Industrial Average (DIA) provides insights into market dynamics and opportunities for diversifying portfolio risks.

During the past decade, the average long-term correlation between each pair of the four main indexes stood impressively high at 0.83, indicating a strong relation in their movements.

However, the IWM and QQQ demonstrated the lowest correlation, slightly under 0.75, suggesting a slight divergence in their performance paths.

This underscores the nuanced relationships that exist among indexes, which can have significant ramifications for portfolio diversification strategies.

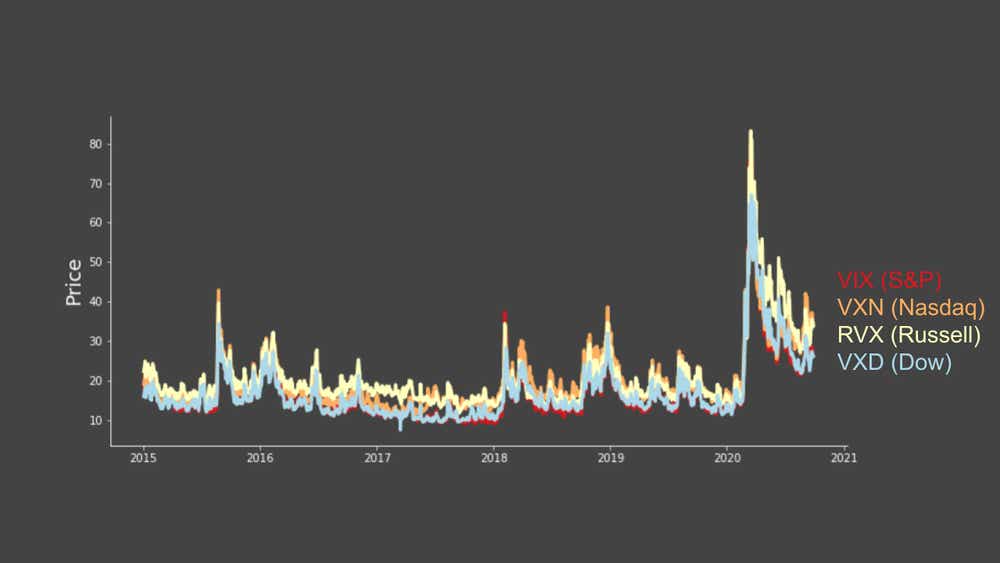

Moreover, the implied volatilities (IVs) of these indexes typically exhibit a unified front, moving in tandem within a similar range.

This collective behavior further indicates the deeply interconnected nature of these major markets, with the Dow's IV showing a slightly weaker correlation against others, providing a marginally independent volatility perspective.

Positive correlation poses a challenge

So, what about when we apply the same option strategies across these indexes? A closer examination into the 45-day, 1 standard deviation (SD) strangles on SPY, QQQ, IWM, and DIA sheds light on the correlation in the performance (P/L) of these strategies across different indexes.

The data suggests that the performances of options strategies across these indexes are also positively correlated. This poses a challenge for traders aiming to employ a uniform strategy across these products as a means of achieving portfolio diversification.

The findings highlight a fundamental takeaway: trading the same options strategy on these highly correlated indexes may not yield the desired diversification effect. Since all four indexes—and by extension, their options performances—show high correlations, traders may find it challenging to mitigate risk through traditional diversification strategies within these instruments.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Seek uncorrelated entities

To navigate this interconnected market environment, traders should consider looking beyond these correlated entities. Seeking out uncorrelated assets or employing a varied mix of strategies and deltas can offer a more robust approach to diversification. This could involve exploring different financial instruments, market sectors, or even international markets that do not move in lockstep with the major U.S. indexes.

In conclusion, while the major indexes offer a snapshot of market sentiment and trends, their high correlations—both in stock movements and option performances—present a challenge for diversification. By understanding these dynamics and exploring beyond the conventional boundaries, traders can enhance their risk management techniques and strive for a more diversified and resilient portfolio.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.