Corn and Wheat Prices Wilt Alongside the Heat

Corn and Wheat Prices Wilt Alongside the Heat

Grain prices tumble as traders assess fundamental and technical outlooks

- Corn prices fall even as crop conditions slide.

- Wheat prices follow corn’s path as bears press on.

- COT data reveals that shorts are capitulating.

Corn prices (/ZC) in Chicago fell about 1%, or 5 cents per bushel, through Tuesday afternoon to trade at the lowest level since July 18 as traders continue to sell the grain amid higher forecasted supply.

The pullback in grain prices has come despite ongoing conflict in the Black Sea because of Russia's decision to suspend an initiative that would have delivered Ukrainian grain to Turkey for distribution to many parts of the world.

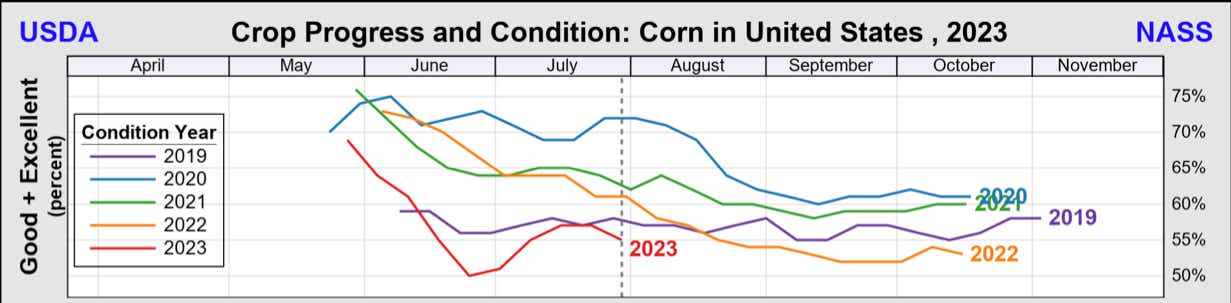

The crop progress report from the United States Department of Agriculture's National Agricultural Statistics Service Information (NASS) on Monday revealed a drop in corn conditions, marking the first decline in a few weeks. The percentage of the corn crop rated as good or excellent remains significantly lower than levels in previous years. The likely factor weighing on the crop is the intense heat experienced across much of the United States during the survey period.

Image source: usda.gov

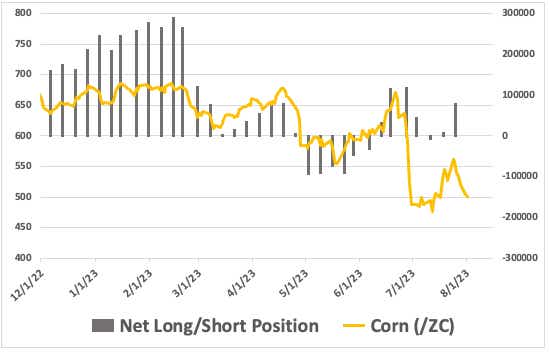

The continuous fall in prices despite the degradation in crop conditions and the USDA's forecast for higher corn ending stocks for 2023 reflects the bearish backdrop in the grains market. However, following a big drop in June and a volatile July, speculators have grown increasingly bullish. Non-commercial traders are now the most net long corn since June 27, according to the latest Commitments of Traders report from the Commodity Futures Trading Commission (CFTC).

Corn technical outlook

The daily price chart doesn’t offer much conviction for bulls or bears. The first half of the year was largely dictated by downward price action before a period of range-breaking volatility in June. A break below the July low would likely introduce further downside potential.

If prices retrace past the 78.6% Fibonacci level from the July high/low, they will threaten that scenario. A rebound from that Fib level, however, could inspire some buying. But bulls would have a lot of work to do to form a trend higher, including breaking the July high and then the June high.

Wheat prices tumble

The crop is facing bearish headwinds similar to those that corn is facing, causing wheat prices (/ZW) in Chicago to decrease by about 2% to $6.52 a bushel. Plentiful precipitation over the last several weeks has rescued much of the crop from drought.

However, exports, according to the United States Department of Agriculture's most recent numbers, remain relatively low compared to recent years. Prices will likely be influenced by the World Agricultural Supply and Demand Estimates report (WASDE) due on Aug. 11.

Currently, the USDA anticipates ending stocks of 592 million bushels for the 2023 marketing season, up from 562 million bushels in the June report. If the ending stocks receive another upward revision, the current selloff would likely proceed.

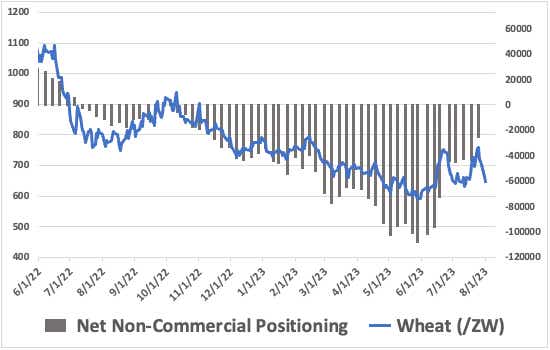

The COT report showed increasing bullish appetite for wheat, although net positioning remains short. For the week ending July 25, non-commercial traders were 25,000 contracts net short. That is the least net short speculators have been since November. Wheat traders are either expecting less downside over the short term or perhaps a rebound in prices.

Wheat technical outlook

The wheat daily chart is showing a double top pattern, with prices quickly approaching the neckline of the pattern (formed from the trough between the two highs marked on the chart). A break below that neckline could induce a round of selling and push prices lower.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.