Copper Price Forecast 2025: How China Stimulus and U.S. Demand Could Drive Growth

Copper Price Forecast 2025: How China Stimulus and U.S. Demand Could Drive Growth

The red metal has broken a two-year losing streak, and tech analysis is turning bullish

- Copper is coming off a winning year after breaking a two-year losing streak.

- China stimulus efforts may help boost demand for the metal.

- U.S. mining is expected to increase, but supply is unlikely to be supported by reduced regulations this year.

Copper 2024: year in review

Copper prices broke a two-year losing streak in 2024 after rising by about 3% following declines of 12% and 8% in 2022 and 2023, respectively.

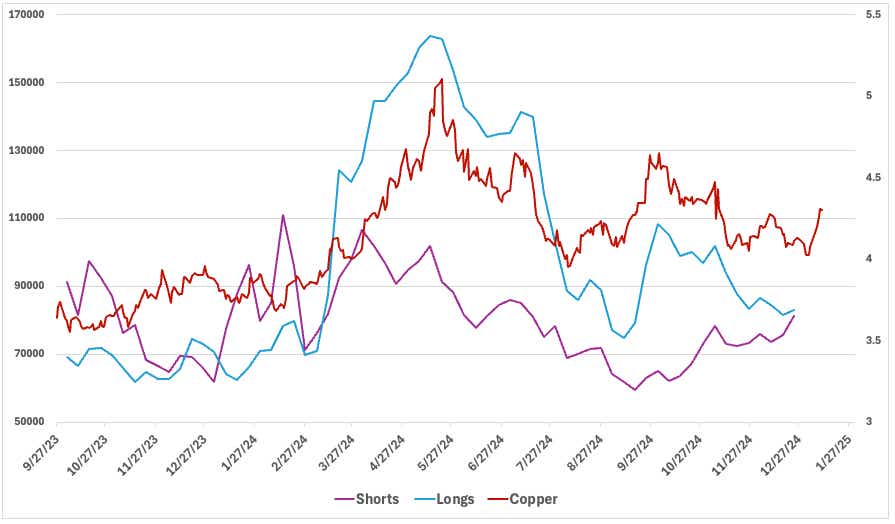

The red metal performed exceptionally well in the first half of last year, rising above $5 per pound before retreating in the second half of the year, falling back to nearly $4 per pound.

The global economic uncertainty that developed in the second half of last year, particularly in China—the largest copper consumer in the world—dragged on the red metal’s sentiment.

Will 2025 provide more gains?

Copper prices got off to a great start in 2025, rising nearly 5% through the first week of trading. The move came despite a rise in the dollar—which usually works against prices because of the currency’s impact on trade.

However, several developments bode well for the industrial metal’s outlook this year.

The first is that China’s government appears more willing to introduce stimulus measures—both from the fiscal and monetary sides.

China expects a new trade war with the incoming Trump administration. While that will likely be negative for global trade, it may also increase Beijing’s willingness to bolster domestic consumption.

A 5% target for Chinese gross domestic product (GDP) growth remains in place for 2025. Beijing has already introduced several measures to boost consumption, including expanding a subsidized program that allows consumers to trade in goods, such as phones.

China also boosted pay for millions of government workers, with about $20 billion in economic impact from those wage hikes. Beijing also agreed to issue about $409 billion in bonds for 2025, the highest on record.

Meanwhile, smelters in China are expected to continue to increase production this year even as the supply of copper concentrate narrows. The increased production estimates follow lower benchmark prices for copper concentrate, which could help to bolster smelters’ profit margins.

U.S. supply to come too late

The Trump administration appears likely to take measures to make it easier for mining projects to take off. That could include faster permitting and reduced regulations, especially around environmental concerns. That should help boost copper supply, but it won’t come in 2025 because mines take years and sometimes decades to start producing.

That said, demand in the United States is likely to increase, especially if current economic conditions persist and the Federal Reserve cuts interest rates. Still, if the U.S. economy continues to chug along, it could help to support copper prices. The main tailwinds could come from electric vehicles and increased data centers to support artificial intelligence.

Trading copper in 2025

A possible target for copper this year could be $5 per pound, according to several analysts. However, there will likely be considerable volatility along the way. A trade war would have an oversized impact on financial markets, especially assets like copper, which are sensitive to trade and overall economic conditions.

Traders increased their short bets on copper late in 2024, with short positioning now at the highest levels since last summer. Prices are still increasing, which could increase copper prices should the current trajectory hold, forcing traders to close their short positions.

Copper prices made a notable technical move early this month, crossing above the 100-day simple moving average (SMA) on Jan. 10. The 200-day SMA is now being attacked, which could lead to a material improvement in the metal’s technical structure if prices manage to close above. Possible resistance from recent swing highs, notably the November swing high at 4.4930, and the September high at 4.79, could come into play in the coming months.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.