Coinbase to Announce Earnings Tomorrow Amid Bitcoin's Rally

Coinbase to Announce Earnings Tomorrow Amid Bitcoin's Rally

By:Mike Butler

COIN is up 26% this year, with an 8% Stock Price Move Expected with earnings per share of $0.41 on $1.25 billion in revenue

- Coinbase is set to report quarterly earnings after the stock market closes tomorrow.

- The company had a big earnings-per-share (EPS) miss last quarter, and the stock price fell slightly.

- Now, it’s expected to report an EPS of $0.41 on $1.25 billion in revenue.

- Bitcoin is just off highs realized in March, which could help drive transaction revenue for Coinbase.

- COIN stock is up over 26% in 2024.

Coinbase Earnings Preview

Coinbase (COIN) is on deck to report quarterly earnings tomorrow, and Bitcoin is just shy of annual highs. Last quarter, Coinbase missed big on earnings-per-share (EPS) estimates,but exceeded revenue estimates for the fourth quarter in a row.

This week, Coinbase is expected to report EPS of $0.41 on $1.25 billion in revenue.

Looking at an annual chart of COIN stock, we can see the company has benefited from the rise in the price of Bitcoin, but this hasn't been without realized volatility. We've seen swift swings in the stock price, and we shouldn't expect this to stop, given the volatility of the sector and questions related to the future of crypto trading and investing. COIN stock price is up over 26% this year, sitting at around $219 per share after opening the year at $173.02.

In a letter to shareholders, Coinbase offered insight into legislative advancements achieved in the space this year: “Crypto legislation has become a mainstream issue in the U.S., garnering bipartisan support, and there is real energy within both the House and the Senate to pass meaningful legislation. We continue to support Stand With Crypto—which now has over 1.3 million advocates—and will continue to invest in policy initiatives throughout the 2024 election cycle to help elect pro-crypto candidates. The approval and launch of the ETH ETFs was another huge step forward for regulatory clarity as it confirmed what we have been saying for years: ETH is not a security. Outside the US, we saw USDC become the first stablecoin to achieve compliance with the European Union's landmark Markets in Crypto-Assets (MiCA) regulatory framework."

One of the main knocks on cryptocurrency investment is the lack of clarity around regulation, and these steps forward could put an end to that, driving more investment and trade traffic from previously skeptical participants.

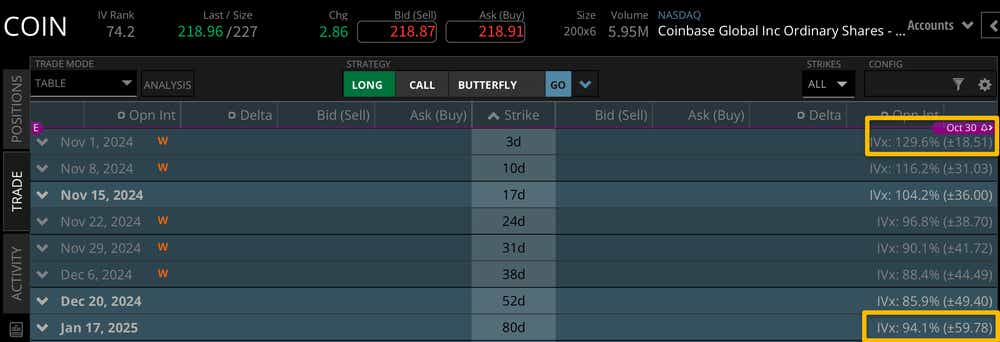

For this week, COIN stock has an implied move of +/- $18.51 from the current stock price of $219. This is based on the current implied volatility that we can derive from the options market. This is over an 8% expected move based on the notional value of the stock price, which is on the higher end of all earnings announcements that typically land between 5%-10% of the stock price.

Looking through the end of the year, we see a +/- $59.78 expected stock price move in the January ’25 options cycle. This week's expected move accounts for less than a third of the expected move through January, which tells us that even after this announcement we should expect to see some big moves in the next few months. This comes as no surprise because the presidential election is around the corner, and that could result in volatile movements for the general market, but especially the cryptocurrency space that's been a focal point for candidates.

Bullish on COIN stock for earnings

With reduced EPS and revenue estimates and the price of Bitcoin surging, bullish COIN investors are looking for a big earnings beat relative to expectations. More information related to regulatory advancements could be released in the earnings call, and positive sentiment could help the bullish momentum for Coinbase.

Bearish on COIN stock for earnings

If you're bearish on COIN stock for earnings, you're looking for an EPS or revenue miss on already reduced expectations. If COIN can't show that they've turned the positive cryptocurrency momentum into dollar signs, we could see the stock sell off after earnings this week.

Tune in to Options Trading Concepts Live at 11 a.m. Central every day this week for a deeper look at earnings announcements, including Coinbase's after the market closes tomorrow.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.