China's Stock Market Surges, Lifting the Prices of U.S.-listed China Stocks

China's Stock Market Surges, Lifting the Prices of U.S.-listed China Stocks

China’s CSI-300 stock exchange rose 8.48%, its biggest daily percentage increase ever

- China’s stock market is surging ahead of a weeklong holiday as traders cheer stimulus measures.

- U.S.-listed China stocks are joining the rally, with big names trading at or near yearly highs.

- More stimulus from the fiscal side would likely help the demand-side of the economy, possibly jolting global economic growth.

- Lags in performance between U.S.-listed and China-listed stocks are nearly impractical to trade for retail.

Chinese stocks rise on stimulus measures

Stocks in China saw some of the biggest gains in nearly two decades today as investors mulled recent efforts by Chinese policymakers to stimulate economic activity in the country. Over the weekend, regional governments such as the Guangzhou government said it would remove restrictions on home purchases in the city. The policy shift was just one part of a wider government effort. Other major cities, such as Shanghai and Shenzhen, also eased restrictions on home buying.

China’s CSI-300, the China equivalent to the U.S. Nasdaq 100, surged 8.48% on today in overnight trading. That was the biggest daily percentage increase on record. The broader Shanghai Composite Index rose over 8%, its best daily move since 2008.

The buying came ahead of the weeklong National Day holiday, which will see the Shanghai Stock Exchange (SSE) closed from Oct. 1-Oct. 7. Traders were likely anxious to buy ahead of the extended time off, signaling the strength of bullish appetite. It also continued the earlier rally from an earlier move by China’s monetary authorities.

Last week, the People’s Bank of China (PBOC) cut its reserve ratio requirement (RRR) by 50 basis points and cut interest rates on existing mortgages to relieve pressure on current homeowners. The bank also slashed its interest rate by 20 basis points. The trifecta of stimulus measures was rare and took markets by surprise. It also reverses the thinking among policymakers that deflation was transitory.

Another unusual move was the choreographing provided by the PBOC Governor Pan Gongsheng, who said that it would likely provide more stimulus later this year. The resulting message provided a clear about-face for the bank’s stance on stimulus.

Of course, the Federal Reserve’s rate cut helped to clear some hurdles for the PBOC to act, the main being the Chinese Yuan. If China significantly eased policy before the Fed’s actions, it would likely put a big hit on the yuan, China’s currency.

U.S-listed China stocks find their footing amid broader market rallies

U.S.-listed Chinese stocks are reflecting the bullishness in Chinese markets, with the iShares China Large-Cap Exchange-Traded Fund (FXI) up nearly 21% in September, marking the largest monthly percentage increase since November 2022.

The S&P 500 was on track to record a fifth monthly gain, as investors cheer the latest move by the Federal Reserve to cut rates amid a rather strong economic backdrop.

Alibaba Group (BABA), one of the largest U.S.-listed Chinese stocks by market capitalization, was up nearly 28% for September going into the last hour of trading for the month. Other names, like Zeekr (ZK)—the recently IPO’d electric vehicle maker—traded 38% higher.

Trading U.S.-listed China stocks on movements in the Chinese market

Stocks trade on separate exchanges but are intrinsically linked as they represent the same company. However, factors outside the individual company also influence the stock. U.S. markets, while generally more liquid, interact more directly with factors influencing the U.S., such as the Federal Reserve’s interest rate policy and overall market sentiment in the region.

For example, the U.S.-listed JD.com (JD) was up about 48% on a month-to-date basis, while JD rose nearly 56% on the Hong Kong Exchanges and Clearing Limited (HKEX). The recent surge in market sentiment in China’s markets clearly helped to propel JD’s stock price higher on the HKEX.

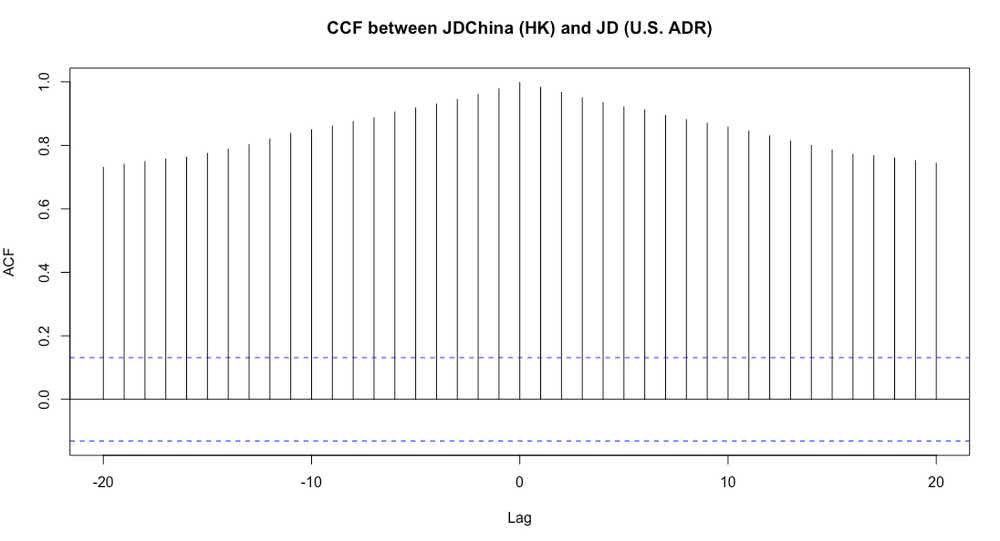

While there are many intricacies to consider, we can analyze the relationship between these two listings using a cross-correlation function (CCF). Simply put, a CCF measures how two time series relate to each other over different time lags by showing the degree to which one series (the China-listed JD) influences the other (the U.S.-listed JD).

The graph below illustrates a CCF analysis between the two stocks measured in weeks. The correlation with no lag highlights how these two listings move very closely together, which isn’t surprising.

The correlation then decreases along both the positive and negative lags, although they remain highly correlated. Because the China market essentially trades one day ahead of the U.S. market, traders may see it as somewhat predictive of the U.S. stock price, given that there is a positive and still highly correlated value in the positive lags, which show how the U.S. listing is influenced in the futures by the current price of the China-listed stock.

However, that would be a flawed view, as the symmetric and near-uniform lag across the time series shows that the U.S. listing and China listing affect each other in a near consistent manner across both lag series. Conversely, if the positive lag showed a significantly higher correlation than the negative lag, it would indicate better predictive power in the model.

While sophisticated trading firms may capture some arbitrage between the two, the CCF here indicates it wouldn’t be practical to implement on a retail level. Therefore, it is crucial to understand the limitations of such models. A CCF does not account for external market events or news, either of which could affect each stock price independently or dependently. Given these limitations, it is prudent not to base trading decisions solely on this type of model.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.