China Cheers Markets With Exports Rise But the Rebound is a Mirage

China Cheers Markets With Exports Rise But the Rebound is a Mirage

By:Ilya Spivak

Signs of economic recovery in China are probably no more than a mirage

- China reports the strongest export growth in nearly three years.

- Front-running higher U.S. tariffs looks like short-lived support.

- Inflation data may cool confidence and hurt China-linked markets.

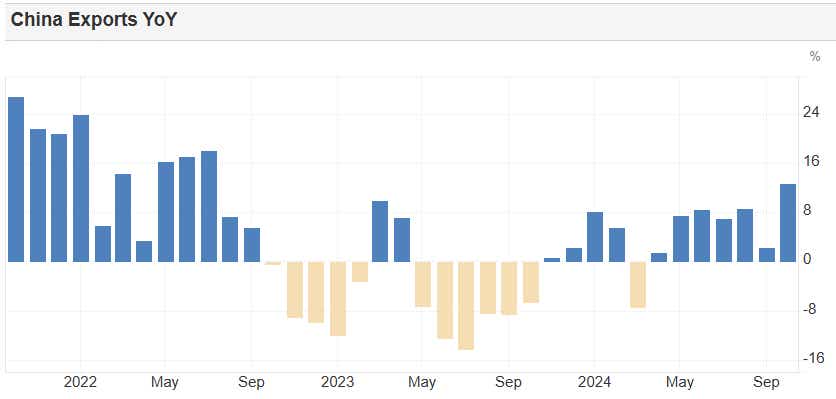

As all eyes fixated on the outcome of the U.S. presidential election, a batch of economic data out of China quietly hinted at some long-awaited signs of life in the world’s second-largest economy. Export growth unexpectedly surged in October, rising at a blistering 12.7% year-on-year. Median forecasts envisioned just 5% ahead of the release.

That amounted to the quickest growth since July 2022. The release followed a better-than-expected reading on purchasing managers index (PMI) data from S&P Global together with Caixin, a Chinese media company. It showed that the pace of economic activity growth accelerated the fastest in four months.

Export growth in China surges, but will the rebound last?

Here too, external demand seemed to play a decisive role. The report cited “another solid rise in export orders” as a pivotal driver of growth in new business activity, with a nod to “rising interest from foreign markets, such as the U.S.” Rather than signal a welcome start to a new trajectory however, this warns of still darker times ahead.

Both candidates in the U.S. presidential election argued for an assertive stance in the increasingly competitive relationship between the world’s leading economic powers. American voters chose the more combative alternative in giving Republican Donald Trump a resounding victory. He speaks of favoring sweeping tariffs as a cure-all.

It's a small wonder that U.S. importers of Chinese wares are trying to hoover up as much inventory as they can before the new administration is in place. Taking the President-elect at face value, all importers will face an increase in tariffs, but those bringing in goods from China will be singled out for especially high rates.

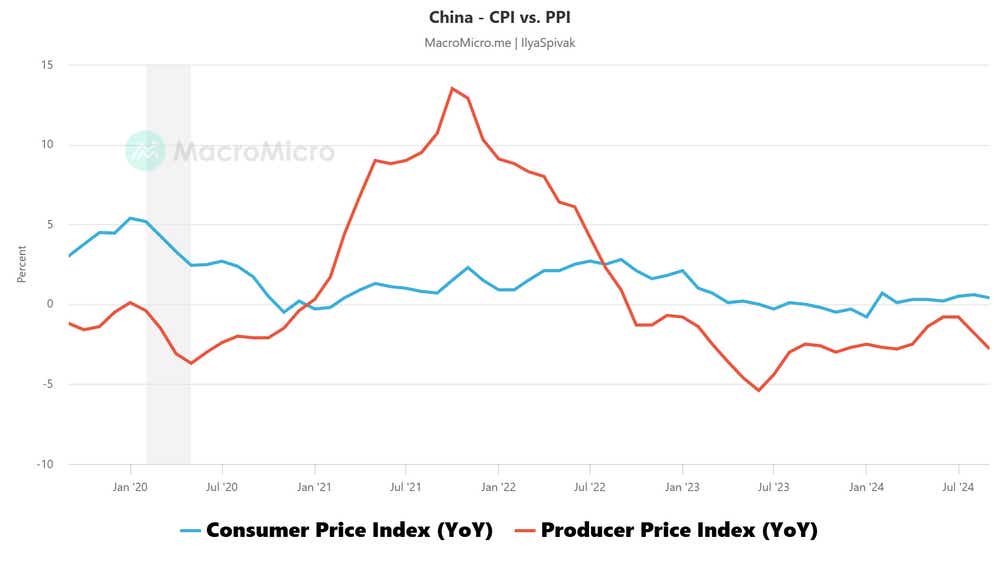

Chinese inflation data may scatter hopes for an upturn

If the upswell in China’s export growth is about front-running rising trade barriers, it is inherently temporary and speaks to the risk of dramatic drop-off downwind. Policymakers in Beijing anticipating as much could be inspired to delay long-hoped-for fiscal stimulus for now, opting to keep their powder dry for tougher times.

On balance, this hints that China’s economy is unlikely to see material improvement in the near term. What this might mean for local stock markets is unclear, as Beijing can effectively mandate them higher. However, proxy assets like the Australian dollar might face selling pressure as optimism gives way to a more circumspect consensus.

Incoming inflation data may be the catalyst for a rethink. It is expected to show that the consumer price index (CPI) rose 0.4% year-on-year in October, matching the prior month’s result. Wholesale deflation is expected to continue as producer prices (PPI) fall 2.5% year-on-year, marking a slight improvement over the 2.8% decline in September.

Soft figures warning that domestic demand remains weak and thereby unlikely to prolong any recovery jump-started by a fleeting surge in exports might push the Aussie dollar lower against its U.S. namesake. Tellingly, the same trade report cheering investors also showed that imports fell 2.3% year-on-year. That is the worst result since June.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.