Lackluster Growth of China GDP May Disappoint Markets Yet Again

Lackluster Growth of China GDP May Disappoint Markets Yet Again

By:Ilya Spivak

Markets linked to China’s economy may suffer as growth struggles and stimulus underwhelms.

- Markets are confident China’s latest stimulus efforts will be short-lived.

- Economic data on inflation, trade and lending has missed the mark this week.

- Soft third-quarter GDP figures may keep China-linked assets under pressure.

China sent financial markets into a frenzy in September when policymakers in Beijing appeared to get serious about lifting the world’s second-largest economy out of its ongoing post-COVID slump. The central bank announced a raft of measures to tempt economic activity with cheap credit and earmarked money to force up the stock market.

It was a hint at the belated embrace of fiscal stimulus that really cheered investors, however. China’s economy has languished in a deflationary spiral for over a year, and monetary inducement had already failed to rouse it before the latest push. A big dose of government spending to inject demand has long been hoped for.

Beijing’s stimulus push misses the mark, again

Tidbits emerging from a special meeting of the Politburo—China’s core leadership group of 24 officials—signaled President Xi Jinping and company have finally overcome their reluctance to throw money at the problem but left out the specifics. Nevertheless, local stock markets jumped nearly 40% in a mere six trading days.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

A follow-on announcement from the Ministry of Finance has since underwhelmed. Pledges to shore up municipal finances as well as buy up idle land and commercial properties stopped short of direct demand generation. Once again, Beijing seemed to offer inducements to tempt everyone but the central government to spend.

Meanwhile, incoming economic data has continued to disappoint. September’s inflation figures showed consumer price growth unexpectedly slowed to 0.4% year-on-year, the weakest in three months. Wholesale prices slumped deeper into deflation mode, sinking at the fastest pace since March.

Trade figures brought more pain. Export growth slowed to a paltry 2.4% and imports added a meager 0.3% year-on-year, marking the weakest readings since April and June, respectively. Loan growth increased, but less so than economists expected. Moreover, loan growth dropped to the slowest since at least 1998 at 8.1% year-on-year.

Chinese GDP data: another disappointment ahead?

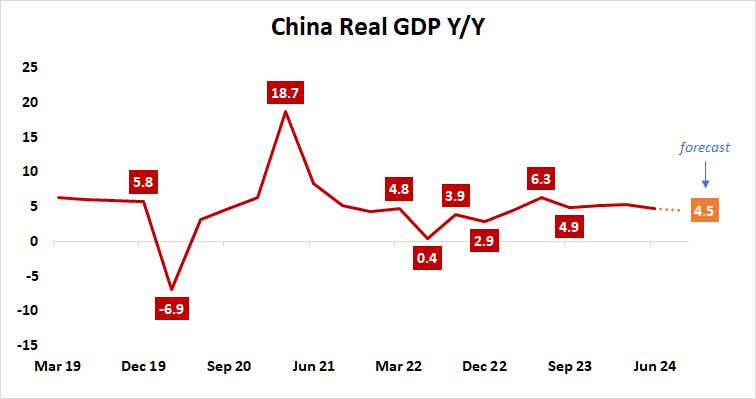

The spotlight now turns to third-quarter gross domestic product (GDP) data. Economic growth is expected to slow for a second consecutive quarter, registering at 4.5% year-on-year. Analytics from Citigroup show Chinese data outcomes continue to trend toward disappointment relative to forecasts, hinting at the risk of downside miss.

A soft result on GDP data might weigh on proxy assets sensitive to Chinese economic trends, such as the Australian dollar and copper. Local stock markets may face pressure, too, having already erased more than half of September’s surge.

However, officially backed firefighting efforts might dilute the price transmission mechanism.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.