Can VVIX Be An Effective Trading Signal?

Can VVIX Be An Effective Trading Signal?

By:Kai Zeng

Lower VVIX/VIX ratios correlate with better performance

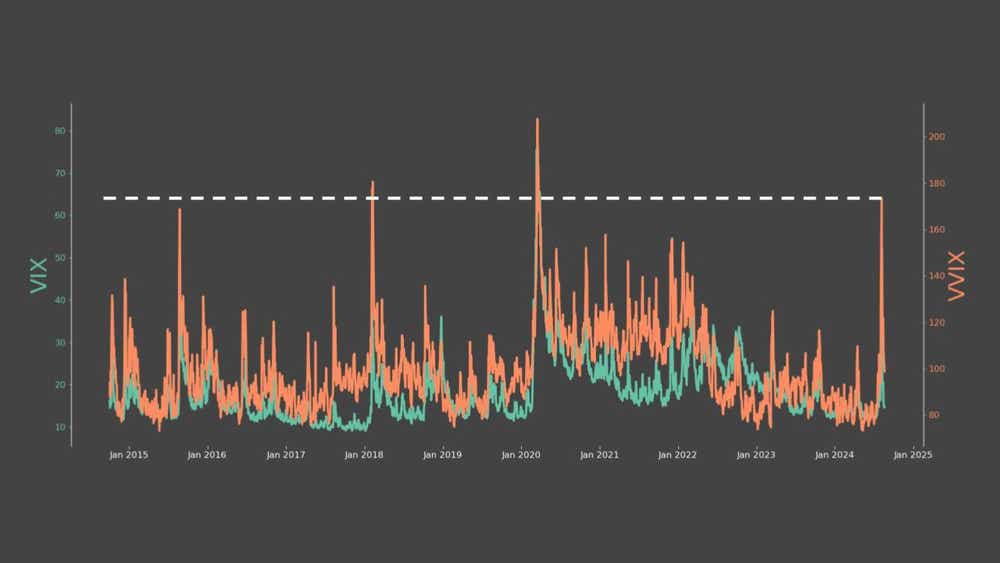

During a significant market pullback in August, the VVIX, which measures the implied volatility of the "fear index"—the CBOE Volatility Index, or VIX—reached its third-highest level in the past decade. This event highlights the intricate relationship between these two volatility measures, which often move in tandem.

The long-term correlation between the VVIX and VIX is 0.84, meaning they tend to move in the same direction most of the time. This correlation makes sense because when the VIX—an indicator of market fear—rises rapidly, it typically signals a market in "panic" mode.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Given this relationship, we explored the question of whether combining VVIX and VIX can offer better market insights. Specifically, we examined the VVIX/VIX ratio (VVIX divided by VIX) over the past 10 years.

Since 2014, the VVIX/VIX ratio has stayed between 5 and 7 about 60% of the time, with a median of 6. As of Aug. 26, the ratio stood at 6.19. This year, the ratio fell outside this 5 to 7 range only once, reaching 4.5 on Aug. 5.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Next, we tested whether this ratio could serve as a trading indicator. We used thresholds of 5 and 6 to analyze the performance of selling options for the SPDR S&P 500 ETF (SPY) over the past decade. Specifically, we looked at selling 45-day-to-expiration (DTE) one-standard-deviation (SD) options, managed at 21 DTE, across three scenarios:

- Below 5

- Between 5 and 6

- Above 6

The results showed the average profit/loss (P/L) decreases as the VVIX/VIX ratio increases. Higher ratios were associated with negative P/L and greater downside risks.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

So, why a does a low ratio lead to better performance?

We found a low VVIX/VIX ratio correlates with better performance because it decreases when the market falls significantly, driving up options premiums.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Additionally, higher ratios correspond to lower VIX levels, indicating these options strategies underperform in low volatility markets.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Key Takeaways:

- Combined Insights: Examining the VIX and VVIX together can provide a deeper understanding of market volatility and potential direction.

- Trading Signal: The VVIX/VIX ratio can serve as a useful trading signal, with lower ratios correlating with better performance.

- Simpler Approach: For most investors, using Implied Volatility (IV) or IV Rank is a simpler and more straightforward signal that serves a similar purpose.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.