Can Soft ISM Data Relieve Market Tariff Woes with Fed Rate Cut Speculation?

Can Soft ISM Data Relieve Market Tariff Woes with Fed Rate Cut Speculation?

By:Ilya Spivak

President Trump’s tariff plans have left investors hoping for a Fed rate cut rescue. Will ISM data help?

- The markets didn’t panic before President Trump’s “Liberation Day” tariff news.

- The plan’s built-in uncertainty has been met with broad-based disappointment.

- Will soggy service-sector ISM data push the Fed to ride to the markets’ rescue?

Global financial markets waited with bated breath as U.S. President Donald Trump prepared to deliver what he described as “Liberation Day”, a sweeping suite of new tariff policies. Details were scarce and a slew of conflicting cues about what the plan aims to achieve kept markets in the dark ahead of the announcement.

Nevertheless, the mood was hardly panic-stricken. The major Wall Street equity benchmarks have made little progress from familiar ranges in the past three trading days. Still, they were heading into the close with modest gains after a seesaw session. Bonds and the U.S. dollar had pulled back a bit, and gold was idling.

The durability of any new tariff regime seemed more important than its policy nuances. The markets ought to have been well aware of the Trump administration’s embrace of trade barriers no later than November yet waited until February to get worried. This signals displeasure with implementation and not tariffs per se.

Markets wanted tariff certainty from “Liberation Day”. They didn’t get it.

This means that if Mr. Trump and his team were to produce something that could be reasonably extrapolated to anchor expectations for investors, business leaders and consumers, then sentiment might have improved. As it happened, the President chose to go another way.

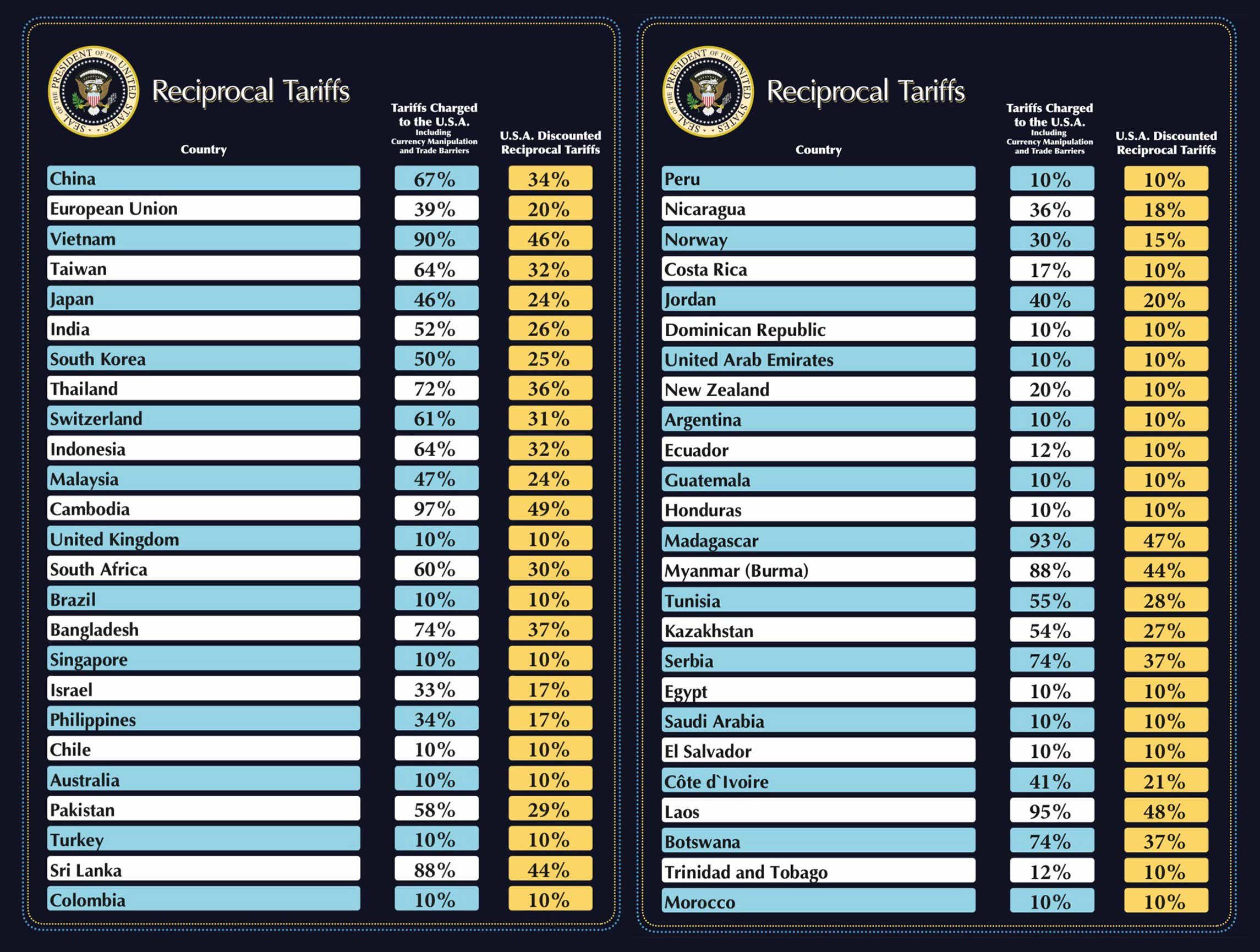

U.S. stock index futures sank in early overnight trade, bonds surged, and gold prices pushed up re-test record highs. That’s after it was revealed that a schedule of tariff rates will go into effect, with a base tariff of 10% followed by additional levies that vary from one trading partner to another.

Taken together, this appears to be the opening bid for a flurry of bilateral negotiations that might take many months to complete. At the same time, President Trump’s penchant for swift policy reversals – as evident in the on-then-off-again tariffs on Canada and Mexico earlier this year – means the way to finalized results is likely to be bumpy.

Will soggy ISM data help markets convince the Fed on interest rate cuts?

The administration has pointedly refused market discipline, with cabinet officials and the President himself signaling they will not be discouraged by stocks’ volatility. Traders may thus turn to the Federal Reserve for a lifeline, hoping that sped-up rate cuts will bring cheap money that helps insulate the markets from trade war drama.

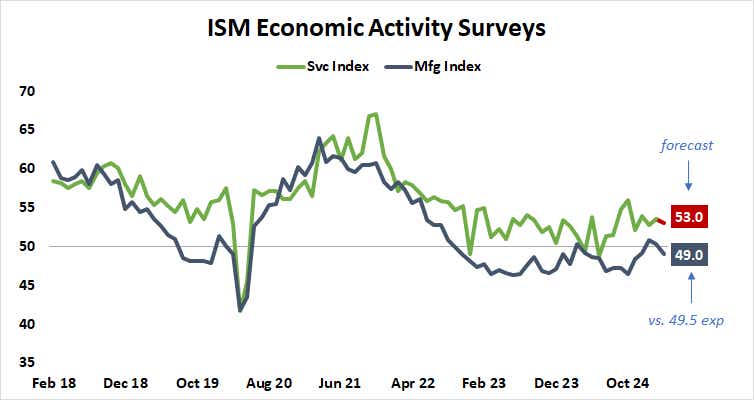

Expectations for how much stimulus can be counted on and when it will arrive will be shaped by incoming purchasing managers index (PMI) data from the Institute of Supply Management (ISM). It is expected to show that service sector activity growth slowed in March, cooling from a two-month high in February.

Analog data from S&P Global warning that worries about fiscal policy uncertainty have become a dampener on services was at the heart of inspiring the selloff in the past six weeks. More of the same in the ISM version of the data seems likely to amplify repricing toward more rate cuts, lifting bonds and yields and the U.S. dollar weaken.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.