Higher BPR Doesn’t Mean Higher Risk

Higher BPR Doesn’t Mean Higher Risk

By:Kai Zeng

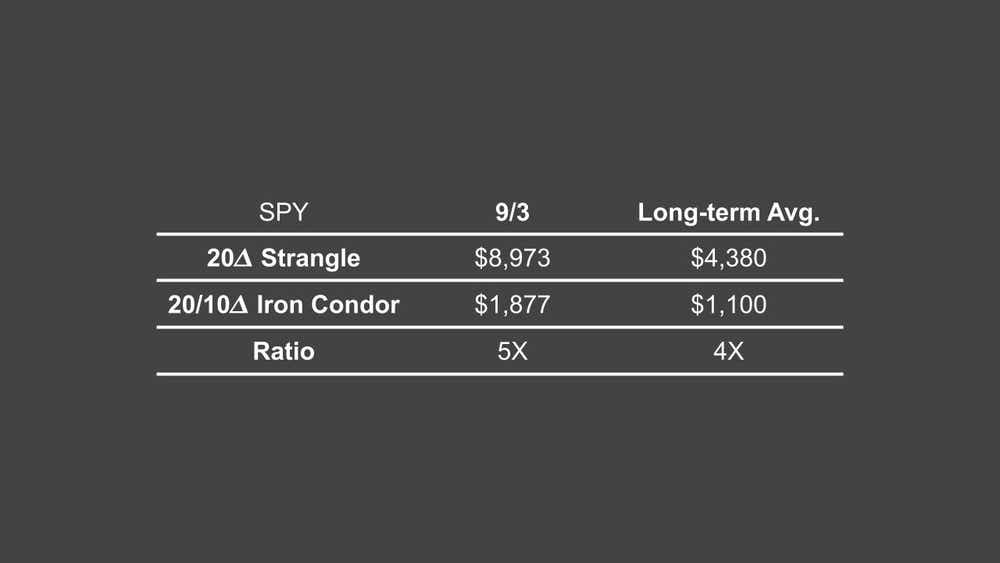

We compared strangles and iron condors to understand the practice of “buying power reduction”

Buying Power Reduction (BPR) Simplified for Non-Traders

When you buy or sell stocks, some of your investment money is held back to cover potential losses. This is what's known as buying power reduction (BPR). Think of it as a safety net to ensure you have enough funds in case the investment doesn't go as planned.

For strategies like strangles, where you predict stocks will stay within a certain price range, the BPR is about 20% of the stock price. If a stock is volatile, the cushion may increase. For more conservative approaches, like iron condors, which set defined profit and loss levels, the BPR is much lower—between 5% and 30%.

Right now, the BPR for a particular strangle strategy is five times higher than for a $5 wide iron condor strategy. During the past two decades, it’s typically been four times higher. This raises a question: Does a strangle strategy naturally carry more risk?

To find out, we tested with the S&P 500 ETF (SPY) and Amazon (AMZN), using two strategies:

- Strangles based on a 20 delta.

- Iron Condors with 20/10 delta.

And two timing approaches:

- Holding positions until they expire.

- Exiting positions 21 days before expiration.

In our study with SPY, we found iron condors prone to loss levels similar to losses with strangles but with a lower success rate.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Managing trades 21 days early improved both strategies but didn't close the gap entirely.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

With AMZN, the trend was similar: Iron condors faced the same level of losses as strangles, with early selling improving outcomes.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

The big takeaway? A higher BPR doesn’t automatically mean more risk with strangles. Lower risk isn’t necessarily tied to how much of your funds are reserved.

Key Points to Remember:

- BPR is a way to gauge investment risk, but more set-aside funds don’t mean more risk.

- Strangles often require a larger BPR than iron condors, but actual losses in many cases were smaller than expected.

- Selling investments 21 days early can cut down on big losses, no matter the strategy.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.