Burry's Latest Bearish Bet—But It's Not What You Think!

Burry's Latest Bearish Bet—But It's Not What You Think!

A CNN headline posted today reads, "Michael Burry, of ‘Big Short’ fame, just bet $1.6 billion on a stock market crash" Well, not exactly.

Hedge fund manager and founder of Scion Capital Michael Burry is most famous for his short of the subprime mortgages during the real estate crisis in 2007-2010.

Is Burry short $1.6 billion on the S&P 500 (SPY) and Nasdaq (QQQ)? The short answer is "NO."

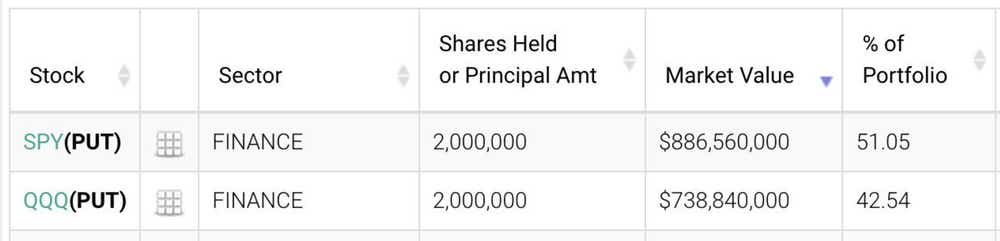

Burry released his Q2 13-F filing with the list of holdings most notable was his bearish option trade.

Michael Burry just shorted the market!

For the umpteenth time. And it's really not what you think it is.

Michael Burry is a hedge fund manager and founder of Scion Capital, most famous for his short of the subprime mortgages during the real-estate crisis in 2007-2010. This was famously portrayed in the movie The Big Short, which was based off his legendary call.

Burry released his Q2 13-F filing with the list of holdings most notable was his bearish option trade.

Is this The Big Short?

When Burry talks, people listen, but they might be getting the wrong impression here.

Is Michael Burry short $1.6 billion on the S&P 500 (SPY) and Nasdaq (QQQ)? The short answer is no. We don’t even know if he still holds this position as it is nearly 60 days since this reporting.

Financial reports use notional value as a metric for market value. Each option has the potential notional exposure of 100 shares of stock. So, the value of each option is calculated as 100 times the value of the security. This, of course, is a bit misleading as we do not know what his strike price is or expiration. And he would likely never take short shares on the position.

At 2 million “shares” of each of SPY and QQQ, this would equal 20,000 put contracts for each ETF. This is certainly a large position but is a drop in the bucket for either ETF which trades millions of put/call contracts per day.

He also didn’t throw $1.6 billion into a market short. So, what might he be holding? And what might be the actual value of the position be? It’s certainly not in zero days till expiration options!

Let's say he got it all right–and is holding a now slightly in-the-money strike on both SPY and QQQ. For SPY, say the $450 strike, and for QQQ say the 370. Let's assume through the end of the year, using the Dec. 15 monthly expirations.

Currently, the SPY 450 strike put option has an open interest of roughly 26,000 and QQQ $370 strike has an open interest of roughly 29,000 contracts, enough to account for his position size

The SPY $450 put currently trades at around $15, at 20,000 contracts that would equate to a current value of roughly $30,000,000. The QQQ $370 put option also trades at around $15 so around $30,000,000 in current market value.

While a total of $60 million in value is certainly large–and this is just my estimate, and the high end of the range at that–it is certainly not $1.6 Billion!

Is it time to get short?

Burry is certainly an enigmatic figure–he’s had some amazing calls but has also been on the other side of the trade many times. Just like any other trader!

The size of this trade is very small relative to the assets under management—the headlines are much sexier than the position.

SPY has a current implied volatility of 18%, implying a roughly +/- $40 one standard deviation move through the end of the year (roughly 10%).

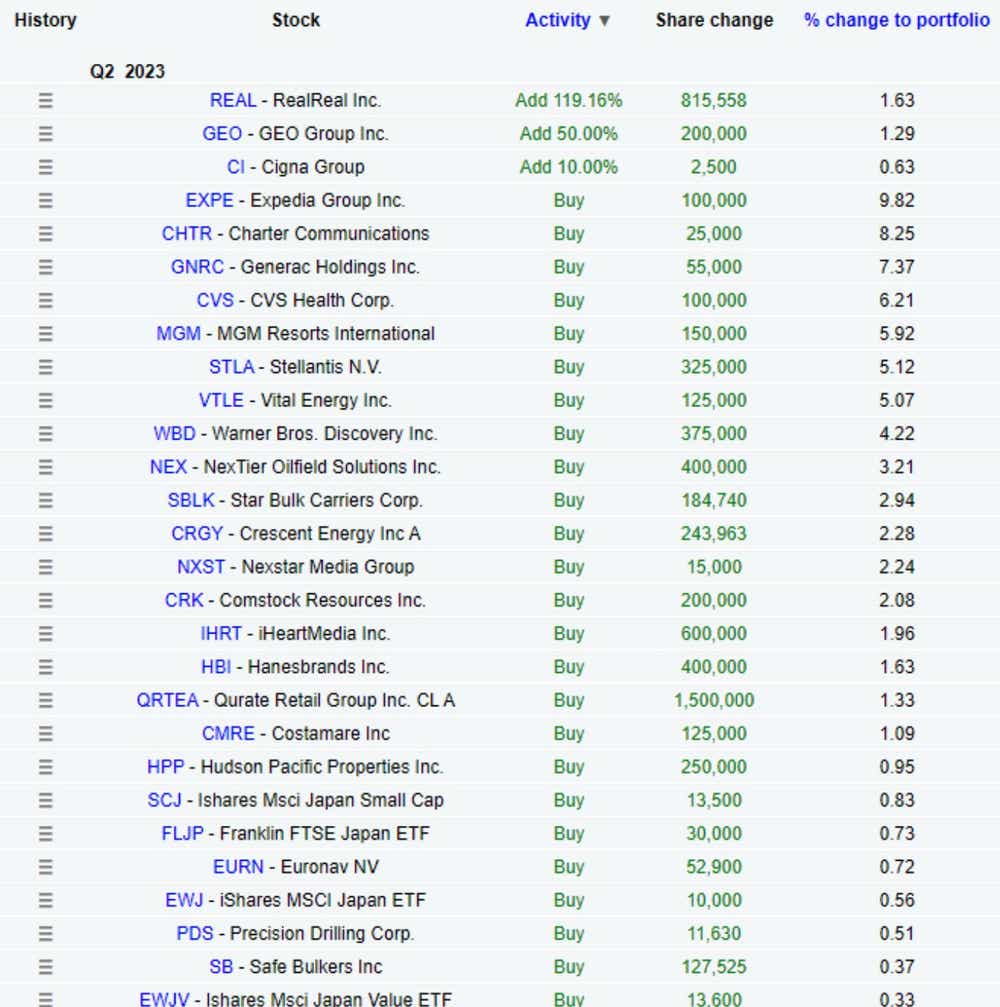

Here are the rest of his holdings:

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.