Bulls Resigned to a Sad Start for August

Bulls Resigned to a Sad Start for August

Technical trendlines broken for the Dow, S&P500 and Nasdaq futures

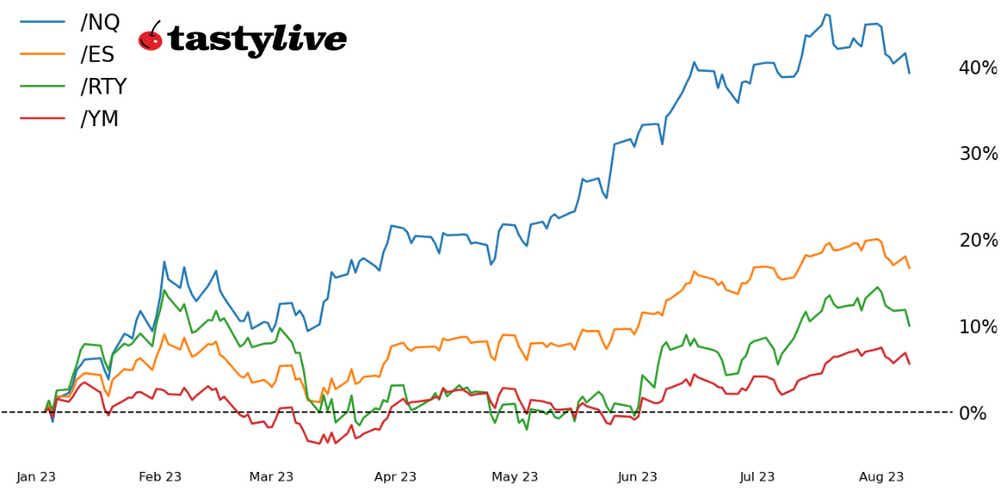

- All four major indexes have traded lower through the first week of August.

- Volatility metrics have expanded in line with their historical tendencies.

- Uptrends that began in May have been broken, suggesting a period of consolidation or correction may have started.

It’s been a rough start to August for the major U.S. stock indexes. Each of the Big Four are in the red month-to-date, led lower by e-mini Nasdaq 100 futures (/NQ) which has shaved nearly 4% from its close on July 31. Coupled with a rise in volatility that is in line with seasonal tendencies, the technical strength of the multi-month rally in equities has been materially harmed.

In fact, given the damage levied against e-mini S&P 500 futures contracts (/ES) and e-mini Nasdaq-100 futures (/NQ), it makes sense that the August-September window—which has historically been unfriendly to stocks—may be shaping up to provide a meaningful consolidation if not an outright correction.

/ES S&P 500 price technical analysis: daily chart (August 2022 to August 2023)

A near-term top may be forming in /ES. Former highs from June and July around 4480/4500 have provided support thus far during the August downswing, but former resistance turned support has already started to give way in the other major indices—a bad omen for /ES.

For the first time since May 24, /ES has posted closes below its daily 21-EMA (one month moving average). MACD (the moving average convergence/divergence indicator) is trending lower (albeit above its signal line), while slow stochastics—a momentum indicator that shows the location of the close relative to the high-low range over a set number of periods—have reached oversold territory for the first time since late-April—uncharacteristic of how momentum indicators were behaving during short-term pullbacks over the past two and a half months (an important signal that “this time is different”). The measured move off the highs, assuming support around 4480/4500 breaks, suggests a move closer to 4360 over the coming weeks.

/NQ Nasdaq 100 price technical analysis: daily chart (August 2022 to August 2023)

/NQ may have the most bearish setup in the short-term. Like /ES, /NQ has posted closes below its daily 21-EMA for the first time in months – since May 4, to be exact. Former highs in June and July, which had turned support, have now been broken. MACD is racing lower, nearing a bearish sell signal, while slow stochastics are holding in oversold territory for the first time since late April. The path of least resistance appears to be lower in the near-term, setting up a window for a healthy correction (which can be a function of both price and time). A return to the late-June swing low at 14853.50 can’t be ruled out before the uptrend reasserts itself.

/RTY Russell 2000 price technical analysis: daily chart (August 2022 to August 2023)

/RTY may be struggling in recent days after a spate of downgrades to the banking sector by Moody’s. Regardless of the catalyst, the momentum profile that defined the rally starting in early-July has been materially damaged; today could produce the first close below the daily 21-EMA since July 6. Like /ES and /NQ, MACD is trending lower nearing a sell signal while slow stochastics are back in oversold territory for the first time since late April. Support may be nearby, as far as the June high at 1929.1 may draw in some longs. Failure here would suggest that a return to 1900–former triangle resistance—may be on the docket over the next few weeks.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.