Bonds Bounce and the Options Market Signals Lows are in Place

Bonds Bounce and the Options Market Signals Lows are in Place

With the U.S. 10-year yield down to 4.130%, we revisit a trade idea

- After the July U.S. JOLTs report, rates markets are reducing expectations of another Fed rate hike this year.

- Fed chair Powell, among other FOMC members, has recently suggested that another hike is possible–but that depends entirely on the data.

- U.S. Treasuries have rallied across the curve, with the 2s10s spread moving higher by +9-bps.

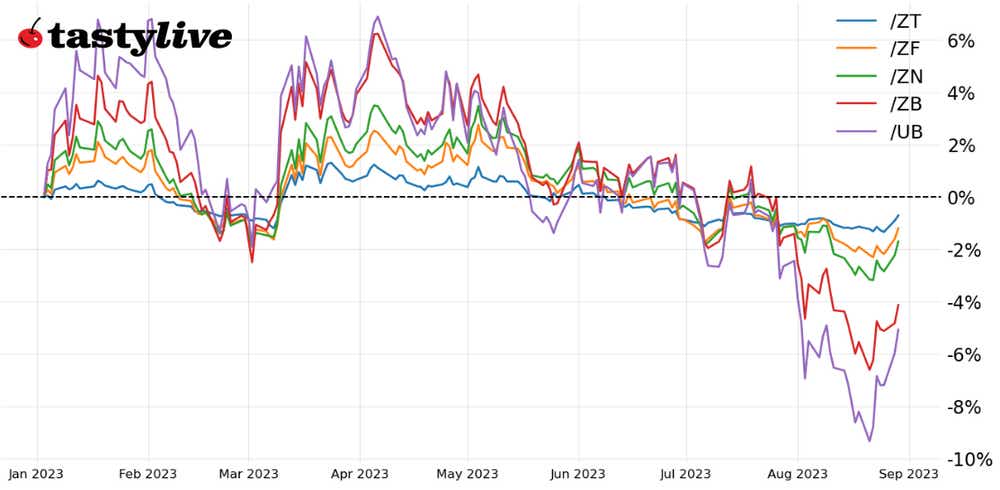

A brutal August may end on a more positive note for bonds. U.S. Treasuries have rallied across the curve following the July U.S. Job Openings and Labor Turnover Survey (JOLTS) report, which showed further normalization of the U.S. labor market.

After peaking at more than two available jobs for every one unemployed person, the U.S. labor market now has 1.51 job openings per unemployed person—still high by historical standards, but well-off its pandemic-era peak.

This is good news for bonds, which have the historical tendency to bottom at the meeting prior to the final rate hike from the Federal Reserve. Rates markets are trading as if the Fed may not need to raise rates again, with the odds of another 25-basis-point (bps) rate hike this cycle dropping from 54% in November to 40% after the jobs data this morning.

That’s not to say that the Fed won’t find the evidence it needs to raise rates again. Fed chair Jerome Powell, in his speech in Jackson Hole, mentioned repeatedly that the FOMC is data dependent. Headline inflation appears set to stay above 3% year-over-year for the next several months, and the U.S. economy continues to run hot (3Q’23 US GDP is tracking at +5.9% annualized in real terms, according to the Atlanta Fed's GDPNow model).

But at least for now, markets are acting as if the final rate hike may be in the rearview mirror, with rate sensitive assets—the Nasdaq 100 (/NQU3), gold (/GCV3), and the U.S. dollar (looking at a blend of /6BU3, /6EU3, and /6JU3)—all acting in a manner consistent with “peak rates” having been reached.

/ZB U.S. 30-year bond price technical analysis: daily chart (November 2022 to August 2023)

It was the long-end of the curve that led the sell-off in the first three weeks of August, and as we approach the final trading days of the month, it’s now the long-end leading the charge higher. /ZNU3, /ZBU3, and /UBU3 have all traded at least 1% higher off their lows, with the latter two adding over 3% from last week’s lows. In fact, for /ZBU3 (or the continuous contract, $/ZB on the platform) is back above its daily 21-EMA (one month moving average) for the first time since July 27, an indication that the tides may have turned.

What’s the trade?

In early-August, we noted that “the options market suggests that traders think that the readjustment upwards in US Treasury yields, and the sell-off in bonds, is nearing its end. In /ZB, for example, selling a put spread around the November 2022 lows, by selling the 116 strike and buying the 114 strike for the September 22 expiry (50DTE), suggests that the probability of profitability (POP) is 80%. The surge in volatility may be creating an environment whereby traders attempting to call the bottom in bonds may be rewarded if they approach the market in a strictly risk-defined manner.”

Today, the same short put vertical (long 114 put/short 116 put) for the September 22 expiry (24DTE) is suggesting a POP of 92%. One must conclude that traders are feeling increasingly confident that a near-term bottom in bonds, and a near-term top in yields, has been reached. This could be the positive omen that stocks, precious metals, and FX desperately need to reverse a putrid August.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.