Bond Market Volatility Surges Amid Bank Stock Crisis

Bond Market Volatility Surges Amid Bank Stock Crisis

The financial markets have seen an uptick in volatility in the wake of the recent bank failures, but the VIX is still trading well below “crisis” levels.

As of March 19, the CBOE Volatility Index (VIX) is trading roughly 25, which is only six points higher than its long-term average of 19. That's well below the record highs observed during the 2008-2009 Financial Crisis, when a slew of bank failures pushed the VIX above 80.

However, volatility has spiked to record levels in other niches of the financial markets.

Bond Market Volatility (^MOVE) Hits 15-Year High

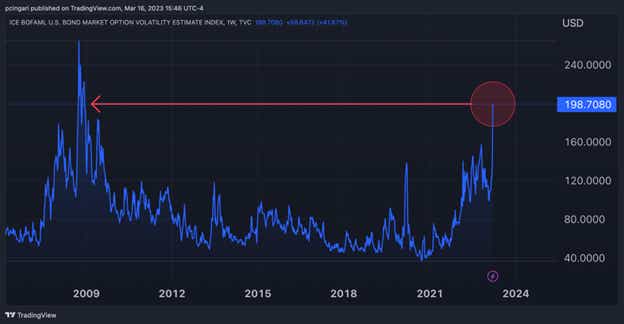

For example, the ICE BofAML MOVE Index (^MOVE), which tracks volatility in the government bond market using the implied volatility of one-month over-the-counter (OTC) options on 2-year, 5-year, 10-year and 30-year Treasuries recently hit a 15-year high.

Government bonds often experience a surge in demand when fear enters the financial markets because investors and traders often “flee” to the relative safety of government-backed securities.

Case in point, from March 10 through March 12, the 2-year Treasury yield suffered its steepest decline since October of 1987 (over the course of a 3-day trading period. The 2-year Treasury yield currently trades for roughly 3.85%, which is considerable lower than just a couple weeks ago when it was trading over 5.00%.

Bond Prices and Yields

Bond prices are inversely correlated to yields, which means that when demand surges for government bonds, yields typically drop.

The yield on the 10-year Treasury bond also plummeted in recent days, and currently trades for roughly 3.40%. A couple of weeks ago, the 10-year Treasury yield was trading closer to 4.00%.

Considering those extreme moves, it’s no great surprise that volatility in the government bond market also experienced a dramatic surge. As illustrated below, the aforementioned MOVE index is now trading at the highest levels since the 2008-2009 Financial Crisis.

As shown above, recent volatility in the bond market has been even more intense than in 2020, when the coronavirus was first spreading across the globe.

Fed March Meeting in Focus: Will The Fed Continue Raising Rates?

The big question now is whether the upcoming meeting of the Federal Reserve—March 21 and 22—will trigger further volatility in the bond markets. And whether that volatility might eventually spill over into the stock market.

So far this year, the U.S. financial system has absorbed two of the three largest bank failures in U.S. history. And based on recent reports, a third bank—First Republic (FRO)—is also teetering on the brink of failure.

On March 15, a consortium of American banks banded together to extend a lifeline to First Republic. Led by J.P. Morgan Chase (JPM), Bank of America (BAC) and Goldman Sachs (GS), 11 different banks deposited a total of $30 billion into First Republic to help backstop a flood of customer withdrawals.

Some estimates suggest that First Republic lost as much as $89 billion in deposits during the week of March 13. As a result, the beleaguered bank was forced to suspend its dividend, which was announced on March 16.

Bank Stocks in Freefall

Over the last month, First Republic shares are down more than 80% and currently trade for about $23/share. Other stocks from the financial services sector experiencing sharp corrections in 2023 include the following (year-to-date performance):

- Silvergate Capital (SI), –88%

- Sunlight Financial (SUNL), -68%

- PacWest Bancorp (PACW), -60%

- Curo Group (CURO), -59%

- Western Alliance (WAL), -47%

- Republic First (FRBK), -43%

- Metropolitan Bank (MCB), -39%

- First Horizon (FHN), -39%

- Zions Bancorp (ZION), -38%

- BankUnited (BKU), -38%

- Customers Bancorp (CUBI), -37%

- Comerica (CMA), -35%

- KeyCorp (KEY), -34%

- Bank of Hawaii (BOH), -34%

For more background on the relationship between Treasury bond prices and Treasury bond yields, readers can check out this installment of Futures Measures on the tastylive financial network.

For daily updates on everything moving the markets, readers can also tune into tastylive, weekdays from 7 a.m. to 4 p.m. CDT.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.