The Bond Market’s Latest Pullback May Be a Buying Opportunity

The Bond Market’s Latest Pullback May Be a Buying Opportunity

Bonds could steal the spotlight in 2025

- The bond market has faced dramatic swings in 2024, with early strength giving way to unexpected weakness in late autumn, driven largely by renewed fear of inflation and fiscal uncertainty related to Donald Trump’s election victory.

- Long-term Treasury bonds, like those tracked by iShares 20+ Year Treasury Bond ETF (TLT), remain a focal point for investors, offering potential upside in a lower-rate environment and a hedge against the risk recession risk.

- As 2025 approaches, the bond market finds itself at a pivotal juncture, with the bull case hinging on further cuts in Federal Reserve interest rates and the continued easing of inflationary pressures.

While the equity markets often command the spotlight, the bond market quietly underpins the global financial system, offering opportunities that are sometimes overlooked. This year, however, bonds have stepped into the limelight, albeit in an unpredictable fashion. Despite the Federal Reserve’s dovish pivot in September, the bond market has confounded expectations with its volatility, leaving investors grappling with a series of contradictory signals.

What began as a promising year for bonds, buoyed by hopes of falling interest rates, took a sharp turn as political and economic dynamics shifted. With Donald Trump’s resounding November victory fueling inflation concerns, yields have climbed and bond prices have retreated. Yet, amid the turbulence, an undercurrent of opportunity is rising. As we look ahead to 2025, the bond market may once again emerge as a critical arena for investors seeking both refuge and reward in a changing economic landscape.

How the bond market took center stage in 2024

The year began with optimism for bonds, as investors anticipated a pivot in U.S. monetary policy would make the bond market a standout performer. Early signs seemed to validate this outlook: The iShares 20+ Year Treasury Bond ETF (TLT) climbed steadily from July through mid-September, driven by expectations of falling interest rates and a softening economic outlook. This rally highlighted the strong inverse relationship between interest rates and bond prices—when rates fall, bond prices typically rise, and vice versa.

But starting in mid-September, sentiment in the bond market shifted abruptly. Yields on government bonds started climbing as concern over inflation reemerged, fueled in part by stronger-than-expected economic data and speculation about the Fed's capacity to sustain its dovish stance. This change in trajectory caught many off guard.

Donald Trump’s victory in the November election amplified these concerns. Investors began to price in the likelihood of widening fiscal deficits tied to Trump’s agenda of tax cuts and increased government spending, further pressuring bond prices. The 10-year Treasury yield, which had been declining steadily just months earlier, surged from 3.65% in mid-September to 4.45% by mid-November, marking one of the most dramatic yield reversals in recent memory.

This sharp rebound in yields left many market watchers puzzled. Under normal circumstances, rate cuts—like those observed in September and November—would typically lead to lower yields, thereby boosting bond prices. However, the prospect of inflation under a Trump-led administration has upended this dynamic. Expectations of increased fiscal spending and widening deficits have led investors to reassess the bond market’s trajectory, with some speculating the Federal Reserve may slow its easing cycle to avoid reigniting inflationary pressures. The result has been a subdued bond market, with TLT up a modest 1% over the past year—its summer and early autumn gains all but erased by the uncertainties of a shifting political and economic landscape.

Yet the bond market’s roller coaster has not eliminated the potential for a brighter outlook. Falling interest rates, should they materialize, remain a plausible scenario, one that could ignite a renewed rally in bonds. For investors eyeing such opportunities, long-term government Treasury bonds stand out as a compelling choice, offering significant upside in a declining-yield environment.

The bond market’s mid-year rally and autumn shift

Analysts suggest the current rate environment presents a strong case for long-term government bonds. Morningstar recently highlighted this potential, stating, "We expect the federal-funds rate to average 2.3% over the next 10 years. Consequently, longer-term government bonds appear to offer an unusually high return relative to cash deposits."

For those bullish on bonds, the iShares 20+ Year Treasury Bond ETF (TLT) therefore stands out as a versatile tool. By tracking U.S. Treasury bonds with maturities of 20 years or more, TLT simplifies a complex market segment into a single, easily tradable instrument. It has become a preferred choice for traders and investors looking to express views on monetary policy or interest rate trends through actionable strategies.

TLT’s performance during the interest rate volatility of 2024 illustrates its potential. Early in the year, optimism around Federal Reserve rate cuts drove a rally in TLT, as falling rates typically push long-term bond prices higher. Between early July and mid-September, TLT posted significant gains, reflecting market expectations of continued Fed easing.

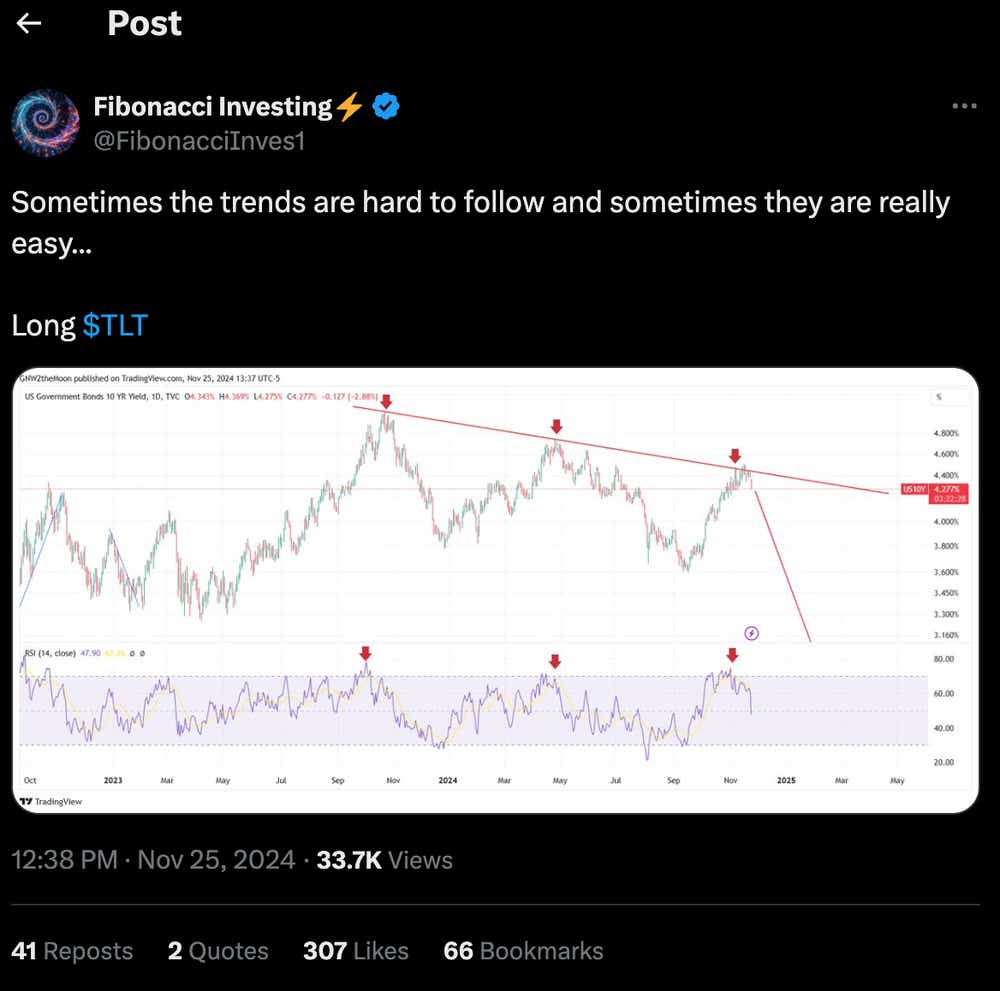

However, as Donald Trump’s election victory appeared increasingly certain, bond yields began to rise on fear of a potential rebound in inflation. The market’s recalibration sent bond prices—including those tracked by TLT—into retreat. Between Sept. 15 and Nov. 17, the 10-year Treasury yield climbed from 3.65% to 4.45%, leading to an 11% drop in TLT over the same period (illustrated below).

Why TLT could break out in the coming months

For investors who believe the Fed will stay on its dovish path despite inflationary risk from fiscal-driven growth, TLT remains a compelling option. Cooling inflation—evident in the latest consumer price index (CPI) reading of 3.1%—bolsters the case for further rate cuts. Should the Fed deliver on these expectations, the resulting decline in yields would likely boost TLT, presenting a significant opportunity for well-positioned investors.

TLT’s historical performance highlights its sensitivity to rate expectations, making it a straightforward and effective tool for capturing gains in a falling-yield environment. For instance, TLT rallied from about $88 per share in early July to over $101 per share by mid-September as bond markets priced in optimism about continued Fed easing. Following a recent pullback, TLT is trading around $93 per share as of today, providing a potential entry point for those confident of lower-rates ahead.

Investors can use TLT in several ways depending on their strategy. For those with a longer-term outlook, TLT can serve as a buy-and-hold asset to capitalize on gains over the full rate-cutting cycle. Meanwhile, active traders might exploit shorter-term volatility driven by economic data or Fed announcements. Additionally, TLT offers associated options, enabling investors to implement more complex market outlooks.

That said, risks to the TLT narrative remain. Faster economic growth, fueled by Trump’s economic and fiscal policies, could push inflation higher and constrain the Fed’s ability to continue cutting rates. In such a scenario, yields may stay elevated or rise further, capping the upside potential for TLT. However, the downside risk is arguably limited because TLT’s 52-week low is approximately $87 per share, offering a degree of cushion for more conservative investors.

TLT’s track record as a recession hedge

Besides benefiting from a decline in interest rates, the iShares 20+ Year Treasury Bond ETF (TLT) may also appeal to investors seeking to hedge against recession-related risks. Long-term U.S. Treasury bonds, which TLT tracks, are considered safe-haven assets that tend to attract capital during periods of economic uncertainty.

Historically, TLT has proven its value in such scenarios. During the Great Recession of 2008–2009, as the Federal Reserve aggressively lowered rates, TLT posted significant gains, reflecting the surge in demand for long-term Treasuries. A similar trend occurred in early 2020 during the onset of the COVID-19 pandemic, when TLT rallied sharply amid market turmoil and emergency rate cuts. These instances demonstrate how TLT can serve as a defensive asset, protecting portfolios when riskier investments, such as equities, falter.

As 2025 approaches, TLT’s role as a recession hedge remains particularly relevant given the current economic scene. While fiscal expansion under the Trump administration has fueled expectations of growth and potential inflation, other factors—including elevated debt levels and tighter financial conditions—could push the economy toward a slowdown. If recession risks materialize, the Fed may accelerate its easing cycle, lowering long-term yields and driving TLT’s value higher.

For investors who view a recession as a growing threat or expect inflation to remain contained over the next three to six months, TLT offers a compelling opportunity. Its ability to serve as both a hedge and a source of upside in a falling-yield environment reinforces its appeal.

2025 could be a pivotal year for the bond market

The bond market in 2024 has presented a complex mix of opportunities and challenges. On one hand, falling interest rates have created potential upside for long-term Treasuries, particularly through instruments like the iShares 20+ Year Treasury Bond ETF (TLT). On the other, concern over fiscal expansion, inflation and market volatility have tempered enthusiasm, reminding investors of the risks inherent in this dynamic space. Still, for those confident in further Federal Reserve rate cuts or seeking a hedge against the risk of recession, the bond market offers a compelling proposition heading into the new year.

According to Morningstar, longer-term government bonds, like those tracked by TLT, "appear to offer an unusually high return relative to cash deposits," reinforcing their appeal as both a defensive play and a means of capturing upside in a declining-yield environment. As such, TLT remains a leading choice for its direct exposure to long-term Treasuries, but it’s certainly not the only option for bullish bond investors.

Thoe seeking alternatives to long-term Treasuries can explore other segments of the bond market through specialized ETFs. Investment-grade corporate bond ETFs, such as the iShares iBoxx Investment Grade Corporate Bond ETF (LQD), offer exposure to high-quality debt with slightly elevated yields compared to government bonds. For those willing to take on more risk in exchange for potentially higher returns, high-yield bond ETFs like the SPDR Bloomberg High Yield Bond ETF (JNK) provide access to the "junk bond" market, which includes lower-rated but higher-yielding debt. Meanwhile, international bond ETFs, such as the Invesco International Corporate Bond ETF (PICB), cater to investors seeking a globally diversified fixed-income portfolio.

For those seeking more advanced tools, bond futures and futures options offer another avenue to access the market, providing leverage and flexibility for investors with experience in this niche. All told, the bond market remains a cornerstone for navigating today’s evolving economic landscape, offering opportunities to diversify portfolios, hedge against recession risks and capitalize on shifting monetary policies. Whether through government, corporate or international bond ETFs—or instruments like futures—investors have a wide array of choices to align their portfolios with their outlook.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.